What is the deadline for PIT finalization for individuals who self-finalize tax with tax authorities in Vietnam?

What is the deadline for PIT finalization for individuals who self-finalize tax with tax authorities in Vietnam?

Pursuant to Clause 2, Article 44 of the Law on Tax Administration 2019:

Deadlines for submission of tax declaration dossiers

...

2. For taxes declared annually:

a) For annual tax statement dossiers: the last day of the 3rd month from the end of the calendar year or fiscal year. For annual tax declaration dossiers: the last day of the first month from the end of the calendar year or fiscal year

b) For annual PIT statements prepared by income earners: the last day of the 4th month from the end of the calendar year;

Thus, the deadline for PIT finalization for individuals who self-finalize tax with tax authorities in Vietnam is determined as follows:

No later than the last day of the fourth month from the end of the calendar year.

What is the deadline for PIT finalization for individuals who self-finalize tax with tax authorities in Vietnam? (Image from the Internet)

What does income subject to annual PIT finalization by individuals in Vietnam include?

Pursuant to Point d, Clause 6, Article 8 of Decree 126/2020/ND-CP:

Taxes declared monthly, quarterly, annually, separately; tax finalization

...

6. The following taxes and amounts shall be declared annually and finalized when an enterprise is dissolved, shuts down, terminates a contract or undergoes rearrangement. In case of conversion (except equitized state-owned enterprises) where the enterprise after conversion inherits all tax obligations of the enterprise before conversion, tax shall be finalized at the end of the year instead of the issuance date of the decision on conversion. Tax shall be finalized at the end of the year):

...

d) Personal income tax for salary payers; salary earners that authorize salary payers to finalize tax on their behalf; salary earners that finalize tax themselves. To be specific:

d.1) Salary payers shall finalize tax on behalf of authorizing individuals, whether tax is deducted or not. Tax finalization is not required if an individual does not earn any income. In case an employee is re-assigned to a new organization after the old organization is acquired, consolidated, divided or converted, or to a new organization that is in the same system as the old organization, the new organization shall finalize tax as authorized by such employee, including the income paid by the old organization, and collect documents about deduction of personal income tax issued by the old organization to the employee (if any).

d.2) A resident salary earner may authorize the salary payer to finalize tax if:

...

d.3) A resident salary earner shall directly submit the personal income tax finalization dossier to the tax authority in the following cases:

...

Thus, among taxable income, annual PIT finalization only applies to income from salaries and remunerations.

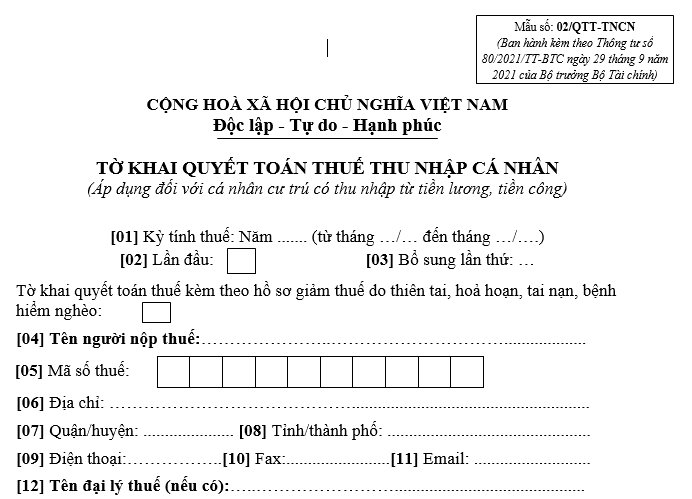

What is the PIT finalization declaration form in Vietnam?

The PIT finalization declaration form in Vietnam applicable to individuals with income from salaries and remunerations is Form 02/QTT-TNCN issued under Circular 80/2021/TT-BTC:

>> Download Download the PIT finalization declaration form applicable to individuals with income from salaries and remunerations

Instructions for filling out the PIT finalization declaration applicable to individuals with income from salaries and remunerations are as follows:

[01] Income from salaries and remunerations for residents applying annual PIT calculation.

[02] Taxpayer marks X in this box if it is the first PIT finalization declaration in the tax calculation period (not yet supplementary).

[03] Taxpayer marks X in this box if they qualify for tax reduction due to natural disasters, fires, accidents, or severe illness affecting their tax-paying ability.

[04] Fill in the full name of the taxpayer.

[05] Fill in the tax identification number issued by tax authorities.

[06] Fill in the address of the taxpayer (house number, street name, village, ward), not including district and province/city names (as they will be filled in at fields [7] and [8]).

[07] Fill in the full name of the tax agent if the taxpayer has a contract with a tax agent to handle tax procedures on their behalf.

[08] Fill in the tax identification number of the tax agent (if any).

[09] Fill in the full name of the income payer.

[10] Fill in the tax identification number of the income payer.

[11] In this column, the taxpayer provides specific amounts or numbers of people according to the guidance in the Indicator column.