What is the application form for tax refund under Double Taxation Agreements and other International Treaties - Form 02/HT in Vietnam?

What is the application form for tax refund under Double Taxation Agreements and other International Treaties - Form 02/HT in Vietnam?

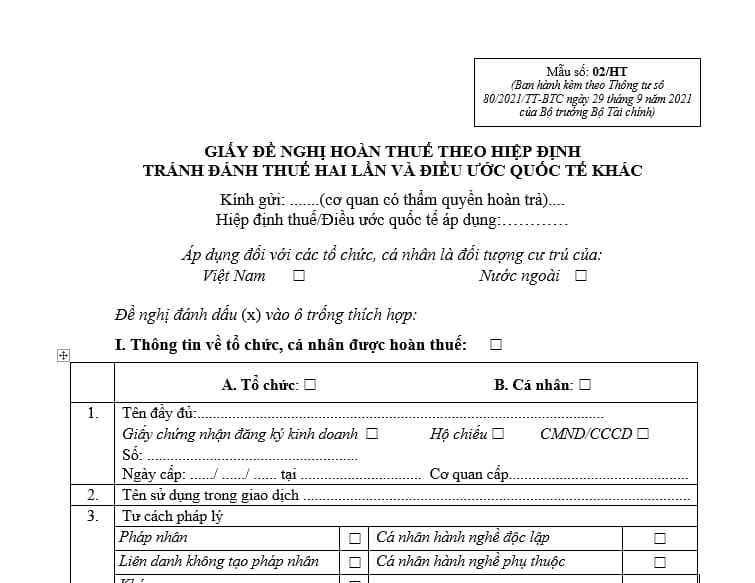

The application form for tax refund under Double Taxation Agreements and other International Treaties - Form 02/HT is the form stipulated in Annex 1 issued together with Circular 80/2021/TT-BTC.

Download the application form for tax refund under Double Taxation Agreements and other International Treaties - Form 02/HT in Vietnam: Here

What is the application form for tax refund under Double Taxation Agreements and other International Treaties - Form 02/HT in Vietnam? (Image from the Internet)

What are the documents required for tax refund under Double Taxation Agreements in Vietnam?

According to Article 30 of Circular 80/2021/TT-BTC, the documents required for tax refund under Double Taxation Agreements in Vietnam include:

- Application form No. 02/HT issued in Annex 1 of Circular 80/2021/TT-BTC.

- Relevant documents, including:

+ The residence certificate issued by the tax authority of the country of residence which has been granted consular legalization and specifies the year of residence;

+ Copies of the business contract, service contract, agent contract, authorization contract, technology transfer contract or employment contract with the Vietnamese party, certificate of deposit in Vietnam, certificate of capital contribution in the company in Vietnam (on a case-by-case basis) certified by the taxpayer;

+ Written confirmation provided by the Vietnamese party of the duration and actual execution of the contract (in case of tax refund to foreign transport companies);

+ The authorization letter in case the legal representative is authorized to follow procedures for application of Tax Agreement. In case the legal representative is authorized to apply for tax refund into the account of another entity, consular legalization (if authorized overseas) or notarization (if authorized in Vietnam) is mandatory;

+ The list of tax payment documents according to Form No. 02-1/HT in Annex 1 of Circular 80/2021/TT-BTC.

What are the documents required for tax refund under other international treaties in Vietnam?

According to Article 30 of Circular 80/2021/TT-BTC, the documents required for tax refund under other international treaties in Vietnam include:

- The application form No. 02/HT in Annex 1 of Circular 80/2021/TT-BTC which is confirmed by the authority that proposed the conclusion of the international treaty.

- Relevant documents, including:

+ Copies of the international treaty;

+ Copies of the contract with the Vietnamese party certified by the foreign party or the authorized representative;

+ Summary of the contract certified by the foreign party or the authorized representative. The summary shall include: names of the contract and its articles; scope of the contract and tax obligations specified in the contract;

+ The authorization letter in case the foreign party authorizes a Vietnamese organization or individual to follow procedures for tax refund under the international treaty. In case the legal representative is authorized to apply for tax refund into the account of another entity, consular legalization (if authorized overseas) or notarization (if authorized in Vietnam) is mandatory;

+ The list of tax payment documents according to Form No. 02-1/HT in Annex 1 of Circular 80/2021/TT-BTC.

What are the methods for submitting the application for tax refund under Double Taxation Agreements and other International Treaties in Vietnam?

According to Article 32 of Circular 80/2021/TT-BTC, the submission of the application for tax refund under Double Taxation Agreements and other International Treaties in Vietnam is as follows:

- Electronic applications

+ The taxpayer shall send the electronic application for tax refund via the information portal of the General Department of Taxation or other information portals as prescribed by regulations of law on electronic tax transactions.

+ Electronic applications for tax refund of taxpayers shall be received as prescribed by regulations of law on electronic tax transactions.

+ Within 03 working days from the date written on the receipt note (Form No. 01/TB-HT in Appendix I of Circular 80/2021/TT-BTC), the tax authority that processes the tax refund application in accordance with Article 27 of Circular 80/2021/TT-BTC (hereinafter referred to as "processing authority") shall decide whether to issue a notice of granted application according to Form No. 02/TB-HT in Appendix of Circular 80/2021/TT-BTC or notice of rejected application according to Form No. 04/TB-HT in Appendix I of Circular 80/2021/TT-BTC via the information portal of General Department of Taxation or other information porters through which the taxpayer submits the electronic tax refund application.

- Physical applications

- In case the taxpayer submits a physical application at the tax authority, the tax official shall examine the satisfactoriness of the application as per regulations. In case the application is not satisfactory, the tax official shall request the taxpayer to supplement the application. In case the application is satisfactory, the tax official shall send a notice of receipt of the application according to Form No. 01/TB-HT in Appendix I of Circular 80/2021/TT-BTC to the taxpayer record the application on the tax administration system.

- In case the taxpayer sends the physical application by post, the tax official shall append the date stamp on the application and record the application on the tax administration system.

- Within 03 working days from the day on which the application is received, the tax authority shall decide whether to issue the notice of granted application according to Form No. 02/TB-HT in Appendix of Circular 80/2021/TT-BTC (if the application is granted), or the notice of unsatisfactory application according to Form No. 03/TB-HT in Appendix I of Circular 80/2021/TT-BTC (for applications sent by post), or the notice of rejected application according to Form No. 04/TB-HT in Appendix I of Circular 80/2021/TT-BTC (if the application is rejected).

Cancellation of tax refund application

- In case the taxpayer wishes to cancel the tax refund application that was sent to the tax authority, the taxpayer shall submit the written request for cancellation of the tax refund application according to Form No. 01/DNHUY in Appendix I of Circular 80/2021/TT-BTC. Within 03 working days from the receipt of Form No. 01/DNHUY, the processing shall send the taxpayer a notice of cancelled tax refund application according to Form No. 02/TB-HT in Appendix I of Circular 80/2021/TT-BTC and close it on the tax authority's records.

- The taxpayer may carry deduct refundable tax from the tax payable on the tax form of the next period from the date of issuance of the notice of cancelled tax refund application if the conditions for declaration, deduction or re-submission of the tax refund application are satisfied.

- In case the tax authority has issued the decision on inspection before tax refund, the taxpayer must not send the written request for cancellation of the tax refund application. The processing authority shall carry out the inspection in accordance with Article 110 of the Law on Tax Administration 2019 and Chapter 8 of Circular 80/2021/TT-BTC.