What is the application form for tax deferral in case of relocation of the business establishment in Vietnam?

What is the application form for tax deferral in case of relocation of the business establishment in Vietnam?

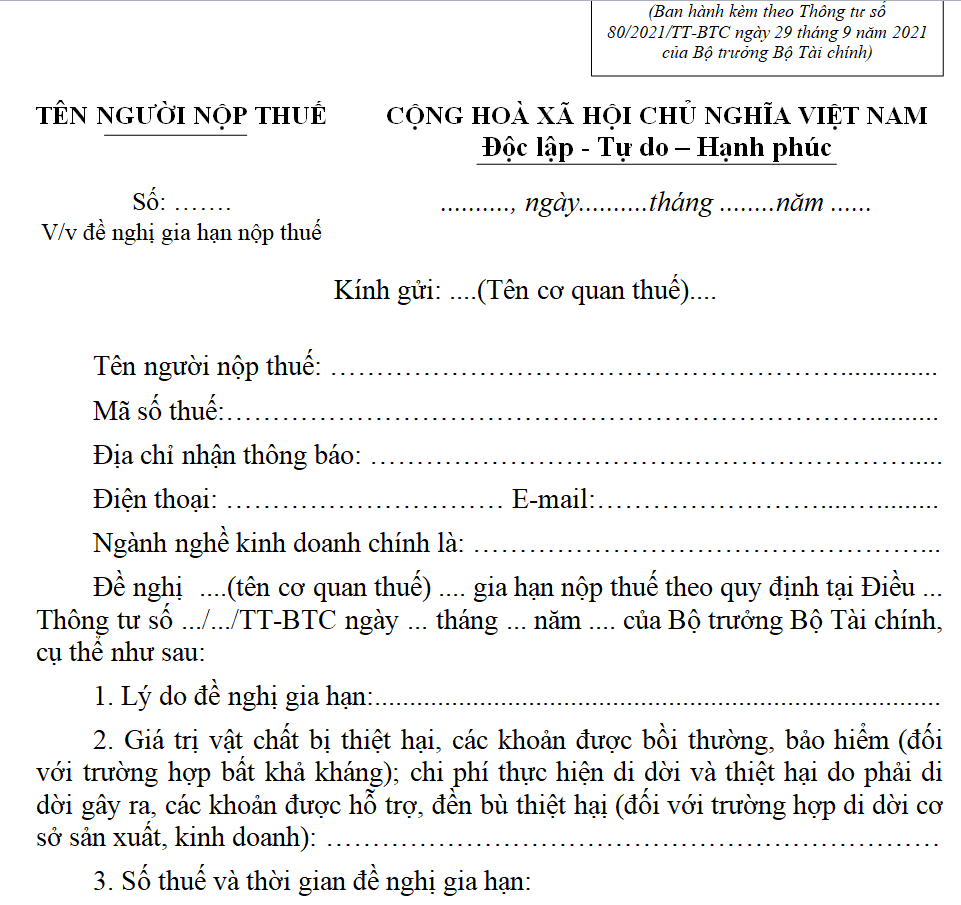

The application for tax deferral submitted by taxpayers is in accordance with form number 01/GHAN issued along with Appendix I of Circular 80/2021/TT-BTC as follows:

Download Form number 01/GHAN to apply for an tax deferral in case of relocation of the business establishment.

What is the application form for tax deferral in case of relocation of the business establishment in Vietnam? (Photo from Internet)

What does the application for tax deferral include in case of relocation of the business establishment in Vietnam?

According to Clause 2, Article 24 of Circular 80/2021/TT-BTC, the application for tax deferral in cases of relocation of production and business facilities, as stipulated in point b, clause 1, Article 62 of the Tax Administration Law 2019 includes:

- The taxpayer's request for an tax deferral, following form number 01/GHAN issued with Appendix I of this Circular;

- Decision by a competent state authority regarding the relocation of production and business facilities concerning the taxpayer (original or a certified copy by the taxpayer);

- Scheme or relocation plan that clearly shows the taxpayer's plan and progress for relocation (original or a certified copy by the taxpayer).

Which authority decides on tax deferral in special cases in Vietnam?

Pursuant to Article 63 of the Tax Administration Law 2019, the following is prescribed:

tax deferral in Special Cases

The Government of Vietnam decides on tax deferrals for subjects and business sectors experiencing special difficulties during specific periods. Extensions do not lead to adjustments in the state budget estimates ratified by the National Assembly.

The special case tax deferral is further guided by Article 19 of Decree 126/2020/ND-CP as follows:

During particular periods when subjects or business sectors encounter special difficulties, the Ministry of Finance shall take the lead, cooperate with related ministries and central authorities to propose to the Government of Vietnam to stipulate the subjects, types of taxes, and other state budget revenues, the duration, procedural order, authority, and dossiers for tax deferrals. tax deferrals do not lead to adjustments in the state budget estimates ratified by the National Assembly.

Thus, the Government of Vietnam is the authority that decides on the tax deferral in special cases.

What are procedures for processing tax deferral applications in Vietnam?

According to Article 65 of the Tax Administration Law 2019, the receipt and processing of tax deferral applications are regulated as follows:

- The tax administration authority receives tax deferral applications from taxpayers through the following methods:

+ Direct submission at the tax management authority;

+ Submission via postal service;

+ Electronic submission through the tax administration authority's electronic portal.

- The tax administration authority processes tax deferral applications according to the following regulations:

+ In the case of legal, complete, and correctly formatted applications, a written notification of tax deferral shall be sent to the taxpayer within 10 working days of receipt of the complete application;

+ If the application is incomplete as per regulations, a written notification shall be sent to the taxpayer within 3 working days of receipt of the application.

Where and How Should Taxes Be Paid?

Based on Article 56 of the Tax Administration Law 2019, the regulations on locations and methods of tax payment are as follows:

Location and Method of Tax Payment

1. Taxpayers shall pay taxes into the state budget as follows:

a) At the State Treasury;

b) At the tax management agency where tax declarations are submitted;

c) Through an organization authorized by the tax management authority to collect taxes;

d) Through commercial banks, other credit institutions, and service organizations as permitted by law.

2. The State Treasury, commercial banks, other credit institutions, and service organizations as regulated by law must arrange locations, facilities, officials, and staff to ensure convenience for taxpayers to promptly remit taxes into the state budget.

3. When receiving tax money or deducting taxes, the authorities or organizations must provide taxpayers with tax receipt documents.

4. Within 8 working hours from the time of collecting taxes from a taxpayer, the authority or organization receiving the tax must transfer the funds into the state budget. In the case of cash tax collection in remote, offshore, and difficult-to-access areas, the time limit for transferring tax into the state budget is as specified by the Minister of Finance.

Thus, taxpayers can directly pay their taxes at the State Treasury; at the tax management agency where tax declarations are received or through an organization authorized by the tax authority to collect taxes.

Moreover, taxes can also be paid through commercial banks, other credit institutions, and service organizations as permitted by law.