What does an application for amendments to tax registration of an individual submitted directly at the tax authority in Vietnam include?

What does an application for amendments to tax registration of an individual submitted directly at the tax authority in Vietnam include?

Based on Sub-item 41 of Item 2, Part 2 of the Procedure issued with Decision 2589/QD-BTC in 2021, the application for amendments to tax registration for individual directly at the tax authority includes:

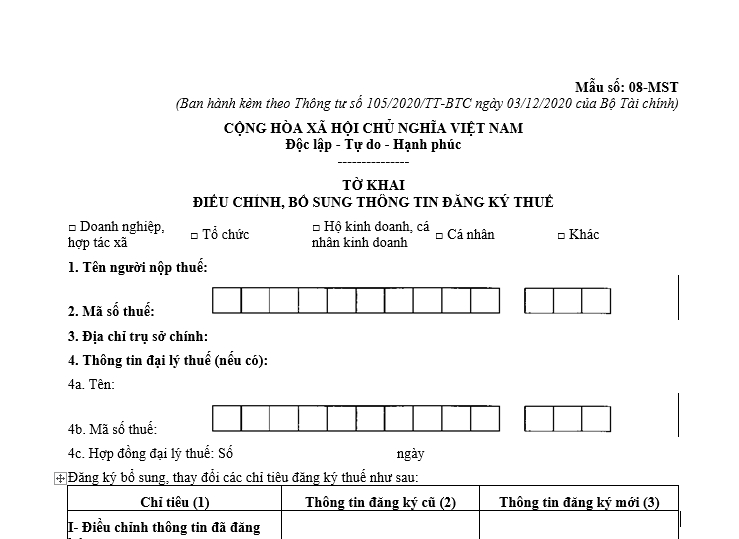

- The application form for amendments to tax registration Form No. 08-MST issued with Circular 105/2020/TT-BTC.

- A copy of the citizen ID card or a copy of the still-valid ID for dependents who are Vietnamese nationals; a still-valid Passport copy for dependents who are foreign nationals or Vietnamese nationals residing abroad in cases where the taxpayer registration information on these documents has changed.

What does an application for amendments to tax registration of an individual submitted directly at the tax authority in Vietnam include? (Image from the Internet)

What is the procedure for amendments to tax registration of an individual submitted directly at the tax authority in Vietnam?

According to Sub-item 41 of Item 2, Part 2 of the Procedure issued with Decision 2589/QD-BTC in 2021, the procedure for amendments to taxpayer registration information for individuals earning personal income tax-liable income (excluding business individuals) and dependents directly at the tax authority, is carried out as follows:

Step 1: Individuals who directly register taxpayer information with the tax authority must notify the Tax Department where they have registered their permanent or temporary residence within 10 working days from the date the information change occurs.

In cases of changes in the information on the ID, citizen ID card, or Passport, the date the information change occurs is 20 days (for mountainous, highland, border, and island districts, it is 30 days) from the date recorded on the ID, citizen ID card, or Passport.

- For cases of electronic taxpayer registration dossiers: The taxpayer accesses the electronic portal chosen to declare the form and sends the prescribed dossiers electronically (if any), signs electronically, and sends it to the tax authority through the chosen electronic portal.

The taxpayer submits the dossier (the taxpayer registration dossier simultaneously with the business registration dossier following the one-stop-shop mechanism) to the competent state management agency as prescribed. The competent state management agency sends the information of the received dossier from the taxpayer to the tax authority through the electronic portal of the General Department of Taxation.

Step 2: Tax authority reception:

- For paper-based taxpayer registration dossiers:

+ If the dossier is submitted directly at the tax authority: The tax officer receives and stamps the receipt on the taxpayer registration dossier, noting the receipt date, the number of documents as per the checklist for directly submitted taxpayer registration dossiers. The tax officer writes an appointment slip indicating the date of result delivery and the processing time for the received dossier.

+ If the taxpayer registration dossier is sent by postal service: The tax officer stamps the receipt, notes the receipt date on the dossier, and records the tax office document number.

The tax officer checks the taxpayer registration dossier. If the dossier is incomplete and requires explanation or supplementation of information or documents, the tax authority notifies the taxpayer using Form No. 01/TB-BSTT-NNT in Appendix II issued with Decree 126/2020/ND-CP within 02 (two) working days from the date of dossier receipt.

- For cases of electronic taxpayer registration dossiers:

The tax authority receives the dossier through the electronic portal of the General Department of Taxation, checks, and processes the dossier through the tax authority's electronic data processing system.

+ Dossier reception: The electronic portal of the General Department of Taxation sends a receipt notification to the taxpayer confirming that the dossier has been submitted through the chosen electronic portal no later than 15 minutes after the tax authority receives the electronic taxpayer registration dossier from the taxpayer.

+ Dossier checking and processing: The tax authority checks and processes the taxpayer's dossier as prescribed by law on taxpayer registration and provides the results through the electronic portal chosen by the taxpayer to create and submit the dossier.

++ If the dossier is complete and complies with the procedures, and results need to be delivered: The tax authority sends the dossier processing results to the electronic portal chosen by the taxpayer as per the timeline prescribed in Circular 105/2020/TT-BTC

++ If the dossier is incomplete or not compliant with the procedures, the tax authority sends a notification of non-acceptance of the dossier to the electronic portal chosen by the taxpayer within 02 (two) working days from the date recorded on the receipt notification of the dossier.

Where to download the application form for amendments to tax registration in Vietnam?

The application form for amendments to tax registration is Form 08-MST issued with Circular 105/2020/TT-BTC.

>> Download the application form for amendments to tax registration here: Here