What is the determination of severance taxable extraction quantity of mercury in Vietnam?

What is the determination of severance taxable extraction quantity of mercury in Vietnam?

According to Clause 1, Article 5 of the severance tax Law 2009, the regulations are as follows:

Taxable extraction quantity

1. For an exploited natural resource the quantity, weight or volume of which can be determined, the taxable extraction quantity is the quantity, weight or volume of natural resource actually exploited in a severance tax period.

2. For an exploited natural resource the quantity, weight or volume of which cannot be determined because this natural resource contains different substances and impurities, the taxable extraction quantity shall be determined based on the quantity, weight or volume of each substance obtained from sorting and classification.

3. For natural resources which are not sold but used for turning out other products, if their actually exploited quantity, weight or volume cannot be directly determined, the taxable extraction quantity shall be determined based on the output of products turned out in a severance tax period and the use norm of natural resource per unit of product.

4. For natural water used for hydropower generation, the taxable extraction quantity is the output of electricity sold by a hydropower generation establishment to an electricity buyer under an electricity purchase and sale contract or the output of delivered electricity, in case such contract is unavailable, which is determined according to the metering system up to Vietnam's measurement and quality standards, certified by the purchaser and seller or the deliverer and recipient.

5. For natural mineral water, natural thermal water and natural water used for industrial purposes, the taxable extraction quantity shall be determined in cubic meter On1) or liter (I) according to the metering system up to Vietnam's measurement and quality standards.

6. For natural resources exploited on a manual, scattered or mobile, irregular basis, if the planned output of exploited natural resources in a year is valued at under VNI) 200 million, a fixed output of exploited natural resources may be determined on a regular or seasonal basis for severance tax calculation. Tax offices shall coordinate with local concerned agencies in determining the fixed output of exploited natural resources for severance tax calculation.

The Government shall detail this Article.

Thus, to determine the severance taxable extraction quantity of mercury, the taxable extraction quantity of mercury is the actual quantity, weight, or volume of the resource extracted during the tax period.

In simpler terms, the tax will be calculated based on the actual quantity of mercury extracted during the tax period.

What is the determination of severance taxable extraction quantity of mercury in Vietnam? (Image from the Internet)

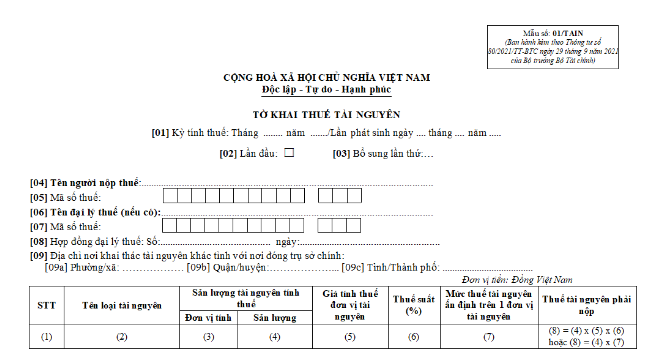

What is the severance tax declaration form for mercury in Vietnam?

The severance tax declaration form for mercury in Vietnam is stipulated in Clause 3, Article 15 of Circular 80/2021/TT-BTC and includes the following basic contents:

- Name of the taxpayer;

- Tax identification number;

- Name of the tax agent (if any);

- Tax identification number;

- Tax agent contract;

- The address of the extraction site other than the address of the main office.

>>> Download the severance tax declaration form for mercury in Vietnam.

What is the severance tax rate for mercury in Vietnam?

Firstly, according to Article 2 of the Severance Tax Law 2009 (amended by Clause 1, Article 4 of the Law on Amendments to Tax Laws 2014), taxable objects are specified as follows:

- Metallic minerals.

- Non-metallic minerals.

- Crude oil.

- Natural gas, coal gas.

- Natural forest products, other than animals.

- Natural aquatic products, including marine animals and plants.

- Natural water, including surface water and underground water, except for natural water used for agriculture, forestry, aquaculture, and salt production.

- Natural swallow's nests.

- Other resources prescribed by the National Assembly Standing Committee.

Mercury is classified under the group of metallic minerals; therefore, mercury is subject to severance tax.

Additionally, according to Article 7 of the severance tax Law 2009, the severance tax rates are stipulated as follows:

- The frame severance tax tariff is specified below:

|

No. |

Group or category of natural resource |

Severance tax rate (%) |

|

I |

Metallic minerals |

|

|

1 |

Iron and manganese |

7-20 |

|

2 |

Titan |

7-20 |

|

3 |

Gold |

9-25 |

|

4 |

Rare earths |

12-25 |

|

5 |

Platinum, silver and tin |

7-25 |

|

6 |

Wolfram and antimony |

7-25 |

|

7 |

Lead, zinc, aluminum, bauxite, copper and nickel |

7-25 |

|

8 |

Cobalt, molybdenum, mercury, magnesium and vanadium |

7-25 |

|

9 |

Other metallic minerals |

5-25 |

|

II |

Non-metallic minerals |

|

|

1 |

Soil exploited for ground leveling and work construction |

3-10 |

|

2 |

Rock, except rock used for lime baking and cement production; gravel; sand, except sand used for glass-making |

5-15 |

|

3 |

Soil used for brick-making |

5-15 |

|

4 |

Granite and refractory clay |

7-20 |

|

5 |

Dolomite and quartzite |

7-20 |

|

6 |

Kaolin, mica, technical quartz, and sand used for glass-making |

7-15 |

|

7 |

Pyrite, phosphorite, and stone for lime baking and cement production |

5-15 |

|

8 |

Apatite and serpentine |

3-10 |

|

9 |

Pit anthracite coal |

4-20 |

|

10 |

Open-cast anthracite coal |

6-20 |

|

11 |

Lignite and fat coal |

6-20 |

|

12 |

Other coals |

4-20 |

|

13 |

Diamond, ruby and sapphire |

16-30 |

|

14 |

Emerald, alexandrite and black precious opal |

16-30 |

|

15 |

Adrite, rodolite, pyrope, berine. Spinel and topaz |

12-25 |

|

16 |

Bluish-purple, greenish-yellow or orange crystalline quartz; chrysolite; white or scarlet precious opal; feldspar; birusa; and nephrite |

12-25 |

|

17 |

Other non-metallic minerals |

4-25 |

|

III |

Crude oil |

6-40 |

|

IV |

Natural gas and coal gas |

1-30 |

|

V |

Natural forest products |

|

|

1 |

Timber of group I |

25-35 |

|

2 |

Timber of group II |

20-30 |

|

3 |

Timber of groups III and IV |

15-20 |

|

4 |

Timber of groups V, VI, VII and VIII and of other categories |

10-15 |

|

5 |

Tree branches, tops, stumps and roots |

10-20 |

|

6 |

Firewood |

1-5 |

|

7 |

Bamboo of all kinds |

10-15 |

|

8 |

Sandalwood and calambac |

25-30 |

|

9 |

Anise, cinnamon, cardamom and liquorice |

10-15 |

|

10 |

Other natural forest products |

5-15 |

|

|

Natural aquatic resources |

|

|

1 |

Pearl, abalone and sea-cucumber |

6-10 |

|

2 |

Other natural aquatic resources |

1-5 |

|

VII |

Natural water |

|

|

1 |

Natural mineral water, natural thermal water and refined natural water, bottled or tinned |

8-10 |

|

2 |

Natural water used for hydropower generation |

2-5 |

|

3 |

Natural water used for production and business activities, except water mentioned at Points 1 and 2 of this group |

|

|

3.1 |

.Surface water |

1-3 |

|

3.2 |

Groundwater |

3-8 |

|

VIII |

Natural swallow's nests |

10-20 |

|

IX |

Other resources |

1-20 |

- Specific severance tax rates for crude oil. natural gas and coal gas shall be determined as partially progressive based on their daily exploited average output.

- Under Clauses 1 and 2 of Article 7 of the severance tax Law 2009, the National Assembly Standing Committee shall stipulate specific severance tax rates for each category of natural resource in each period on the following principles:

+ Ensuring conformity with the list of groups and categories of natural resource and within the severance tax rate bracket prescribed by the National Assembly:

+ Contributing to the state management of natural resources; protection, exploitation and rational, economical and effective use of natural resources:

+ Contributing to assuring state budget revenues and market stabilization.

Therefore, referring to the above frame severance tax tariff, mercury falls under the group of metallic minerals and is subject to severance tax.

The severance tax rate for mercury ranges from 7-25% depending on the quantity.