What is the 2024 form for authorization to issue e-invoices in Vietnam? What are the principles of authorizing the issuance of e-invoices in Vietnam?

What is the 2024 form for authorization to issue e-invoices in Vietnam?

Currently, the authorization to issue e-invoices must be in written form (either contract or agreement) between the delegating party and the authorized party, and therefore, the law does not stipulate a specific Form for the authorization to issue e-invoices.

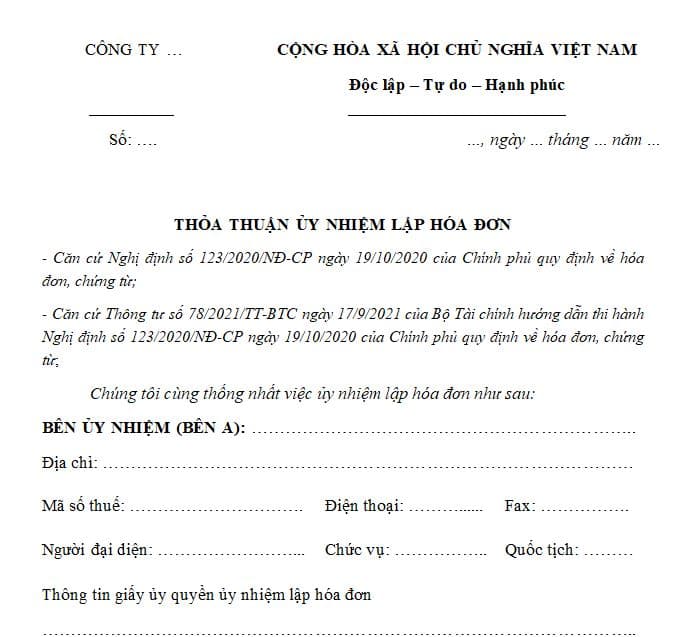

However, based on Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC, the authorization to issue e-invoices can be drafted as per the following Form:

Download the 2024 Form for the authorization to issue e-invoices

What is the 2024 form for authorization to issue e-invoices in Vietnam? What are the principles of authorizing the issuance of e-invoices in Vietnam? (Image from the Internet)

What are the principles of authorizing the issuance of e-invoices in Vietnam?

According to Clause 1, Article 3 of Circular 78/2021/TT-BTC, the principles of authorizing the issuance of e-invoices are stipulated as follows:

- Sellers of goods or services, being enterprises, economic organizations, or other organizations are entitled to authorize a third party that has a relationship with the seller, and is eligible to use e-invoices and not in the case of suspending the use of e-invoices as prescribed in Article 16 of Decree 123/2020/ND-CP to issue e-invoices for goods and services transactions. The relationship is determined according to the law on tax administration;

- Authorization must be in the form of a written document (contract or agreement) between the delegating party and the authorized party;

- The authorization must be notified to the tax authority when registering to use e-invoices;

- E-invoices issued by the authorized organization are e-invoices with or without tax authority codes and must display the name, address, and tax code of both the delegating party and the authorized party;

- Both the delegating party and the authorized party are responsible for posting this information on their company websites or publicizing it via mass media so that purchasers of goods and services are informed of the authorization to issue invoices. Upon the expiration or prior termination of the authorization agreement, both parties must remove the postings from their websites or notify via mass media about the cessation of the authorization to issue e-invoices;

- In cases where the authorized invoice is an e-invoice without a tax authority code (hereinafter referred to as non-code e-invoice), the delegating party must transfer the electronic invoice data to the managing tax authority directly or through a service provider to send the electronic invoice data to the managing tax authority;

- The authorized party is responsible for issuing authorized e-invoices accurately as they occur, in accordance with the agreement with the delegating party, and in compliance with the principle specified in Clause 1, Article 3 of Circular 78/2021/TT-BTC.

Is it necessary to notify the tax authority about the authorization to issue e-invoices in Vietnam?

Based on Point a, Clause 3, Article 3 of Circular 78/2021/TT-BTC, notifying the tax authority about the authorization to issue e-invoices is regulated as follows:

Authorization to Issue E-Invoices

...

- Notify the tax authority about the authorization to issue e-invoices

a) Authorization is identified as a change in the registration information for using e-invoices according to Article 15 of Decree No. 123/2020/ND-CP. Both the delegating party and the authorized party must use Form 01DKTD/HDDT issued with Decree No. 123/2020/ND-CP to notify the tax authority about the authorization to issue e-invoices, including cases of early termination of the authorization according to agreements between the parties;

b) The delegating party fills in the information of the authorized party, and the authorized party fills in the information of the delegating party on Form 01DKTD/HDDT issued with Decree No. 123/2020/ND-CP as follows:

- For both delegating and authorized parties in Section 5 "List of Digital Certificates Used," fill in complete information on the digital certificates of both parties;

- For the authorized party in Column 5, Section 6 "Registration of Authorization to Issue Invoices," fill in the information on the name, delegating organization, and tax code of the delegating party.

According to the above provisions, authorization is identified as a change in the registration information for using e-invoices. Therefore, both the delegating party and the authorized party must notify the tax authority about the authorization to issue e-invoices, including cases of prior termination of the authorization as agreed between the parties.

Both the delegating party and the authorized party must use Form 01DKTD/HDDT Download issued in conjunction with Decree 123/2020/ND-CP to notify the tax authority about the authorization to issue e-invoices.