What is the CIT declaration form - Form 01/VTNN applicable to foreign marine shipping companies in Vietnam?

What is the CIT declaration form - Form 01/VTNN applicable to foreign marine shipping companies in Vietnam?

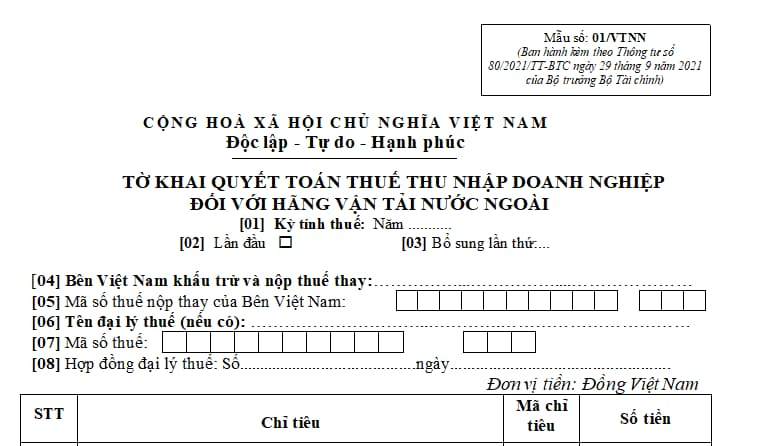

The CIT declaration form - Form 01/VTNN applicable to foreign marine shipping companies prescribed in Appendix 2 issued together with Circular 80/2021/TT-BTC is as follows:

Download the CIT declaration form - Form 01/VTNN applicable to foreign marine shipping companies: Here

What is the CIT declaration form - Form 01/VTNN applicable to foreign marine shipping companies in Vietnam? (Image from the Internet)

What does the CIT finalization dossier of foreign marine shipping companies in Vietnam include?

According to Section 13.5 stipulated in Appendix 1 issued together with Decree 126/2020/ND-CP, the CIT finalization dossier of foreign marine shipping companies in Vietnam includes:

- CIT Finalization Declaration Form for foreign marine shipping companies (Form 01/VTNN issued together with Circular 80/2021/TT-BTC).

- Appendix showing statement on income from international transport (applicable to enterprises operating ships) (Form 01-1/VTNN issued together with Circular 80/2021/TT-BTC).

- Appendix showing statement on income from international transport (applicable to exchange/share slots) (Form 01-2/VTNN issued together with Circular 80/2021/TT-BTC).

- Appendix showing statement on container detention revenue (Form 01-3/VTNN issued together with Circular 80/2021/TT-BTC).

What is the determination of the revenue subject to CIT of foreign marine shipping companies in Vietnam?

According to point b, clause 1, Article 13 of Circular 103/2014/TT-BTC, the regulations are as follows:

Corporate income tax

The basis for tax calculation is the revenue subject to corporate income tax CIT and tax rate (%).

CIT payable

=

Revenue subject to CIT

x

CIT rate

...

b) Determination of revenue subject to CIT in some cases:

....

b.6) Revenue subject to CIT of a foreign marine shipping company is the total charge for transport of passengers, cargo, and other surcharges received by the shipping company from the loading port to the unloading port (including charge for the consignments transit through intermediate ports) and/or charge fro transport of cargo between Vietnam’s ports.

The charge being the basis for calculating CIT does not include the charge on which CIT has been paid at a Vietnam’s port and the charge paid to a Vietnamese courier for transporting goods from a Vietnam’s port to an intermediate port.

Example 21:

Company A acts as an agent of foreign marine shipping company X. According to the agent contract, company A, on behalf of company X, receives goods to be transported abroad, issues bills of lading, collects charges, etc.

Company B of Vietnam hires company X (via company A) to transport goods from Vietnam to America for USD 100,000.

Company A hires ships from Vietnamese or foreign companies to carry goods from Vietnam to Singapore for USD 20,000. From Singapore, goods shall be transported to the USA by ships of company X.

Revenue subject to CIT of company X is calculated as follows:

Revenue subject to CIT = 100,000 – 20,000 = 80,000 USD

b.7) Revenue subject to CIT from outbound logistics services (whether the service charge is paid by the consignor or consignee) is the whole revenue received by the foreign contractor exclusive of international transport charge payable to the courier (by air or by sea).

b.8) Revenue subject to CIT from outbound postal services (whether the service charge is paid by the consignor or consignee) is the whole revenue received by the foreign contractor.

...

Thus, the revenue subject to CIT of a foreign marine shipping company is the total charge for transport of passengers, cargo, and other surcharges received by the shipping company from the loading port to the unloading port (including charge for the consignments transit through intermediate ports) and/or charge fro transport of cargo between Vietnam’s ports.