What is the detailed schedule for the 2024 auditor and accountant exams in Vietnam? What are the duties and powers of the State Audit Office of Vietnam in tax administration?

What is the detailed schedule for the 2024 auditor and accountant exams in Vietnam?

The Exam Council for Auditors and Accountants 2024 issued Notice 163/TB-HDTKTVKTV2024...Download on November 19, 2024, regarding the 2024 auditor and accountant examinations.

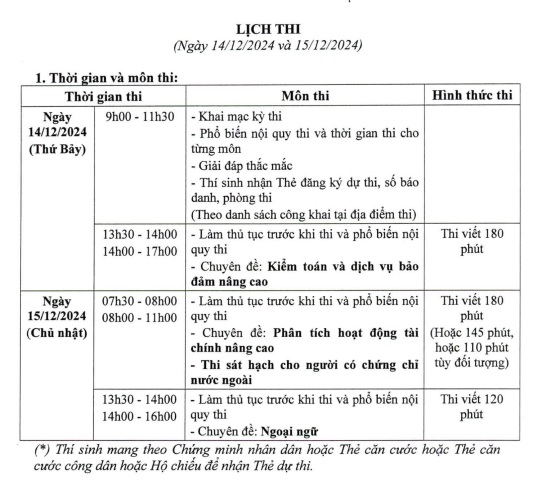

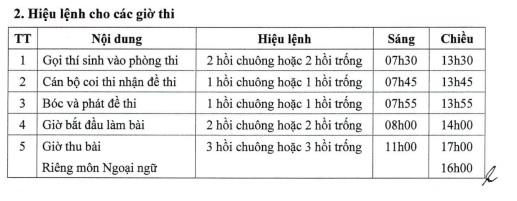

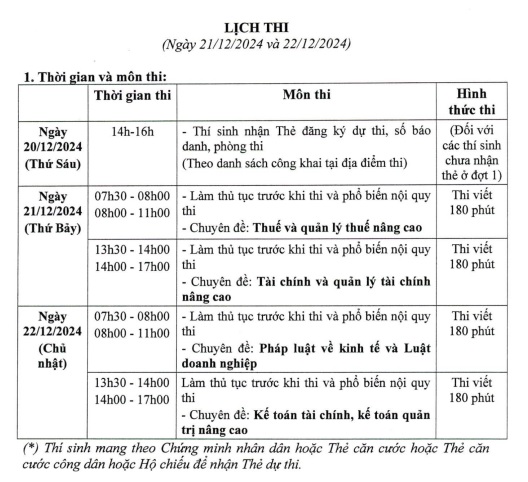

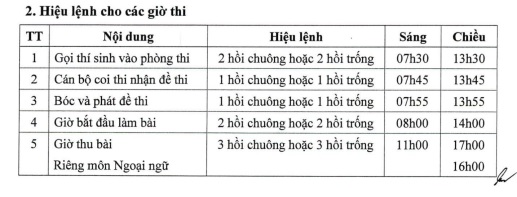

To be specific, the schedule for the 2024 auditor and accountant exams according to Notice 163/TB-HDTKTVKTV2024...Download is as follows:

(1) Exam Dates:

- Phase 1: Saturday and Sunday, December 14-15, 2024;

- Phase 2: Saturday and Sunday, December 21-22, 2024.

(2) Exam Locations:

- Northern Region: Academy of Finance.

+ Opening ceremony and exam card collection at the old campus of the Academy of Finance, 58 Le Van Hien, Duc Thang Ward, Bac Tu Liem District, Hanoi (morning of December 14, 2024).

+ Exam venue at the new campus of the Academy of Finance, 69 Duc Thang, Duc Thang Ward, Bac Tu Liem District, Hanoi (afternoon of December 14, 2024, and on December 15, 21, 22, 2024).

- Southern Region: Opening ceremony, exam card collection and examination at the University of Finance and Marketing, 27 Tan My, Tan Thuan Tay, District 7, Ho Chi Minh City.

(3) Detailed Exam Schedule and Subjects

- Phase 1: Saturday and Sunday, December 14-15, 2024;

- Phase 2: Saturday and Sunday, December 21-22, 2024.

View detailed schedule for the 2024 auditor and accountant exams in Notice 163/TB-HDTKTVKTV2024...Download

What is the detailed schedule for the 2024 auditor and accountant exams in Vietnam? (Image from Internet)

What are the duties and powers of the State Audit Office of Vietnam in tax administration?

Pursuant to Article 21 of the Law on Tax Administration 2019, the duties and powers of the State Audit Office of Vietnam in tax administration are as follows:

(1) Conduct operational audits on tax administration agencies according to the legal provisions regarding the state audit, tax laws, and other related legal regulations.

(2) For recommendations of the State Audit Office of Vietnam related to the tax obligations of taxpayers, the following provisions apply:

- In cases where the State Audit Office of Vietnam directly audits the taxpayer as per the provisions of the State Audit Office of Vietnam Law and makes recommendations regarding the obligation to contribute to the state budget, the State Audit Office of Vietnam must send the audit report or minutes to the taxpayer, and the taxpayer is responsible for implementing the recommendations according to the audit report of the State Audit Office of Vietnam. If the taxpayer disagrees with the State Audit Office of Vietnam's recommendations, the taxpayer has the right to appeal the recommendations of the State Audit Office of Vietnam.

- In cases where the State Audit Office of Vietnam does not directly audit the taxpayer but audits at the tax administration agency where the recommendations in the audit report relate to the taxpayer's tax obligations, the State Audit Office of Vietnam sends an excerpt containing the tax obligation recommendation to the taxpayer for implementation.

The tax administration agency is responsible for organizing the implementation of the State Audit Office of Vietnam’s recommendations. If the taxpayer disagrees with the taxable obligations, the taxpayer may submit a written request for reconsideration of their taxable obligations to the tax administration agency and the State Audit Office of Vietnam. Pursuant to the taxpayer's proposal, the State Audit Office of Vietnam will lead and collaborate with the tax administration agency to accurately determine the taxpayer's tax obligations and assume responsibility as prescribed by law.

May auditors receive a certificate for practicing tax procedures without taking an exam in Vietnam?

According to Clause 2, Article 105 of the Law on Tax Administration 2019, the following is stipulated:

Certificate for Providing Tax Procedure Services

...

- A person holding an auditor certificate or an accountant certificate issued by a competent authority is granted a certificate for tax procedure services without having to take the examination for the certificate.

- A person with a certificate for tax procedure services who works at a tax agency is referred to as a tax agent employee. tax agent employees must fully participate in knowledge updating programs.

...

Thus, auditors are granted a certificate for practicing tax procedure services without having to take the examination for the certificate.

Note: A person with a certificate for tax procedure services who works at a tax agency is called a tax agent employee. tax agent employees must fully participate in knowledge updating programs.

Who is ineligible to become a tax agent employee in Vietnam?

Pursuant to Clause 4, Article 105 of the Law on Tax Administration 2019, the following individuals are not eligible to become tax agent employees:

(1) Officials and public employees; officers, non-commissioned officers, professional soldiers, defense workers, defense public employees; police officers, non-commissioned officers, and public security workers;

(2) Persons prohibited from practicing tax procedure services, accounting, auditing according to legally effective court judgments or decisions; persons being prosecuted for criminal responsibility;

(3) Persons who have been convicted of offenses violating economic management order related to taxation, finance, accounting that have not been expunged; persons being subject to administrative disciplinary measures for education at the commune, ward, or commune-level town, or mandatorily sent to educational facilities, compulsory detoxification centers;

(4) Persons fined for administrative violations concerning tax administration, accounting, auditing within a period of 06 months from the date of completing penalties in case of a warning or 01 year in case of other penalties execution.