What is the application form for VAT declaration cancellation in Vietnam in 2024?

What is the application form for VAT declaration cancellation in Vietnam in 2024?

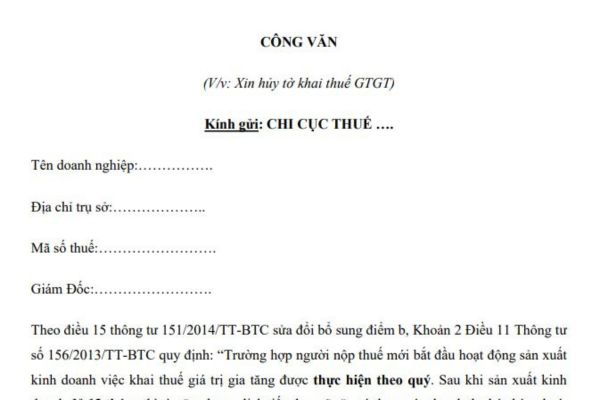

Currently, there is no legal document that provides detailed regulations regarding the sample Official Dispatch requesting the cancellation of a VAT declaration due to making false filing. Therefore, organizations and individuals can refer to the Sample Official Dispatch requesting cancellation of a VAT declaration due to making false filing updated for 2024 as follows:

application form for VAT declaration cancellation 2024 download

What is the application form for VAT declaration cancellation in Vietnam in 2024? How much is the maximum fine for making false VAT declaration 2024? (Image from the Internet)

How much is the maximum fine for making false VAT declaration in Vietnam in 2024?

The form of penalty for making false or incomplete declarations of the criteria on tax returns is stipulated in Clause 2, Article 12 of Decree 125/2020/ND-CP as follows:

Penalty for making false or incomplete declaration of the contents in the tax dossier that does not lead to lack of payable tax or increase of exempted or reduced tax amount

1. A fine ranging from 500,000 VND to 1,500,000 VND shall be imposed for making false or incomplete declaration of criteria in the tax dossier that does not relate to the determination of tax obligation, except for the act specified in Clause 2 of this Article.

2. A fine ranging from 1,500,000 VND to 2,500,000 VND shall be imposed for making false or incomplete declaration of the criteria on the tax return, the appendices attached to the tax return that does not relate to the determination of tax obligation.

3. A fine ranging from 5,000,000 VND to 8,000,000 VND shall be imposed for one of the following acts:

a) making false or incomplete declaration of criteria related to the determination of tax obligation in the tax dossier;

b) Acts specified in Clause 3, Article 16; Clause 7, Article 17 of this Decree.

4. Remedies:

a) Required to re-declare and supplement documents in the tax dossier for the acts specified in Clauses 1, 2 and Point a, Clause 3 of this Article;

b) Required to adjust the tax loss and deductible input VAT carried forward, if any, for the acts specified in Clause 3 of this Article.

Meanwhile, based on Clause 5, Article 5 of Decree 125/2020/ND-CP as follows:

Principles of administrative penalty for taxation and invoicing violations

...

5. For the same administrative tax, invoice violation, the fine level for organizations shall be two times the fine level for individuals, except for the fine levels specified in Articles 16, 17, and 18 of this Decree.

And Clause 4, Article 7 of Decree 125/2020/ND-CP states as follows:

Forms of penalty, remedies, and principles for applying fines for administrative taxation and invoice violations

...

4. Principle for applying fine levels

a) The fine levels provided in Articles 10, 11, 12, 13, 14, 15, Clauses 1, 2, Article 19, and Chapter III of this Decree apply to organizations.

For taxpayers who are households, household businesses, the fine level applies as for individuals.

...

Thus, according to the regulations, for making false or incomplete declaration of criteria on the tax return, organizations may be fined up to 8,000,000 VND for administrative violations.

In the case of individuals committing violations, the fine will be half the level of the organization's fine.

Additionally, individuals who commit making false or incomplete declarations on the tax return must also undertake rectification by re-declaring and supplementing documents in the tax dossier.

What is the limitation period for administrative penalties for making false VAT declaration in Vietnam in 2024?

The limitation period for administrative penalties is stipulated in Clause 2, Article 8 of Decree 125/2020/ND-CP as follows:

Limitation period for administrative tax and invoice penalties; period considered as not being penalized; tax collection period

...

2. Limitation period for administrative tax penalties

a) The limitation period for procedural tax violations is 02 years, from the date of committing the violation.

The date of committing an administrative tax procedure violation is the day following the deadline for performing tax procedures as prescribed by the tax management law, except in the following cases:

For acts specified in Clause 1, Points a, b Clause 2, Clause 3 and Point a Clause 4, Article 10; Clauses 1, 2, 3, 4, and Point a Clause 5, Article 11; Clauses 1, 2, 3 and Points a, b Clause 4, Clause 5, Article 13 of this Decree, the date of committing the violation for calculating the limitation period is the date the taxpayer performs taxpayer registration or notifies the tax authority or submits the tax return.

For acts specified in Point c, Clause 2, Point b, Clause 4, Article 10; Point b, Clause 5, Article 11; Points c, d Clause 4, Article 13 of this Decree, the date of committing the violation for calculating the limitation period is the date on which the authority person in the performance of duties discovers the violation.

...

Thus, according to the regulations, the limitation period for administrative penalties for making false or incomplete declaration on the tax return is 02 years from the date of committing the violation.