What are the regulations on personal income tax on incomes from bonus shares in Vietnam?

What are the regulations on personal income tax on incomes from bonus shares in Vietnam?

Based on Clause 11, Article 26 Circular 111/2013/TT-BTC stipulates the procedures for tax declaration and tax finalization as follows:

Tax Declaration and Tax Finalization

...

11. Tax declaration on wages and salaries for income from bonus shares.

Individuals receiving shares as a reward from their employers are not immediately subject to wage and salary tax. When these shares are transferred, they must declare tax for the income from the transfer and the wage and salary income.

Simultaneously, according to Article 7 Circular 111/2013/TT-BTC (provisions related to personal income tax for business individuals in this Article are abolished by Clause 6, Article 25 Circular 92/2015/TT-BTC):

Tax Basis for taxable income from business and wages and salaries

The tax basis for income from business and wages and salaries is taxable income and tax rates. Specifically:

1. Taxable income is determined by the taxable income as guided in Article 8 of this Circular minus (-) the deductions as follows:

...

2. Tax Rates

Personal income tax rates on income from business and wages and salaries are applied according to the progressive tax rate schedule stipulated in Article 22 of the Personal Income Tax Law.

...

3. Tax Calculation Method

Personal income tax for income from business, wages, and salaries is the total tax calculated according to each income bracket. The tax for each income bracket is the taxable income of that bracket multiplied by (×) the corresponding tax rate of that bracket.

Accordingly, when businesses award shares to their employees, the income is considered taxable income from wages and salaries.

Employees are not immediately subject to wage and salary tax upon receiving shares from their employers. Tax must be declared only when the shares are transferred, accounting for both the income from the transfer and the wage and salary income.

How to declare personal income tax on incomes from bonus shares in Vietnam? (Image from the Internet)

How should employees declare personal income tax on incomes from bonus shares in Vietnam?

According to the guidance in Official Dispatch 44496/CTHN-TTHT of 2024, employees who receive bonus shares should declare personal income tax as follows:

According to the provisions at point d, clause 5, Article 7 of Decree 126/2020/ND-CP, organizations declare and pay tax on behalf of individuals receiving stock dividends; shareholders receiving awarded stock; individuals whose capital increase is recorded due to profit retention; individuals contributing capital with real estate, contributed capital, or securities.

The timing of the tax declaration and payment is when the individual incurs a transaction transferring the same type of securities, transferring capital, or withdrawing capital.

When individuals receive stock dividends or shareholders receive awarded stock, the organization is responsible for declaring and paying tax on behalf of the individuals when they transfer the same type of securities as follows:

When securities are traded on the stock exchange:

- Securities companies, commercial banks where individuals have deposit accounts, or fund management companies are responsible for declaring and paying tax on behalf.

When securities are not traded on the stock exchange:

- For securities of public companies registered at the Securities Depository Center, the responsibility still belongs to the securities company or commercial bank.- For securities of joint-stock companies that are not public companies but authorize securities companies to manage the list of shareholders, the securities company will declare the tax on behalf of them.- If not falling into the above cases, the issuing organization will have the responsibility to declare and pay tax on behalf.

Additionally, Clause 8, Article 1 of Decree 91/2022/ND-CP supplements Clause 4, Article 43 of Decree 126/2020/ND-CP as follows:

Provisions at point d.1, clause 5, Article 7 of Decree 126/2020/ND-CP are implemented from January 1, 2023.

In cases where individuals receive dividends in the form of securities, shareholders receiving awarded shares are recorded in the investor's securities account before or on December 31, 2022, and have not been declared or paid tax by the securities companies, commercial banks where the individual has a deposit account, the fund management company where the individual entrusts their portfolio, or the issuing organization, the individuals will declare and pay personal income tax according to the personal income tax laws and will not be penalized for late submission of tax returns or charged late payment fees (if any) as stated in Clause 11, Article 16 of Tax Administration Law 2019 from December 5, 2020, to the end of December 31, 2022.

Thus, the responsibility for tax declaration and payment in the case of companies with listed shares traded on the stock exchange, individuals receiving stock dividends (securities not through the stock exchange system), the organization will declare and pay taxes as follows:

- Registered securities of public companies at the Central Securities Depository, the organization will declare and pay tax on behalf of individuals receiving stock dividends; current shareholders receiving awarded stock as per point d, clause 5, Article 7 of Decree 126/2020/ND-CP, effective from January 1, 2023.

Tariffs and personal income tax rates for income from wages and salaries in Vietnam

Based on the provisions of Article 7 Circular 111/2013/TT-BTC, the tax basis for income from business and wages and salaries is taxable income and tax rates.

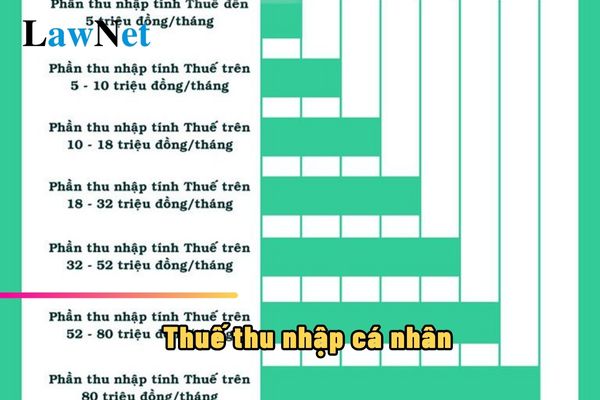

Personal income tax rates on income from business and wages and salaries are applied according to the progressive tax rate schedule stipulated in Article 22 of the Personal Income Tax Law 2007, specifically:

| Tax Bracket | Taxable Income/Year (million VND) | Taxable Income/Month (million VND) | Tax Rate (%) |

| 1 | Up to 60 | Up to 5 | 5 |

| 2 | Over 60 to 120 | Over 5 to 10 | 10 |

| 3 | Over 120 to 216 | Over 10 to 18 | 15 |

| 4 | Over 216 to 384 | Over 18 to 32 | 20 |

| 5 | Over 384 to 624 | Over 32 to 52 | 25 |

| 6 | Over 624 to 960 | Over 52 to 80 | 30 |

| 7 | Over 960 | Over 80 | 35 |

Personal income tax for income from business, wages, and salaries is the total tax calculated according to each income bracket. The method of tax calculation is as follows:

Tax at each income bracket = (Taxable income of the bracket) × (Corresponding tax rate of the bracket)

To summarize, employees receiving bonus shares are subject to personal income tax on wages and salaries. Employees will not be immediately subject to personal income tax at the time of receiving the bonus shares; rather, they will have to pay personal income tax on the gains from the transfer of shares.

The responsibility for personal income tax declaration falls upon the organizations declaring on behalf of the individuals as stipulated in point d, clause 5, Article 11 of Decree 126/2020/ND-CP. The method of calculating personal income tax payable on income from wages and salaries is based on the aforementioned formula.