What income does the PIT declaration form - Form 04/NNG-TNCN in Vietnam apply to?

What income does the PIT declaration form - Form 04/NNG-TNCN in Vietnam apply to?

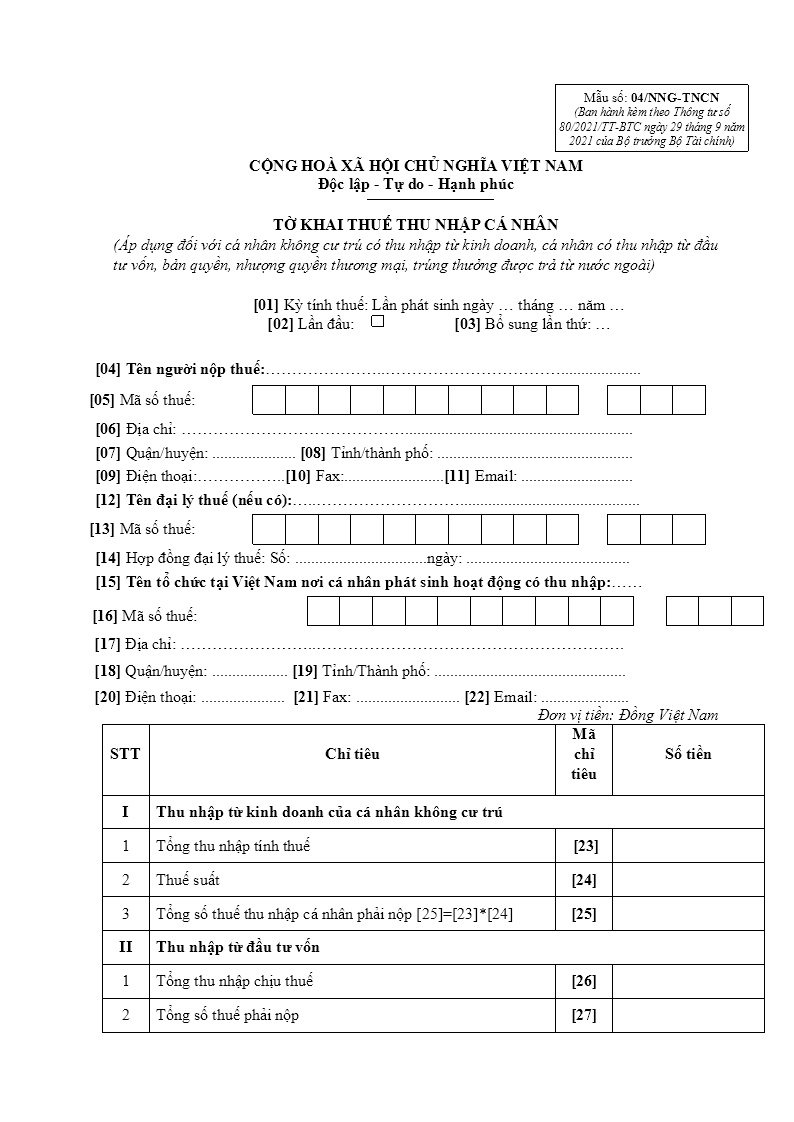

The PIT declaration form - Form 04/NNG-TNCN applies to non-residents with income from business, individuals with income from capital investment, royalties, franchising, and winning prizes paid from abroad as stipulated in Section 7, Appendix 2 issued together with Circular 80/2021/TT-BTC as follows:

Download Form 04/NNG-TNCN: Here

What income does the PIT declaration form - Form 04/NNG-TNCN in Vietnam apply to? (Image from Internet)

What does income from capital investment subject to PIT in Vietnam include?

According to Clause 3, Article 2 of Circular 111/2013/TT-BTC, amended by Clause 6, Article 11 of Circular 92/2015/TT-BTC, the following income from capital investment is subject to PIT:

Incomes from capital investment are personal income in the form of:

- Interest on the loans given to other organizations, enterprises, business households, business individuals and groups of business individuals according to loan contracts or agreements, except for the interests paid by credit institutions and branches of foreign banks according to Point g.1 Clause 1 Article 3 of this Circular.

- The dividends earned from capital contribution to purchase of shares.

- Profits from capital contributions to limited liability companies, partnerships, cooperatives, joint-ventures, business cooperation contracts, and other forms of business under the Law on Enterprises and the Law on Cooperatives; profits from capital contribution in establishment of credit institutions according to the Law on credit institutions, capital contributions to securities investment fund and other investment funds that are established and operated within the law.

Profits from capital investment of private companies and single-member limited liability companies under the ownership of individuals shall not be included in Assessable income.

- The added value of capital contribution received when the enterprise is dissolved, converted, divided, split, merged, amalgamation, or upon capital withdrawal.

- Incomes from interest on bonds, treasury bills, and other valuable papers issued by Vietnamese organizations, except for the incomes defined in Point g.1 and g.3 Clause 1 Article 3 of this Circular.

- The incomes from capital investment in other forms, including capital contribution in kind, by reputation, rights to use land, patents.

- Incomes from dividends paid in bonds, incomes from reinvested profit.

What is the method of calculating PIT on income from capital investment in Vietnam?

Under Article 10 of Circular 111/2013/TT-BTC:

Bases for calculation of tax on incomes from capital investment.

Bases for calculation of tax on incomes from capital investment are the assessable income and tax rates.

1. Assessable income

Assessable income from capital investment is the Assessable income earned by the individual according to Clause 3 Article 2 of this Circular.

2. The tax rate on the income from capital investment is 5% according to the whole income tax table.

3. Time to calculate the assessable income

The assessable income from capital investment shall be calculated when the taxpayer is paid by the income payer.

The times to calculate assessable income in some cases:

a) The income from additional value of capital contribution guided in Point d Clause 3 Article 2 of this Circular shall be calculated when the person actually receives the income when the enterprise is dissolved, converted, divided, merged, amalgamated, or when the capital is withdrawn.

b) The income from reinvested profit as guided in Point g Clause 3 Article 2 of this Circular shall be calculated when the person transfers or withdraws capital.

c) The income from dividend in shares guided in Point g Clause 3 Article 2 of this Circular shall be calculated when the person transfers his shares.

d) Where the individual receives an income from outward investment in any shape or form, the assessable income shall be calculated when the person receives the income.

4. Tax calculation

Personal income tax payable

=

Assessable income

x

5% tax

Therefore, the method of calculating PIT on income from capital investment in Vietnam is as follows:

PIT payable = Assessable income × Tax rate 5%