What is the 2025 e-invoice web portal of the General Department of Taxation of Vietnam? How to search for e-invoice information in the web portal?

What is the 2025 e-invoice web portal of the General Department of Taxation of Vietnam?

Pursuant to Clause 1, Article 46 of Decree 123/2020/ND-CP, the General Department of Taxation is the entity providing e-invoice information upon the request of Central-level state management agencies and organizations. Provincial Tax Departments and District Tax Departments provide information upon requests from equivalent level government agencies and organizations.

The latest 2025 e-invoice web portal is the e-invoice Portal of the General Department of Taxation. It is the official website provided by the General Department of Taxation for citizens and businesses to search and register e-invoices.

Website address: https://hoadondientu.gdt.gov.vn

The database on the portal is synchronized in real-time, ensuring that e-invoice information can be retrieved quickly and accurately.

Which entities are eligible to use the latest 2025 e-invoice web portal of the General Department of Taxation of Vietnam?

Entities eligible to use the General Department of Taxation's e-invoice Portal to search invoices are organizations and individuals (taxpayers) that have been directly managed by tax authorities and "Accepted" the use of e-invoices according to Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC.

Upon being "Accepted," taxpayers will be provided with an account to access the General Department of Taxation’s e-invoice Portal at https://hoadondientu.gdt.gov.vn

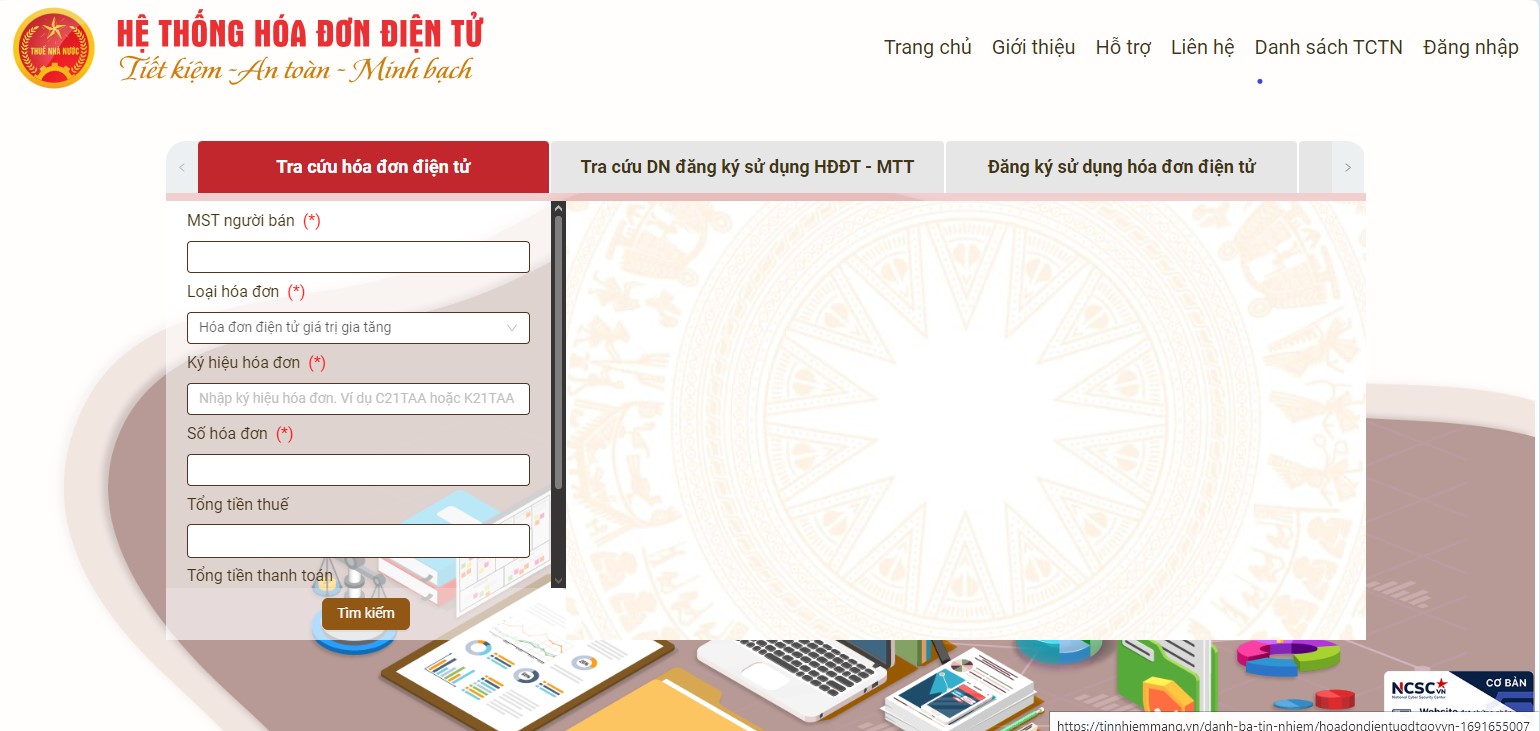

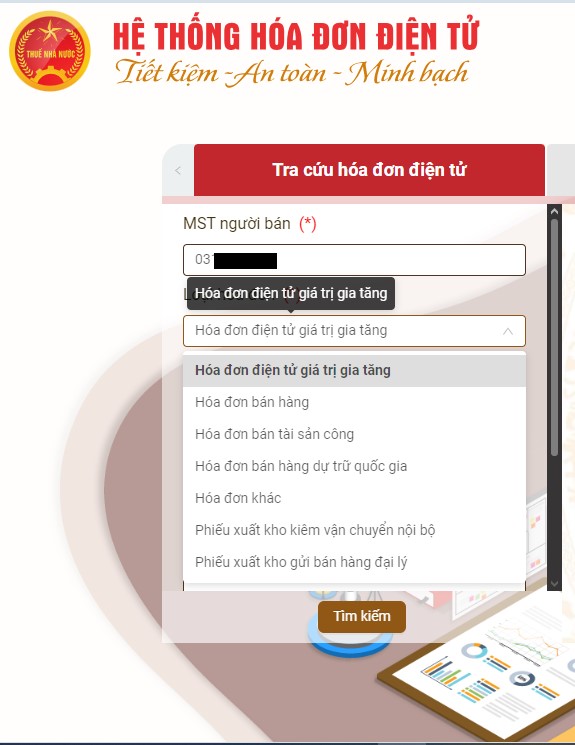

To search for e-invoice information, users should follow these steps:

Step 01: Access the e-invoice System website at https://hoadondientu.gdt.gov.vn

Step 02: Enter all required information marked with (*), including:

Seller’s Tax Identification Number (*)

Invoice Type (*)

Invoice Symbol (*)

Note: When entering the "Invoice Symbol," exclude the leading number character. For example: 1C21TAA => C21TAA

Invoice Number (*)

Enter the captcha code (*)

Step 03: Select “Search”

Step 04: Check the e-invoice search results

When the e-invoice information is valid, users will see the processing status of the invoice displayed as "Invoice code issued."

If the message shows “No invoice matching the search information of organization/individual” then the invoice does not exist. Users should verify their input information for accuracy and perform the search process again.

What is the 2025 e-invoice web portal of the General Department of Taxation of Vietnam? (Image from the Internet)

Who are the users of e-invoice information in Vietnam?

The users of e-invoice information are defined under Clause 2, Article 46 of Decree 123/2020/ND-CP as follows:

Subjects providing, using e-invoice information

1. The General Department of Taxation provides e-invoice information upon request from Central-level state management agencies and organizations. Provincial Tax Departments and District Tax Departments provide information upon requests from equivalent level government agencies and organizations.

2. Entities using e-invoice information include:

a) Businesses, economic organizations, households, individuals conducting business as sellers of goods, providers of services; organizations, individuals as buyers of goods and services;

b) State management agencies using e-invoice information for administrative procedures as prescribed by law; to check the legality of circulating goods on the market;

c) Credit institutions using e-invoice information for tax procedures, bank payment procedures;

d) Organizations providing e-invoicing services;

e) Organizations using e-document information to deduct personal income tax.

The users of e-invoice information include:

- Businesses, economic organizations, households, individuals conducting business as sellers of goods, providers of services; organizations, individuals as buyers of goods and services;

- State management agencies using e-invoice information for administrative procedures as prescribed by law; to check the legality of circulating goods on the market;

- Credit institutions using e-invoice information for tax procedures, bank payment procedures;

- Organizations providing e-invoicing services;

- Organizations using e-document information to deduct personal income tax.

In addition, Decree 123/2020/ND-CP stipulates the responsibilities of users of e-invoice information, specifically in Article 53 as follows:

+ Use e-invoice information for the correct purpose, serving professional activities according to the functions and tasks of the information user, compliant with the law on protecting state secrets.

+ Equip sufficient means and technical equipment to ensure the implementation of searching, connection, and use of e-invoice information.

+ Register for access rights to exploit and use e-invoice information.

+ Manage and secure access account information for the e-portal, phone numbers receiving e-invoice information queries, and e-document information provided by the General Department of Taxation.

+ Ensure the construction, implementation, and operation of systems receiving e-invoice information.