What is the 2024 CIT finalization form in Vietnam?

What is the 2024 CIT finalization form in Vietnam?

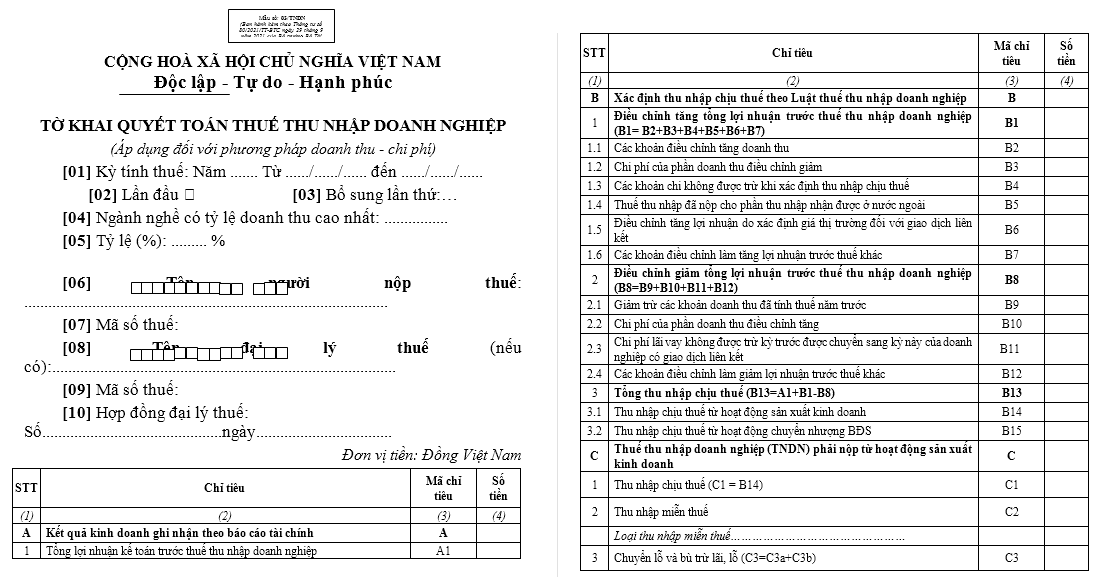

Based on Appendix 2 issued with Circular 80/2021/TT-BTC, the CIT finalization form is Form 03/TNDN as follows:

>>> Download the latest Form 03/TNDN corporate income tax finalization for 2024.

What is the 2024 CIT finalization form in Vietnam? (Image from the Internet)

Does turnover for calculating taxable income include processing fees in Vietnam?

Based on Article 5 of Circular 78/2014/TT-BTC, regulations on turnover for calculating taxable income are as follows:

Turnover

1. Turnover for calculating taxable income is determined as follows:

Turnover for calculating taxable income is the total amount from the sale of goods, processing fees, provision of services including subsidies, surcharges, and extras that the enterprise is entitled to, regardless of whether money has been collected or not.

a) For enterprises paying value-added tax under the credit method, turnover does not include value-added tax.

Example 4: Enterprise A pays value-added tax under the credit method. The value-added invoice contains the following details:

Selling price: 100,000 VND.

VAT (10%): 10,000 VND.

Total payment: 110,000 VND.

Turnover for calculating taxable income is 100,000 VND.

b) For enterprises paying value-added tax by the direct method on the added value, turnover includes value-added tax.

Example 5: Enterprise B pays value-added tax by the direct method on the added value. The sales invoice only states the selling price as 110,000 VND (including VAT).

Turnover for calculating taxable income is 110,000 VND.

c) In the case of an enterprise with service business activities where customers pay in advance for several years, the turnover for calculating taxable income is allocated over the number of years paid in advance or determined according to lump-sum payment turnover. In the case the enterprise is enjoying tax incentives, the determination of the tax amount entitled to incentives must be based on the total corporate income tax payable for the years of advance payment divided (:) by the number of years of advance payment.

Therefore, according to the regulations above, turnover for calculating taxable income will indeed include processing fees.

What are the regulations on corporate income taxpayers in Vietnam?

Based on Article 2 of Circular 78/2014/TT-BTC, the regulations are as follows:

* Corporate income taxpayers are organizations engaged in production, trading of goods, and services with taxable income (hereinafter referred to as enterprises), including:

- Enterprises established and operating according to the Law on Enterprises, Law on Investment, Law on Credit Institutions, Law on Insurance Business, Law on Securities, Law on Petroleum, Law on Commerce, and other legal documents in forms: Joint-stock companies; Limited liability companies; Partnerships; Private enterprises; Law offices, Private notary offices; Parties in business cooperation contracts; Parties in petroleum product sharing contracts, Joint venture oil and gas companies, Joint operating companies.

- Public and private non-profit units engaged in production and trading of goods and services with taxable income in all fields.

- Organizations established and operating under the Law on Cooperatives.

- Enterprises established under foreign laws (hereinafter referred to as foreign enterprises) with a permanent establishment in Vietnam.

* A permanent establishment of a foreign enterprise is a production and business basis through which the foreign enterprise conducts all or part of its production and business activities in Vietnam, including:

- Branches, executive offices, factories, workshops, means of transport, mines, oil and gas fields, or other places of natural resource extraction in Vietnam;

- Construction sites, construction, installation, assembly projects;

- Service provision facilities, including consultancy services through employees or other organizations or individuals;

- Agents for foreign enterprises;

- Representatives in Vietnam in case of an authorized representative with the right to sign contracts under the foreign enterprise's name or an unauthorized representative but regularly performs the delivery of goods or provision of services in Vietnam.

In cases where a double taxation avoidance agreement signed by the Socialist Republic of Vietnam stipulates otherwise on permanent establishments, the provisions of that agreement shall prevail.

- Other organizations outside those mentioned in points a, b, c, and d of Clause 1 of this Article, engaged in production, trading of goods, or services, with taxable income.