What is the application form for TIN deactivation in Vietnam?

What is the application form for TIN deactivation in Vietnam?

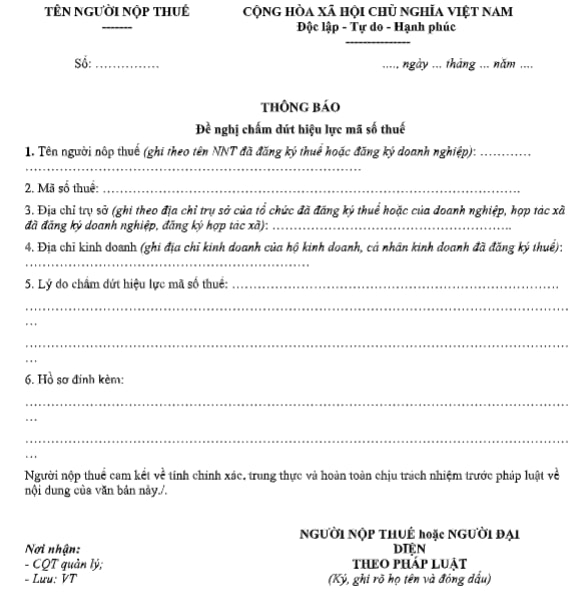

The document for the application for TIN deactivation is specified in Form No. 24/DK-TCT, issued together with Circular 105/2020/TT-BTC as stipulated in Articles 38 and 39 of the Law on Tax Administration 2019. To be specific:

Download Form 24/DK-TCT for the application for TIN deactivation: Here

What is the application form for TIN deactivation in Vietnam? (Image from the Internet)

Vietnam: May a person have his/her TIN deactivated?

Based on Clause 2, Article 39 of the Law on Tax Administration 2019, the deactivation (cancellation of the TIN) can be carried out under the following circumstances for taxpayers who register directly with the tax authority:

- deactivation of business activities, with no further tax obligations for non-business organizations;

- Revocation of the business registration certificate or equivalent license;

- Being divided, merged, or consolidated;

- Being notified by the tax authority that the taxpayer is not operating at the registered address;

- Individual is deceased, missing, or legally incapacitated;

- Foreign contractor after the contract has ended;

- Contractor or investor participating in a petroleum contract upon conclusion or transfer of all rights under the contract.

What are principles for TIN deactivation in Vietnam?

Based on Clause 3, Article 39 of the Law on Tax Administration 2019, the principles for deactivating the validity of a TIN are as follows:

- The TIN must not be used in economic transactions from the date the tax authority announces its deactivation;

- The TIN of an organization after deactivation must not be reused, except as specified in Article 40 of the Law on Tax Administration 2019;

- The TIN of a household business or individual when deactivated does not invalidate the TIN of the household business's representative and can be used to fulfill other tax obligations of that individual;

- When an enterprise, economic organization, other organization, or individual deactivates a TIN, any substitute TIN must also be deactivated;

- When a taxpayer who is a supervisory unit deactivates a TIN, dependent units must also have their TINs deactivated.

What are cases of TIN reactivation for household businesses in Vietnam?

According to the provisions of Article 40 of the Law on Tax Administration 2019, the regulations are as follows:

TIN reactivation

1. Taxpayers who register with business registration, cooperative registration, or business operation registration, upon legal status reactivation as prescribed by relevant business, cooperative, or business registration laws, can simultaneously restore their TINs.

2. Directly registered taxpayers with the tax authority can submit a request to restore their TIN to the direct managing tax authority in the following cases:

a) Receiving a revocation cancellation document from the competent authority regarding the business registration certificate or equivalent license;

b) Intention to continue business activities after submitting the deactivation request to the tax authority but before the tax authority issues a deactivation notice;

c) Receiving notification from the tax authority that the taxpayer is not operating at the registered address but has not had the business license revoked or TIN deactivated.

3. The TIN can be used in economic transactions from the effective date of the legal status reactivation decision by the business registration authority or the date the tax authority announces the reactivation of the TIN.

4. The documentation for requesting the TIN reactivation includes:

a) A written request for TIN reactivation;

b) Other related documents.

Taxpayers who are household businesss can register directly with the tax authority to submit documents requesting the reactivation of their TIN in the following cases:

- The competent authority issues a document cancelling the revocation of the business registration certificate or equivalent license;

- Intention to continue business activities after having submitted the deactivation request to the tax authority but before the tax authority issues a deactivation notice;

- The tax authority notifies the taxpayer is not operating at the registered address but has not had the business license revoked or TIN deactivated.