What are the procedures for non-agricultural land tax exemption or reduction at the tax authority in Vietnam?

What are the procedures for non-agricultural land tax exemption or reduction at the tax authority in Vietnam?

Under subsection 31, Section 1 of administrative procedures issued with Decision 1462/QD-BTC 2022, the procedures are guided as follows:

Step 1: Submit the application

Organizations, households, and individuals submit an application for non-agricultural land tax exemption or reduction at the supervisory tax authority or the agency receiving administrative procedures on the land according to the interlinked single-window system.

In the case of submitting an application for exemption or reduction of land rent at the agency receiving administrative procedures on land according to the interlinked single-window system, the transfer of the application to the tax authority is carried out according to legal regulations on the order and procedures for receiving and transferring applications to determine the financial obligations on land for land users.

Step 2: Receive the ap[plication by the tax authority:

- The supervisory tax authority;

- Or the agency receiving administrative procedures on land according to the interlinked single-window system.

What are the procedures for non-agricultural land tax exemption or reduction at the tax authority in Vietnam? (Image from the Internet)

What does the application for non-agricultural land tax exemption or reduction in Vietnam include?

According to Article 57 Circular 80/2021/TT-BTC, the application for non-agricultural land tax exemption or reduction in Vietnam include:

- In case of exemption of reduction of annual non-agricultural land use tax payable by a household or individual which is not exceeding 50.000 VND, the application shall contain:

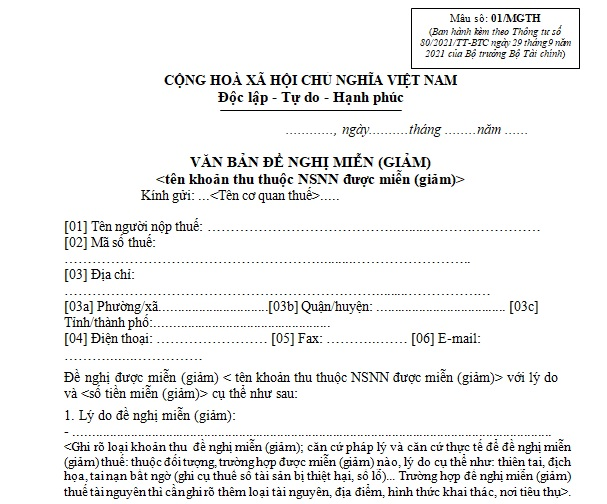

+ The application form No. 01/MGTH in Appendix I hereof;

+ Copies of documents relevant to the land plot on which tax is imposed, such as, the LUR Certificate, land allocation decision, land lease decision or contract, decision to permit land repurposing;

+ Documents of documents proving eligibility for non-agricultural land tax exemption or reduction.

The head of the tax authority responsible for the area where the land plot is location shall, on the basis of the application for tax exemption/reduction specified in this Clause, determine the amount of non-agricultural land use tax eligible to exemption or reduction and decide whether to grant exemption or decision.

In the cases specified in Clause 4, Clause 5, Clause 6 Article 9 and Clause 2, Clause 3 Article 10 of the Law on Non-agricultural Land Use Tax 2010, the head of the tax authority responsible for the area where the land plot is located shall issue a common decision according to the list of eligible taxpayers compiled by the People’s Committee of the commune. Annually, the People’s Committee of the commune shall review and send the list of taxpayers eligible for tax exemption or reduction to the tax authority.

In the cases specified in Clause 9 Article 9 and Clause 4 Article 10 of the Law on Non-agricultural Land Use Tax 2010, the head of the tax authority responsible for the area where the land plot is located shall issue a decision on tax exemption or reduction according to application submitted by the taxpayer and confirmation of the People’s Committee of the commune where the land plot is located.

- In case the annual non-agricultural land use tax payable by a household or individual is not exceeding 50.000 VND, submission of the tax exemption application is not required. The tax authority shall, via TMS application, extract a list of taxpayers eligible for tax exemption and send it to the People’s Committee of the communes where the taxpayers' land is located for comparison and confirmation.

What is the time limit for processing the application for non-agricultural land tax exemption or reduction at the tax authority in Vietnam?

Under subsection 31, Section 1 of administrative procedures issued with Decision 1462/QD-BTC 2022, the time limit for processing the application for non-agricultural land tax exemption or reduction at the tax authority in Vietnam is as follows:

- Within 30 days from the date of receiving the complete application, the tax authority shall decide on tax exemption or reduction or notify the taxpayer in writing of the reasons for ineligibility.

- In case of needing a real-world inspection to have sufficient grounds to process the tax exemption and reduction application, within 40 days from the date of receiving the complete application, the tax authority shall issue a decision on tax exemption or reduction or notify the taxpayer in writing of the reasons for ineligibility.

What is the application form for non-agricultural land tax exemption or reduction in Vietnam?

The application form for non-agricultural land tax exemption or reduction in Vietnam is form 01/MGTH issued with Appendix 1 Circular 80/2021/TT-BTC:

Download Form 01/MGTH - the application form for non-agricultural land tax exemption or reduction in Vietnam: Here