What are procedures for declaration of personal income tax exemption for income from transfer, inheritance, and gifts of real estate in Vietnam?

What are procedures for declaration of personal income tax exemption for income from transfer, inheritance, and gifts of real estate in Vietnam?

Pursuant to Subsection 4 Section 2 Appendix issued together with Decision 2780/QD-BTC in 2023, the procedures for declaration of personal income tax exemption for income from transfer, inheritance, and gifts of real estate in Vietnam is carried out in the following steps:

Step 1: Individuals transferring real estate subject to tax exemption (including houses, future constructions) prepare and submit tax exemption dossiers along with tax declaration dossiers at the single window department or the Tax Department where the real estate is located.

In case the single window department is not yet implemented locally, the dossier is directly submitted to the land use right registration office where the transferred real estate is located.

In case individuals transfer houses, future constructions, they declare tax and pay personal income tax at the local Tax Department where the house or future construction is located.

Step 2: The tax authority receives the dossier:

++ If the dossier is submitted directly to the tax authority or sent by post: the tax authority shall receive and process the dossiers as prescribed.

++ If the dossier is submitted to the tax authority through electronic transactions, the receipt, check, acceptance, processing, and outcome delivery shall be through the tax authority’s electronic data processing system.

Step 3: The tax authority examines the dossiers and delivers the results.

What are procedures for declaration of personal income tax exemption for income from transfer, inheritance, and gifts of real estate in Vietnam? (Image from the Internet)

What are methods for declaration of personal income tax exemption for income from transfer, inheritance, and gifts of real estate in Vietnam?

Pursuant to Subsection 4 Section 2 Appendix issued together with Decision 2780/QD-BTC in 2023, methods for declaration of personal income tax exemption for income from transfer, inheritance, and gifts of real estate in Vietnam are as follows:

- Submit directly at the single window department or the Tax Department where the real estate transfer, inheritance, gift is located, or the land use right registration office where the real estate transfer, inheritance, gift is located (for cases where the single window department has not been implemented locally);

- Send via postal system;

- Send electronic dossiers to the tax authority through electronic transactions (The General Department of Taxation’s electronic portal/the competent state agency’s electronic portal, or the T-VAN service provider).

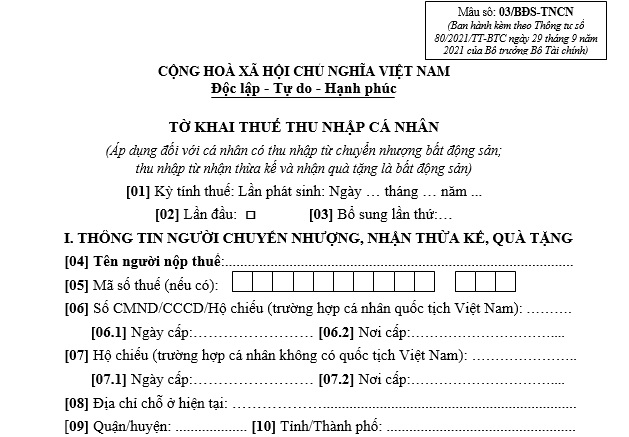

What is the tax declaration form for individuals with income from real estate transfers, inheritance, and gifts in Vietnam?

The tax declaration form for individuals with income from real estate transfers, inheritance, and gifts is the Personal Income Tax Declaration Form No. 03/BDS-TNCN issued together with Appendix 2 Circular 80/2021/TT-BTC:

>> Download the tax declaration form for individuals with income from real estate transfers, inheritance, and gifts

In which,

Instructions for declaring Indicator [51]:

If the taxpayer does not have co-ownership and is exempt from the entire tax according to regulations on personal income tax (TNCN) for real estate transfer, inheritance, and gift, they only need to check the first line of column [51.7] or specify the reason for exemption in column [51.8] without declaring other information;

If there are co-ownerships (regardless of tax exemption or not), the taxpayer representative must fully declare all information in Indicator [51];

(3) If the taxpayer does not have co-ownership but has partially exempted TNCN, declare corresponding indicators:

- For exempted tax, the taxpayer declares indicators [51.2], [51.3], [51.4], [51.6], and [51.7] or [51.8]- For payable tax: the taxpayer declares indicators [51.2], [51.3], [51.4], and [51.5].

(4) Declare Indicator [51.4]:

- In case of co-ownership, the taxpayer representative must declare the ownership ratio of the owner and other co-owners;

- In case the taxpayer does not have co-ownership but has partially exempted tax, the taxpayer shall determine the ownership ratio as a basis for calculating the payable tax, exempted tax on real estate transfer, inheritance, and gift.

Instructions for declaring Part: “TAXPAYER or LEGAL REPRESENTATIVE OF THE TAXPAYER”: only declare on behalf of the taxpayer in case there is no exempted tax and before signing, clearly state “Declared on behalf.” Declare on behalf when the real estate transfer contract specifies that the buyer is responsible for declaring personal income tax, or when the taxpayer authorizes another individual as per the Law.