What is classification of applications for refund of tax on exports and imports subject to inspection before refund in Vietnam?

What is classification of applications for refund of tax on exports and imports subject to inspection before refund in Vietnam?

Based on Article 22 of Decree 126/2020/ND-CP, the classification of applications for refund of tax on exports and imports subject to inspection before refund includes the following:

- Cases subject to pre-inspection, post-tax refund:

+ Dossiers of taxpayers requesting the first tax refund for each refund case as prescribed by tax laws. In the case where the taxpayer submits a tax refund dossier to the tax authority for the first time but is not eligible for a tax refund as prescribed, the next tax refund request will still be determined as the first tax refund request;

+ Dossiers of taxpayers requesting tax refunds within 2 years from the time they were penalized for tax evasion;

+ Dossiers of organizations that are dissolving, bankrupt, ceasing operations, selling, transferring, or handing over state-owned enterprises;

+ Tax refund dossiers classified as high risk according to the risk management categorization in tax administration;

+ Tax refund dossiers that are subject to a pre-tax refund but have exceeded the deadline according to the written notice from the tax authority, and the taxpayer has not explained or supplemented the tax refund dossier or has provided explanations and supplements but failed to prove the declared tax amount is correct;

+ Tax refund dossiers for exported and imported goods that do not make payments through commercial banks, other credit institutions as prescribed by law.

- In addition to the above cases, dossiers subject to pre-inspection, post-tax refund include:

+ Taxpayers who, within 12 months up to the date of submitting a tax refund request dossier, have been identified by customs authorities to have committed customs violations that have been penalized more than twice (including the act of incorrect declaration leading to a shortage of tax payable or an increase in tax exempted, reduced, refunded, or unpaid) with the penalty exceeding the authority level of the Head of Customs Branch as prescribed by law on administrative violation handling.

+ Taxpayers who, within 24 months up to the date of submitting a tax refund request dossier, have been identified by customs authorities to have been penalized for smuggling or illegal transportation of goods across borders.

+ Taxpayers being coerced to enforce administrative decisions on tax management.

+ Goods subject to excise tax.

+ Imported goods that need to be re-exported back to the foreign country (or re-exported to a third country or re-exported into a non-tariff area) via different checkpoints; exported goods that need to be re-imported back to Vietnam via different checkpoints.

Classification of applications for refund of tax on exports and imports subject to inspection before refund in Vietnam (Image from the Internet)

What are cases eligible for export and import tax refunds in Vietnam

Based on Clauses 1 and 2, Article 19 of the Law on Export and Import Duties 2016, cases eligible for export and import tax refunds include:

(1) Taxpayers who have paid import or export duties but have no imported or exported goods or have imported or exported fewer goods than those for which export or import duties have been paid;

(2) Taxpayers who have paid export duties but the exported goods must be re-imported are eligible for export duty refund and exempt from import duties;

(3) Taxpayers who have paid import duties but the imported goods must be re-exported are eligible for import duty refund and exempt from export duties;

(4) Taxpayers who have paid duties for imported goods to be used in production and business but have used them to produce exported goods;

(5) Taxpayers who have paid duties for machinery, equipment, tools, and vehicles of organizations and individuals permitted to temporarily import for re-export, except for those rented to carry out investment projects, construction, installation of works, and production services, when re-exported back abroad or re-exported into a non-tariff area.

The amount of import duty refunded is determined based on the remaining usable value of goods when re-exported, calculated according to the time used and stored in Vietnam. If the goods have no remaining usable value, the paid import duty will not be refunded.

Note:

- No tax refund is provided for the amount of tax if the refundable amount is below the minimum level as prescribed by the Government.

- Goods mentioned in (1), (2), (3) above are eligible for tax refund when they have not been used, processed, or manufactured.

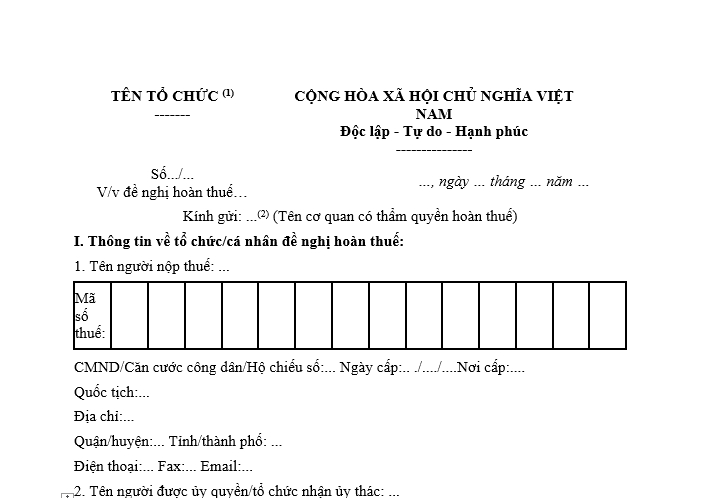

What is the written request for refund of export/import duty?

The latest written request for refund of export/import duty is form No. 09 issued together with Decree 18/2021/ND-CP as follows:

>> Download the latest template for the written request for refund of export/import duty