What is an electronic VAT invoice? What is the form for electronic VAT invoices in Vietnam in 2024?

How is the electronic VAT invoice defined?

According to Clause 1, Article 3 of Decree 123/2020/ND-CP, an electronic VAT invoice is defined as follows:

- An e-invoice is an invoice with or without a tax authority code, presented in electronic data format, issued by organizations or individuals selling goods or providing services using electronic means to record the sale of goods or provide services as prescribed by accounting laws and tax laws. This includes invoices generated from cash registers connected to electronic data transfer to tax authorities, where:

- An e-invoice with a tax authority code is an e-invoice that receives a code from the tax authority before being sent to the buyer by the selling organization or individual.

The tax authority code on the e-invoice includes a transaction number, a unique sequence of numbers generated by the tax authority's system, and an encoded string based on the seller's information on the invoice.

- An e-invoice without a tax authority code is an e-invoice sent to the buyer by the selling organization without a tax authority code.

What are the electronic VAT invoice form in Vietnam under Decree 123?

Reference templates for electronic VAT invoices according to Decree 123/2020/ND-CP:

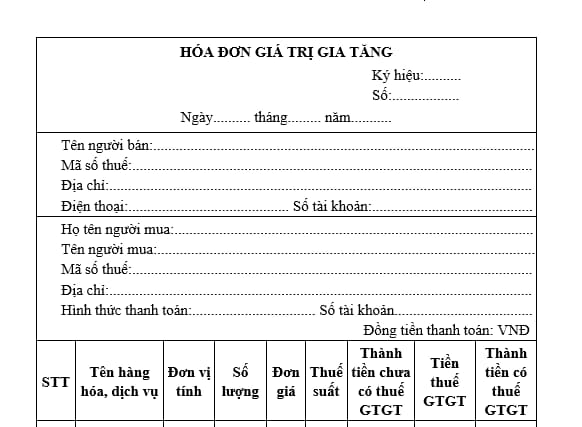

Form No. 01/GTGT

- Used for organizations and individuals declaring value-added tax by the deduction method

Form No. 01/GTGT is used for organizations and individuals declaring value-added tax by the deduction method

Download the reference template for e-invoices: Form No. 01/GTGT here

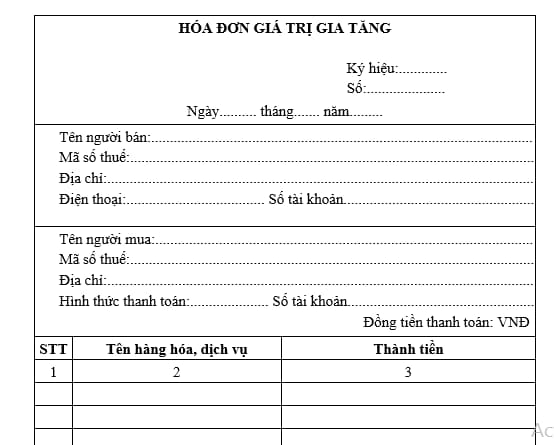

Form No. 01/GTGT-DT

- Used for certain specific organizations and enterprises

Form No. 01/GTGT-DT used for certain specific organizations and enterprises

Download the reference template for e-invoices: Form No. 01/GTGT-DT here

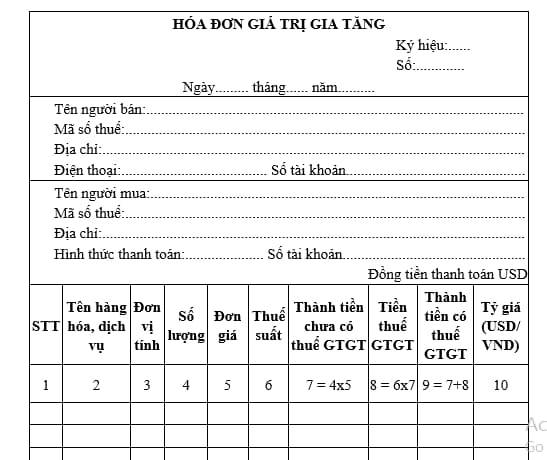

Form No. 01/GTGT-NT

- Used for specific organizations and enterprises that collect in foreign currencies

Form No. 01/GTGT-NT used for specific organizations and enterprises that collect in foreign currencies

Download the reference template for e-invoices: Form No. 01/GTGT-NT here

What is an electronic VAT invoice? What is the form for electronic VAT invoices in 2024? How to handle erroneous invoices in Vietnam? (Image from the Internet)

How to handle erroneous invoices in Vietnam?

Based on Article 19 of Decree 123/2020/ND-CP, the handling of erroneous e-invoices is regulated as follows:

(1) In case the seller discovers an e-invoice with a tax authority code that has not been sent to the buyer but contains errors, the seller must notify the tax authority using Form No. 04/SS-HDDT, Appendix IA attached to this Decree, to cancel the erroneous e-invoice and issue a new e-invoice, digitally sign it, and send it to the tax authority for a new invoice code to be issued, replacing the erroneous invoice to send to the buyer. The tax authority will cancel the erroneous e-invoice already coded, stored in the tax authority's system.

Download Form No. 04/SS-HDDT (Notification of erroneous e-invoice) here

(2) In case an e-invoice with a tax authority code or an e-invoice without a tax authority code has been sent to the buyer and the buyer or seller discovers errors, the handling is as follows:

- In case of errors regarding the name or address of the buyer, but the tax identification number and other contents are correct, the seller notifies the buyer of the invoice errors and is not required to issue a new invoice. The seller must notify the tax authority of the erroneous e-invoice using Form No. 04/SS-HDDT, Appendix IA attached to this Decree, except in cases where the e-invoice without a tax authority code has the aforementioned errors but has not yet sent the invoice data to the tax authority.

- In case of errors in: the tax identification number; errors in the amount recorded on the invoice, tax rate, tax amount, or goods not complying with specifications or quality on the invoice, one of the following two options can be used for e-invoices:

+ The seller issues an e-invoice adjusting the erroneous invoice. If the seller and buyer agree to draft an agreement before issuing an adjustment invoice for an erroneous invoice, the seller and buyer draft such an agreement, clearly stating the errors, followed by the seller issuing an e-invoice to adjust the erroneous invoice.

The e-invoice adjusting an erroneous e-invoice must include the phrase “Adjustment for invoice Form No... symbol... number... date... month... year”.

+ The seller issues a new e-invoice replacing the erroneous e-invoice unless the seller and buyer agree to draft an agreement before issuing a replacement invoice for the erroneous invoice already issued, in which case the seller and buyer draft such an agreement, clearly stating the errors, followed by the seller issuing an e-invoice replacing the erroneous invoice.

The new e-invoice replacing the erroneous e-invoice must include the phrase “Replacement for invoice Form No... symbol... number... date... month... year”.

The seller digitally signs the new e-invoice adjusting or replacing the erroneous e-invoice, then sends it to the buyer (for e-invoices without a tax authority code) or sends it to the tax authority for a code to be issued for a new e-invoice to send to the buyer (for e-invoices with a tax authority code).

- For the airline industry, exchanged or refunded documents for air transport are considered adjustment invoices without needing the information “Adjustment increase/decrease for invoice Form No... symbol... date... month... year”. Air transport enterprises are allowed to issue their invoices for cases of refund and exchange of transport documents issued by agents.