What are the Lunar and Gregorian calendars in Vietnam in 2025? What is the deadline for submitting financial statements for 2024 for sole proprietorships?

What are the Lunar and Gregorian calendars in 2025?

The year 2025 is not a leap year and therefore has 365 days. The year 2025 begins on January 29, 2025 (which is the 1st of January in the lunar year of At Ty) and lasts until February 16, 2026 (which is the 29th of December in the lunar year of At Ty).

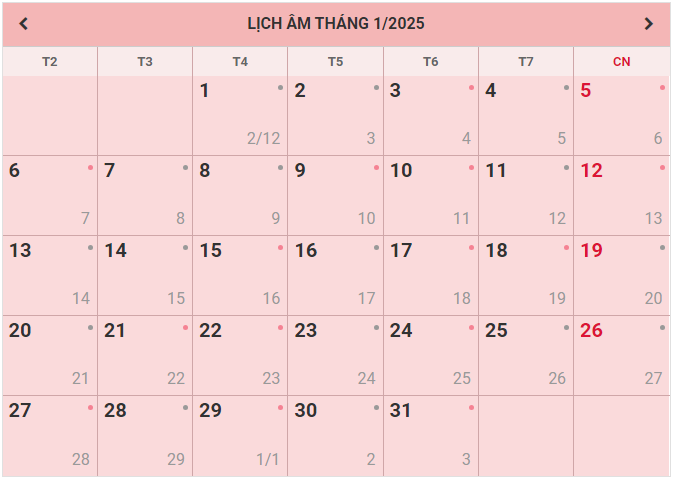

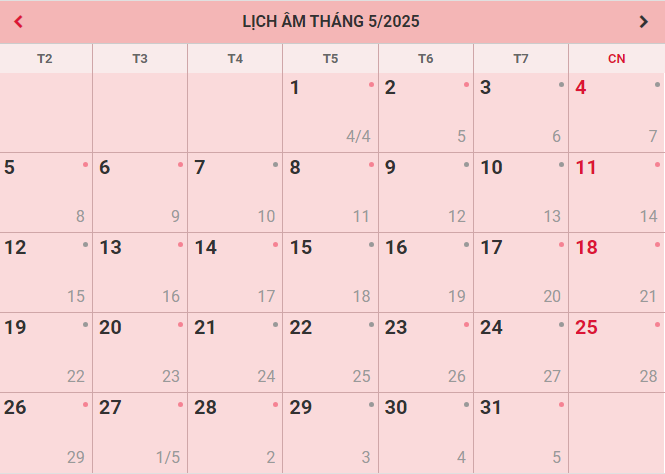

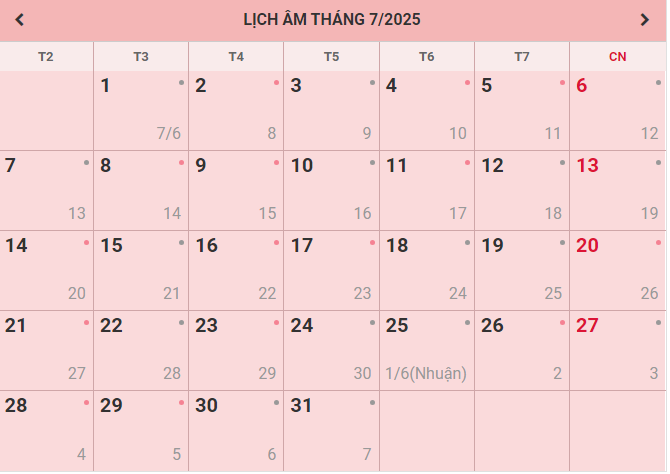

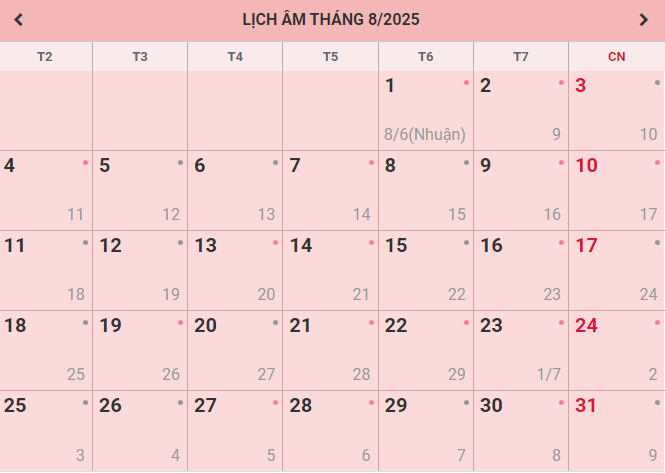

Refer to the lunar calendar 2025 and the Gregorian calendar 2025 for each specific month below:

Gregorian calendar January (Lunar December/2024)

Gregorian calendar February (Lunar January and 01/February 2025)

Gregorian calendar March (Lunar February, March)

Gregorian calendar April (Lunar March, April)

Gregorian calendar May (Lunar April, May)

Gregorian calendar June (Lunar May, June)

Gregorian calendar July (Lunar June)

Gregorian calendar August (Lunar June, July)

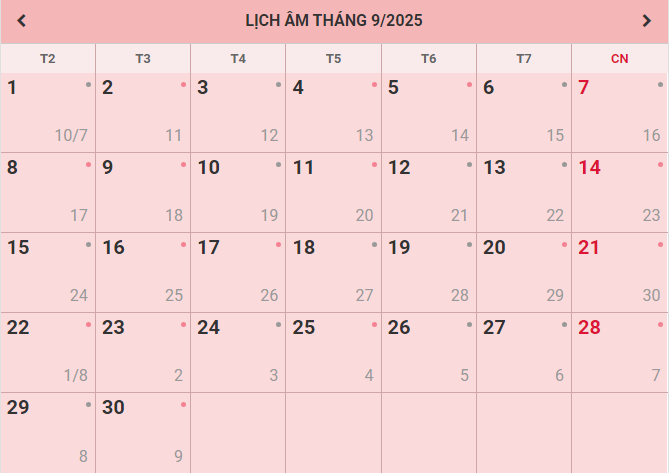

Gregorian calendar September (Lunar July, August)

Gregorian calendar October (Lunar August, September)

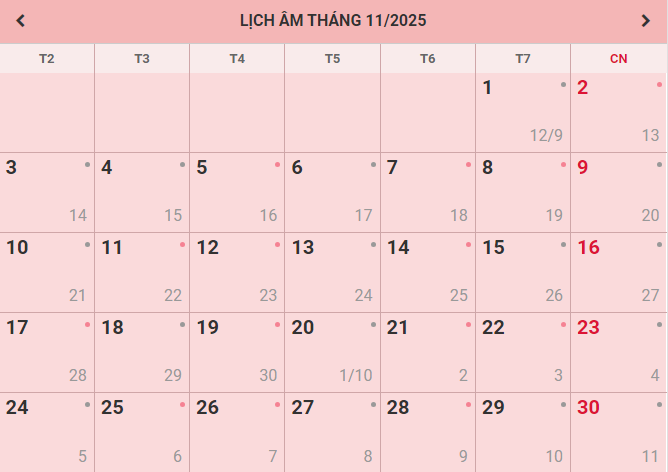

Gregorian calendar November (Lunar September, October)

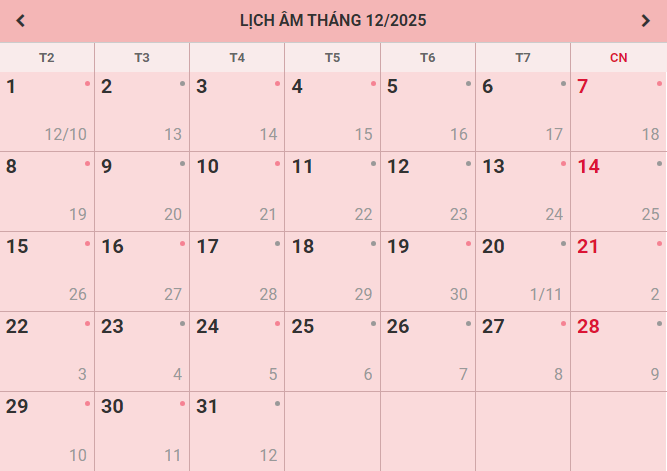

Gregorian calendar December (Lunar October, November)

Gregorian calendar January 2026 (Lunar November, December)

Gregorian calendar February 2026 (Lunar December)

What are the Lunar and Gregorian calendars in Vietnam in 2025? What is the deadline for submitting financial statements for 2024 for sole proprietorships? (Image from the Internet)

What is the deadline for submitting financial statements for 2024 for sole proprietorships in Vietnam?

Pursuant to point a, clause 2, Article 109 of Circular 200/2014/TT-BTC which stipulates the deadline for submitting financial statements for sole proprietorships as follows:

Deadline for submitting financial statements

- For state enterprises

...

b) Deadline for submitting annual financial statements:

- Accounting units must submit their annual financial statements no later than 30 days from the end of the financial year; For parent companies and state corporations, no later than 90 days;

- Subsidiary accounting units of state corporations must submit their annual financial statements to the parent company or corporation according to the deadline prescribed by the parent company or corporation.

- For other types of enterprises

a) Accounting units that are sole proprietorships and partnerships must submit their annual financial statements no later than 30 days from the end of the financial year; for other accounting units, the deadline for submitting annual financial statements is no later than 90 days;

b) Subsidiary accounting units must submit their annual financial statements to the superior accounting unit according to the deadline prescribed by the superior accounting unit.

Thus, under the above regulation, the deadline for sole proprietorships to submit annual financial statements is no later than 30 days from the end of the financial year. This means the deadline for sole proprietorships to submit financial statements for 2024 is January 30, 2025.

What is the penalty for sole proprietorships that are late in submitting financial statements in Vietnam?

Pursuant to Article 12 of Decree 41/2018-ND-CP which regulates the penalties for violations of regulations on submitting and disclosing financial statements as follows:

Penalties for violations of regulations on submitting and disclosing financial statements

- A fine from 5,000,000 VND to 10,000,000 VND for any of the following acts:

a) Submitting financial statements to the competent state agency late under 03 months compared to the prescribed deadline;

b) Disclosing financial statements late under 03 months compared to the prescribed deadline.

- A fine from 10,000,000 VND to 20,000,000 VND for any of the following acts:

a) Disclosing financial statements without full content as prescribed;

b) Submitting financial statements to the competent state agency without the accompanying audit report in cases where the law requires an audit;

c) Submitting financial statements to the competent state agency late from 03 months or more compared to the prescribed deadline;

d) Disclosing financial statements without the accompanying audit report in cases where the law requires an audit;

đ) Disclosing financial statements late from 03 months or more compared to the prescribed deadline.

- A fine from 20,000,000 VND to 30,000,000 VND for any of the following acts:

a) Providing false information, figures in the disclosed financial statements;

b) Providing, publishing financial statements for use in Vietnam with inconsistent figures within the same accounting period.

- A fine from 40,000,000 VND to 50,000,000 VND for any of the following acts:

a) Not submitting financial statements to the competent state agency;

b) Not disclosing financial statements as prescribed.

- Remedial measures:

Mandating the submission and disclosure of audit reports accompanying financial statements for violations stipulated in point b, d, clause 2 of this Article.

According to the above regulation, if a sole proprietorship is late in submitting financial statements to the competent state agency, they will be penalized at the following two levels:

- Late under 03 months compared to the prescribed deadline will incur a fine from 5,000,000 VND to 10,000,000 VND;

- Late from 03 months or more compared to the prescribed deadline will incur a fine from 10,000,000 VND to 20,000,000 VND;

Note: The above penalty levels apply to organizations; the penalty levels for individuals are half of those applied to organizations (clause 2, Article 6 of Decree 41/2018/ND-CP, as amended by clause 2, Article 5 of Decree 102/2021/ND-CP).