What are regulations on notification on erroneous invoices in Vietnam? Which form is used for notifying erroneous invoices in Vietnam?

What are regulations on notification on erroneous invoices in Vietnam?

Based on Article 19 of Decree 123/2020/ND-CP, regulations regarding the notification of erroneous invoices are specified as follows:

(1) In the case where the seller detects an electronic invoice with tax code already issued by the tax authority but not yet sent to the buyer having errors, the seller must notify the tax authority using Form No. 04/SS-HDDT in Appendix 1A issued together with this Decree 123/2020/ND-CP about the cancellation of the erroneous e-invoice with the issued code and subsequently issue a new e-invoice, digitally sign it and send it to the tax authority for a new code to replace the erroneous invoice to send to the buyer. The tax authority will carry out the cancellation of erroneous e-invoices with issued codes stored in the tax authority's system.

(2) In cases where the electronic invoice with a tax authority code or the electronic invoice without a tax authority code has been sent to the buyer and either party discovers errors, the handling is as follows:

- If there are errors in the name or address of the buyer but not in the tax identification number, and other details are correct, the seller must notify the buyer of the error without having to re-issue the invoice. The seller must notify the tax authority of the erroneous electronic invoice using Form No. 04/SS-HDDT in Appendix 1A issued with Decree 123/2020/ND-CP, except when the electronic invoice without a tax authority code has not been sent to the tax authority.

- In cases of errors: tax identification number; monetary amounts recorded on the invoice, wrong tax rates, tax amounts, or goods listed on the invoice being incorrect in specification and quality, one of the following methods can be chosen:

+ The seller issues an adjustment e-invoice for the erroneous invoice. If the seller and buyer agree on creating a prior agreement before issuing an adjustment invoice for the erroneous invoice, they must create an agreement document specifying the errors, after which the seller issues an adjustment e-invoice for the erroneous invoice.

The adjustment e-invoice must contain the line "Adjustment for invoice Form No... symbol... number... dated... month... year".

+ The seller issues a new e-invoice to replace the erroneous e-invoice, except in cases where the seller and buyer agree on creating a prior agreement document before issuing a replacement invoice for the erroneous invoice. They then create an agreement document specifying the errors, after which the seller issues a new e-invoice to replace the erroneous invoice.

The new replacement e-invoice must contain the line "Replacement for invoice Form No... symbol... number... dated... month... year".

The seller digitally signs the new adjustment or replacement e-invoice and sends it to the buyer (for e-invoices without a tax authority code) or sends it to the tax authority to have a code issued for the new e-invoice to send to the buyer (for e-invoices with a tax authority code).

+ For the airline industry, exchange and refund invoices for airline transport documents are considered adjustment invoices without needing the information “Adjustment increase/decrease for invoice Form No... symbol... dated... month... year”. Airlines may issue their invoices for refund or exchange transport documents issued by agents.

(3) In cases where the tax authority discovers an erroneous electronic invoice with a tax code or an electronic invoice without a tax code already issued, the tax authority will notify the seller using Form No. 01/TB-RSDT in Appendix 1B issued with Decree 123/2020/ND-CP for checking errors.

Within the notification period listed on Form No. 01/TB-RSDT in Appendix 1B, the seller must notify the tax authority using Form No. 04/SS-HDDT in Appendix 1A issued with Decree 123/2020/ND-CP regarding verifying erroneous e-invoices.

If the notification deadline on Form No. 01/TB-RSDT in Appendix 1B is exceeded and the seller does not notify the tax authority, the tax authority will issue a second notice to the seller using Form No. 01/TB-RSDT in Appendix 1B. If the second notification period is exceeded without a response from the seller, the tax authority may consider proceeding to an inspection regarding e-invoice use.

(4) Within one working day, the tax authority will notify about the receipt and results of processing using Form No. 01/TB-HDSS in Appendix 1B issued with Decree 123/2020/ND-CP. Canceled e-invoices are void for use but must be stored for reference purposes.

Moreover, point a clause 1 Article 7 of Circular 78/2021/TT-BTC provides guidelines on notifying errors in invoices:

In cases where an e-invoice has errors that need a new tax code or requires handling through adjustment or replacement as per Article 19 of Decree No. 123/2020/ND-CP, the seller may choose to use Form No. 04/SS-HDDT in Appendix 1A issued with Decree 123/2020/ND-CP to notify the adjustment for each erroneous invoice or for multiple erroneous e-invoices and may send the notification using Form No. 04/SS-HDDT to the tax authority at any time but no later than the last day of the VAT declaration period in which the adjustment e-invoice arises.

What are regulations on notification on erroneous invoices in Vietnam? (Image from Internet)

Which form is used for notifying erroneous invoices in Vietnam?

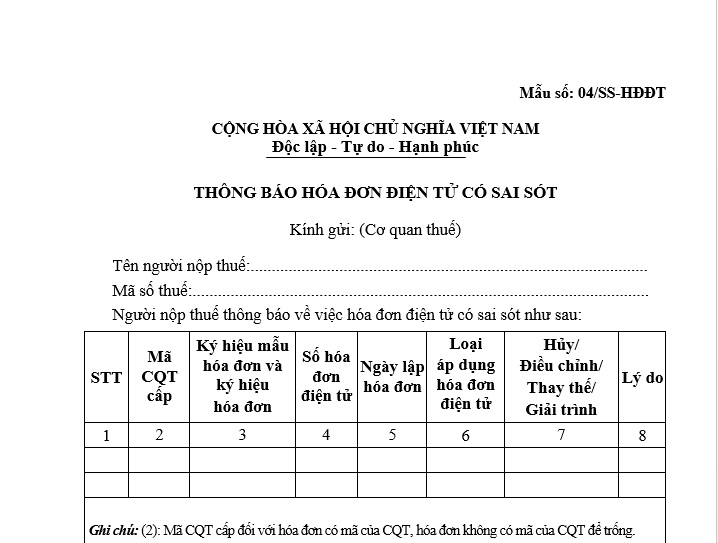

Based on Article 19 of Decree 123/2020/ND-CP, the form for notifying erroneous invoices is regulated in Appendix 1A issued together with Decree 123/2020/ND-CP and is Form 04/SS-HDDT.

Form 04/SS-HDDT appears as follows:

Form 04/SS-HDDT - Notice regarding erroneous invoices...Download

What are penalties for late submission of notices regarding erroneous invoices in Vietnam?

According to Article 29 of Decree 125/2020/ND-CP (as rectified by clause 2 of Official Dispatch 29/CP-KTTH 2021), the penalty for late submission of notices regarding erroneous invoices is specified as follows:

| Days Late | Penalty |

| Exceeding the regulation by 01-05 days, with mitigating factors | Warning |

| Exceeding the regulation by 01-10 days, without mitigating factors | Fine between 1,000,000 - 3,000,000 VND |

| Exceeding the regulation by 11-20 days | Fine between 2,000,000 - 4,000,000 VND |

| Exceeding the regulation by 21-90 days | Fine between 4,000,000 - 8,000,000 VND |

| Exceeding the regulation by 91 days or more | Fine between 5,000,000 - 15,000,000 VND |

Note: The aforementioned fines apply to organizations. In cases of violation by individuals, the fines are 1/2 of those for organizations.

In addition to timely notifying the buyer and tax authority, sellers must make adjustments to correct errors as required by law. After correcting the errors, sellers must retain the original electronic invoices and notification of errors for e-invoices in accordance with legal requirements, to serve possible future inspections or audits.