What day is the 6th of the 2025 Tet holiday in Vietnam? Which tax return is due on the 6th day of the Tet holiday in Vietnam?

What day is the 6th of the 2025 Tet holiday in Vietnam?

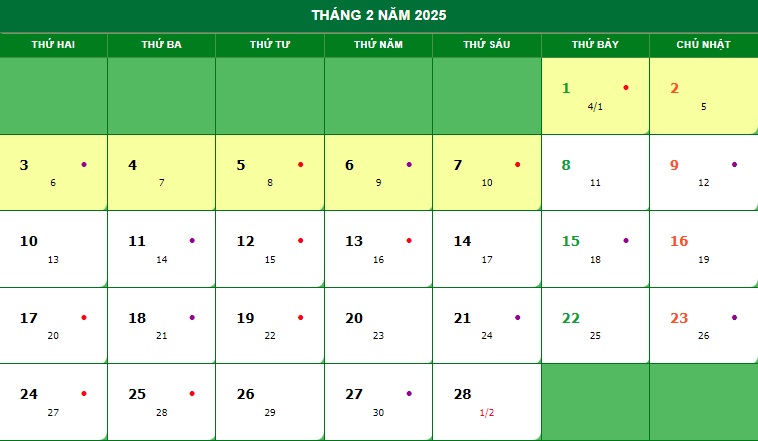

Based on the Perpetual Calendar for February 2025 as follows:

Thus, the 6th day of the Tet holiday will fall on Monday, February 3, 2025 (i.e., January 6, 2025, of the lunar calendar is February 3, 2025, of the solar calendar).

Shall employees return to work on the 6th day of the Tet holiday in Vietnam?

Recently, the Office of the Government of Vietnam issued Official Dispatch 8726/VPCP-KGVX 2024 regarding the Tet holiday and several public holidays in 2025.

The Prime Minister agreed with the proposal from the Ministry of Labor, Invalids and Social Affairs regarding the Tet holiday for officials, public servants, and employees as follows:

- During the the 2025 Tet holiday, officials and public employees receive a continuous 9-day holiday, consisting of 5 days of New Year holiday and 4 weekly days off.

- Specifically, officials and public employees and workers are granted a 5-day Lunar New Year holiday, from Monday, January 27, 2025, to the end of Friday, January 31, 2025 (i.e., from the 28th day of the 12th lunar month of the Year of the Dragon to the 3rd day of the 1st lunar month of the Year of the Snake).

- However, because in 2025, all 5 days of the Tet holiday fall on weekdays, employees will receive an additional 2 weekend days off before and 2 days off after the New Year holiday.

- Agencies and units should arrange standby departments according to regulations and work reasonably to handle tasks continuously, ensure good service for organizations and the public, and pay attention to appoint officials to handle unexpected and urgent tasks that may arise during the Tet and holiday period as prescribed.

- Ministries, agencies, and localities must have specific and appropriate plans and measures to encourage units, enterprises, organizations, and individuals to actively implement production, business, economic, social activities, ensure stability of commodity supply and demand, services, prices, market; contribute towards promoting production, business, economic growth, practicing thrift, combating wastefulness, striving to successfully implement goals and tasks of the 2025 plan, the year of acceleration and breakthrough in implementing the 2021-2025 five-year plan, creating a solid foundation and premise for rapid and sustainable development in the coming periods.

Therefore, the Tet holiday 2025 for employees will be a continuous 9-day break starting from January 25 - February 2, 2025 (from the 26th of the 12th lunar month to the end of the 5th of the 1st lunar month).

Thus, on the 6th day of the Tet holiday (February 3, 2025), employees will begin to return to work.

What day is the 6th of the the 2025 Tet holiday in Vietnam? (Image from the Internet)

Which tax return is due on the 6th day of the Tet holiday in Vietnam?

Below are the tax returns that must be submitted on the 6th day of the Tet holiday:

| Date | Report | Legal Basis |

| February 3, 2025 (The deadline was January 30, 2024, but this was the 2nd day of the Tet holiday, so it was pushed to the next working day after the holiday) |

Payment of business license tax for 2025 | Clause 1, Article 10 Decree 126/2020/ND-CP Clause 1, Article 1 Decree 91/2022/ND-CP |

| February 3, 2025 (The deadline was January 30, 2024, but this was the 2nd day of the Tet holiday, so it was pushed to the next working day after the holiday) |

Payment of provisional Corporate Income Tax for Q4/2024 | Clause 1, Article 55 Law on Tax Administration 2019 Clause 1, Article 1 Decree 91/2022/ND-CP |

| February 3, 2025 (The deadline was January 30, 2024, but this was the 2nd day of the Tet holiday, so it was pushed to the next working day after the holiday) |

VAT return for Q4/2024 | Clause 1, Article 44 Law on Tax Administration 2019 Clause 1, Article 1 Decree 91/2022/ND-CP |

| February 3, 2025 (The deadline was January 30, 2024, but this was the 2nd day of the Tet holiday, so it was pushed to the next working day after the holiday) |

Personal Income Tax return for Q4/2024 | Clause 1, Article 44 Law on Tax Administration 2019 Clause 1, Article 1 Decree 91/2022/ND-CP |

What is the current licensing fee rate in Vietnam?

The licensing fee rate is regulated in Article 4 Decree 139/2016/ND-CP (amended and supplemented by Clause 2, Article 1 Decree 22/2020/ND-CP) as follows:

(1) licensing fee rates for organizations conducting production and business activities of goods and services are as follows:

+ Organizations with charter capital or investment capital over 10 billion VND: 3,000,000 VND/year;

+ Organizations with charter capital or investment capital of 10 billion VND or less: 2,000,000 VND/year;

+ Branches, representative offices, business locations, public service providers, other economic organizations: 1,000,000 VND/year.

The licensing fee for organizations with charter capital or investment capital over 10 billion VND and organizations with charter capital or investment capital of 10 billion VND or less is based on the charter capital recorded in the business registration certificate; if there is no charter capital, it is based on the investment capital recorded in the investment registration certificate.

(2) licensing fee rates for individuals, households conducting production and business activities of goods and services are as follows:

+ Individuals, groups of individuals, households with an annual revenue over 500 million VND: 1,000,000 VND/year;

+ Individuals, groups of individuals, households with an annual revenue over 300 million to 500 million VND: 500,000 VND/year;

+ Individuals, groups of individuals, households with an annual revenue over 100 million to 300 million VND: 300,000 VND/year.

+ Revenue used as the basis for determining the licensing fee for individuals, groups of individuals, households following the guidance of the Ministry of Finance.

(3) Small and medium enterprises transitioning from household businesses (including branches, representative offices, business locations) when the exemption period for licensing fees expires (the fourth year from the establishment of the enterprise): if it ends within the first 6 months of the year, pay the full year's licensing fee, if it ends within the last 6 months of the year, pay 50% of the full year's licensing fee.

Households, individuals, groups of individuals who dissolve and resume production and business activities in the first 6 months of the year pay the full year's licensing fee, while in the last 6 months pay 50% of the full year's licensing fee.

Note:

- Organizations with charter capital or investment capital over 10 billion VND and organizations with charter capital or investment capital of 10 billion VND or less, in case of changes in charter capital or investment capital, the basis for determining the licensing fee rate is the charter capital or investment capital of the previous year immediately preceding the year of the licensing fee calculation.

In cases where charter capital or investment capital is recorded in the business registration certificate or investment registration certificate in foreign currency, it is converted into Vietnamese dong for determining the licensing fee rate according to the buying rate of commercial banks and credit institutions where the licensing fee payer has an account at the time they pay the licensing fee to the state budget.

- Fee payers in operation, who send a document to the tax authority for direct management about temporarily suspending production and business activities during the calendar year, are exempt from paying the licensing fee for the year of temporary suspension, under the condition that the document requesting temporary suspension of production and business activities is sent to the tax authority before the fee payment deadline as prescribed (January 30 annually) and the licensing fee for the year requesting temporary suspension has not yet been paid.

In cases of temporary suspension of production and business activities that do not meet the above conditions, the full year's licensing fee must be paid.