What is a certificate of personal income tax withholding in Vietnam? When is the certificate of personal income tax withholding issued?

What is a certificate of personal income tax withholding in Vietnam?

According to the provisions in Clause 4, Article 3 of Decree 123/2020/ND-CP, the regulations on documents are as follows:

Interpretation of terms

........

- A document is a record used to note information on withheld taxes, tax collection, fees, and charges belonging to the state budget as prescribed by tax management laws. The documents as stipulated in this Decree include certificate of personal income tax withholdings, tax receipts, fee receipts, and charges which are displayed in electronic form or printed form, self-printed.

As stipulated in Clause 1, Article 25 of Circular 111/2013/TT-BTC, the regulations on tax withholding are as follows:

Tax Withholding and Tax Withholding Certificates

- Tax withholding is the act of an organization or individual paying income to calculate and deduct the payable tax amount from the taxpayer's income before paying the income.

From the definitions given in the above two regulations, we can understand the certificate of personal income tax withholding as follows:

A certificate of personal income tax withholding (PIT) is a document issued by an organization or individual paying income to an employee whose income is subject to PIT withholding, aiming to confirm information on the PIT amount withheld.

What are the regulations for issuing certificate of personal income tax withholdings in Vietnam?

According to Point a, Clause 2, Article 25 of Circular 111/2013/TT-BTC, the cases eligible for issuance of a certificate of personal income tax withholding are as follows:

- Organizations and individuals who have withheld tax from the income payments as guided in Clause 1 of this Article must issue a tax withholding certificate at the request of the deductee. In case the individual authorizes tax finalization, no withholding certificate is issued.

- Issuing withholding certificates in specific cases as follows:

- For individuals not under a labor contract or under contracts less than three (03) months: such individuals have the right to request the organization, individual paying income to issue a withholding certificate for each tax deduction occurrence or one certificate covering multiple tax deductions in one tax period.

- For individuals under labor contracts of three (03) months or more: the organization, individual paying income issues only one withholding certificate for the individual in one tax period.

What is a certificate of personal income tax withholding in Vietnam? When is the certificate of personal income tax withholding issued? (Image from the Internet)

Is the certificate of personal income tax withholding still issued in self-printed or ordered-to-print forms, and what is the latest form of the certificate of personal income tax withholding in Vietnam?

Clause 1, Article 33 of Decree 123/2020/ND-CP stipulates as follows:

Electronic document format:

Receipt types specified in point b, clause 1, Article 30 of this Decree must comply with the following format:

a) The electronic receipt format uses the XML (Extensible Markup Language) format, created for sharing electronic data between information technology systems;

b) The electronic receipt format comprises two components: a component containing the business data of the electronic receipt and a component containing the digital signature data;

c) The General Department of Taxation constructs and publishes the business data component of the electronic receipt and the digital signature data component and provides tools to display the contents of the electronic receipt under regulations of this Decree.

As per the above regulations, the certificate of personal income tax withholding must be converted to an electronic document from July 1, 2022, and it will no longer be issued in printed or ordered-to-print forms.

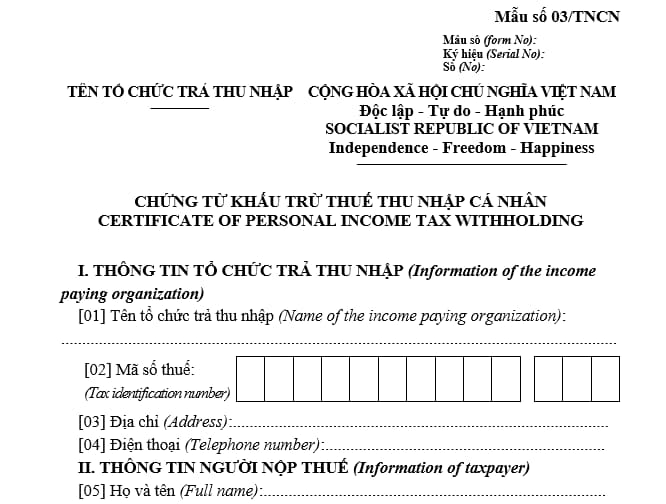

The latest form of the certificate of personal income tax withholding issued alongside Decree 123/2020/ND-CP:

Download: The latest electronic certificate of personal income tax withholding form according to Decree 123/2020/ND-CP here