What is the definition of excise tax in Vietnam? What are the goods subject to excise tax?

What is the definition of excise tax in Vietnam?

Currently, the Vietnamese law does not specify the definition of excise tax. However, based on the taxable and non-taxable objects under Article 2 of the Excise Tax Law 2008 (amended by Clause 1 Article 1 of the Law on Amendments to Excise Tax Law 2014) and Article 3 of the Excise Tax Law 2008, the definition of excise tax may be defined.

Simultaneously, under Article 5 of the Excise Tax Law 2008:

Tax bases

Excise tax bases include the taxed price of a taxable goods or service and the tax rate. The payable excise tax amount is the excise taxed price multiplied by the excise tax rate.

From the synthesis of the above regulations, the excise tax is an indirect tax levied on certain luxury goods and services to regulate production, importation, and societal consumption.

Simultaneously, it strongly regulates the income of consumers, contributing to increasing the State Budget revenue and strengthening business production management for taxable goods and services.

The excise tax is paid by the facilities directly producing the goods, but the consumers pay the tax as it is included in the sale price.

What are the 10 goods subject to excise tax in Vietnam?

Under Article 2 of the Law on excise tax 2008 and Article 2 of Decree 108/2015/ND-CP, the objects subject to excise tax include:

Taxable objects

1. Goods:

a/ Cigarettes, cigars and other tobacco preparations used for smoking, inhaling, chewing, sniffing or keeping in mouth;

b/ Liquor;

c/ Beer;

d/ Under-24 seat cars, including cars for both passenger and cargo transportation with two or more rows of seats and fixed partitions between passenger holds and cargo holds;

e/ Two- and three-wheeled motorcycles of a cylinder capacity of over 125 cm3;

f/ Aircraft and yachts;

g/ Gasoline;

h/ Air-conditioners of 90,000 BTU or less;

i/ Playing cards;

j/ Votive gilt papers and votive objects.

2. Services:

a/ Dance halls:

b/ Massage parlors and karaoke bars;

c/ Casinos; prize-winning video games, including jackpot and slot games and games on similar machines;

d/ Betting;

e/ Golf business, including the sale of membership cards and golf playing tickets;

f/ Lottery business.

Therefore, referring to the above regulations, the 10 goods subject to excise tax in Vietnam according to current legal regulations include:

- Cigarettes, cigars and other tobacco preparations used for smoking, inhaling, chewing, sniffing or keeping in mouth;

- Liquor;

- Beer;

- Under-24-seat cars, including cars for both passenger and cargo transportation with two or more rows of seats and fixed partitions between passenger holds and cargo holds;

- Two- and three-wheeled motorcycles of a cylinder capacity of over 125 cm3;

- Aircraft and yachts;

- Gasoline of all kinds, naphtha, reformade components and other components for mixing gasoline;

- Air-conditioners of 90,000 BTU or less;

- Playing cards;

- Votive gilt papers and votive objects.

*Note: Goods subject to excise tax must be complete products, not including parts for assembling these goods.

What are the tax rates applicable to the group of goods subject to excise tax?

Article 5 of the excise tax Law 2008 provides for the tax bases:

Tax bases

Excise tax bases include the taxed price of a taxable goods or service and the tax rate. The payable excise tax amount is the excise taxed price multiplied by the excise tax rate.

Furthermore, the payable excise tax amount is determined by the following formula:

excise tax payable = Taxable price x Tax rate

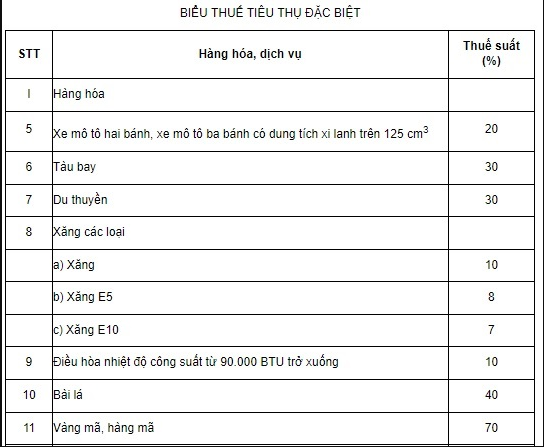

Additionally, according to Article 7 of the excise tax Law 2008 (amended by Clause 4 Article 1 of the Law on Amendments to Excise Tax Law 2014, Clause 2 Article 2 of the Law on Amendments to Law on Value Added Tax Law, Excise Tax Law, and Tax Administration Law 2016 and Article 8 of the Law on Amendments to Law on Public Investment Law, Public-Private Partnership Investment Law, Investment Law, Housing Law, Bidding Law, Electricity Law, Enterprise Law, excise tax Law, and Civil Judgment Enforcement Law 2022) the excise tax rates for types of goods are as follows:

Tax Rates

The excise tax rates for goods and services are specified in the excise tax Tariff below:

...

Therefore, depending on the type of goods, the tax rate will vary accordingly.

What is the definition of excise tax in Vietnam? What are the 10 goods subject to excise tax? (Image from the Internet)

What are the cases of excise tax refund in Vietnam?

Under Article 8 of the Excise Tax Law 2008, excise taxpayers may have the paid tax amounts refunded in the following cases:

- Goods temporarily imported for re-export:

- Goods which are raw materials imported for export production and processing;

- Finalization of overpaid tax amounts upon merger, consolidation, separation, split-up. dissolution, bankruptcy, ownership change, enterprise transformation or operation termination;

- Upon issuance of tax refund decisions by competent agencies under law. and cases of excise tax refund under treaties to which the Socialist Republic of Vietnam is a contracting party.

The excise tax refund under Points a and b of this Clause is applicable only to actually exported goods.