What are the fines for individuals engaging in food and beverage service in Vietnam for late tax payment?

What are the fines for individuals engaging in food and beverage service in Vietnam for late tax payment?

Individuals engaging in food and beverage services who fail to pay it on time will be penalized for late payment based on Clause 2, Article 59 of the Law on Tax Management 2019. According to the above law, the calculation of late payment interest and the period for which late payment interest is calculated as follows:

Penalties for Late Payment of Taxes

[…]

2. The method for calculating late payment interest and the period for which late payment interest is calculated are stipulated as follows:

a) The late payment interest is calculated at the rate of 0.03% per day on the amount of late tax payment;

b) The period for calculating late payment interest is continuously counted from the day after the due date specified in Clause 1 of this Article until the day before the date on which the tax arrears, tax recovery, increased tax, assessed tax, or delayed tax transfer is fully paid into the state budget.

3. Taxpayers must self-determine the late payment interest as specified in Clause 1 and 2 of this Article and pay it into the state budget accordingly. In cases where taxpayers have overpaid tax, late payment interest, or penalties, such overpaid amounts will be handled as stated in Clause 1, Article 60 of this Law.

4. If 30 days have passed since the tax payment deadline, and the taxpayer has not yet paid the tax, late payment interest, or penalties, the tax authority will notify the taxpayer of the outstanding amount and the number of days late.

5. No late payment interest will be charged in the following cases:

a) Taxpayers supplying goods and services payable by the state budget, including subcontractors specified in contracts signed with the investor and directly paid by the investor, are not liable for late payment interest.

The tax arrears exempt from late payment interest must not exceed the amount of unpaid state budget funds.

b) In cases stipulated at point b, Clause 4, Article 55, of this Law, no late payment interest is charged during the time awaiting the results of analysis and assessment; while the official price is not yet determined; or the actual payment amount, including adjustments included in the customs value, has not been confirmed.

6. No late payment interest is charged for debts suspended under Article 83 of this Law.

7. If taxpayers amend tax declarations leading to a reduction in the payable tax amount or if a tax authority or relevant state authority's inspection results in a reduction in the payable tax amount, the corresponding amount of late payment interest will be adjusted accordingly.

8. Taxpayers required to pay late payment interest as noted in Clause 1 of this Article will be exempt from such interest in cases of force majeure as defined in Clause 27, Article 3 of this Law.

9. The Minister of Finance prescribes the procedures for handling late tax payments.

Therefore, individuals engaging in food and beverage services who fails to pay tax on time will be penalized at the rate of 0.03% per day on the amount of late tax payment.

What are the fines for individuals engaging in food and beverage service in Vietnam for late tax payment? (Image from the Internet)

Are individuals engaged in small-scale food and beverage service in Vietnam required to pay flat tax?

Based on the provisions of Article 51 of the Law on Tax Management 2019:

- Tax authorities shall determine the flat tax payable by household businesses and individual businesses who fail to comply with or fully comply with regulations on accounting, invoices and documents, except for the cases in Clause 5 of this Article.

- Tax authority shall impose flat tax according to declarations of household businesses and individual businesses, the database of tax authorities, and comments of Tax Advisory Council of the commune.

- Flat tax shall be imposed by calendar year (or by month for seasonal business). Flat tax shall be published in the commune. The taxpayers shall inform the tax authority when changing their business lines or scale, suspend or shut down the business in order to adjust the flat tax.

- The Minister of Finance shall specify the bases and procedures for determination of flat tax payable by household businesses and individual businesses.

- Household businesses and individual businesses whose revenues and employees reach the upper limit for extra-small enterprises prescribed by regulations of law on small and medium enterprises shall do accounting and declare tax.

* Note: The flat tax is calculated on either a calendar year or a monthly basis for seasonal business activities. The flat tax must be publicly disclosed within the commune, ward, commune-level town.

If there are changes in business sectors, scales, or if the business is suspended or temporarily halted, the taxpayer must report to the tax authority to adjust the flat tax accordingly.

Therefore, small-scale individuals engaging in food and beverage services who do not fully comply with accounting, invoice, and voucher policies, except for other cases specified by law, must pay flat tax.

>>> Tax declaration form for households and individuals engaging in business activities Download.

How to calculate flat tax rates for individuals engaged in small-scale food and beverage service in Vietnam?

Flat taxes for individuals engaging in business activities are based on their taxable revenue and the tax rate applied to that revenue.

The flat tax for individual business households will be calculated according to the following formula (according to Clause 3, Article 10 of Circular 40/2021/TT-BTC):

| VAT payable = Taxable revenue x VAT rate Personal income tax payable = Taxable revenue x Personal income tax rate |

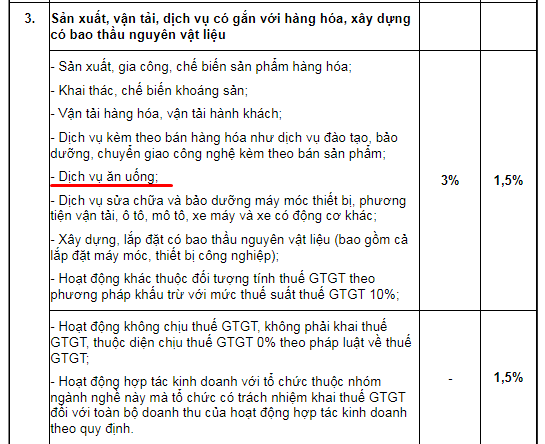

*The specific VAT and personal income tax rates are as follows:

The flat tax rates are specified in Appendix 1 of the List of Business Sectors for VAT and Personal Income Tax Rates as a percentage of revenue for households and individuals engaged in business activities, issued along with Circular 40/2021/TT-BTC, which states:

>>> See detailed list of flat tax rates: Here <<<

Therefore, small-scale individuals engaging in food and beverage services pay flat taxes in accordance with the formula stated above.