What are obligations to be fulfilled by the taxpayer prior to TIN deactivation in Vietnam?

What are cases of TIN reactivation in Vietnam?

According to the provisions of Clause 1 and Clause 2 Article 39 of the 2019 Tax Administration Law, a taxpayer's TIN validity will be reactivated in the following cases:

- For taxpayers who register businesses at the same time as taxpayer registration with enterprises/cooperatives/business registration, the TIN validity will be reactivated in the following cases:

+ The taxpayer ceases business operations/dissolves/bankrupts.

+ The competent authority revokes the business registration certificate, business registration certificate, or cooperative registration certificate.

+ The taxpayer undergoes division, separation, consolidation, or merger.

- For taxpayers who directly register with the tax authority, the TIN validity will be reactivated if one of the following cases occurs:

+ Ceasing business operations or no longer incurring any tax obligations to the non-business organization.

+ Revocation of the business registration certificate or equivalent valid license.

+ Division, separation, consolidation, or merger.

+ The tax authority issues a notice that the taxpayer is not operating at the registered address.

+ A foreign contractor upon the completion of the contract.

+ A contractor or investor engaging in a petroleum contract, upon the conclusion of the contract or upon transferring all participation interests in the petroleum contract to another party.

+ The individual’s death, disappearance, or loss of civil act capacity as prescribed by law.

What are obligations to be fulfilled by the taxpayer prior to TIN deactivation? (Image from the Internet)

What are obligations to be fulfilled by the taxpayer prior to TIN deactivation in Vietnam?

According to Clause 1 Article 15 of Circular 105/2020/TT-BTC, the obligations that a taxpayer must complete prior to TIN deactivation are as follows:

- The taxpayer must submit the invoice usage report as prescribed by the law on invoices;

- The taxpayer completes the obligation of submitting tax declaration dossiers, paying taxes, and handling any excess tax payments or unclaimed VAT (if any);

- In the case where the managing unit has subordinate units, all subordinate units must complete the procedures to reactivate their TIN validity before the managing unit can reactivate its TIN validity.

Which form is used to apply for the deactivation of a personal TIN?

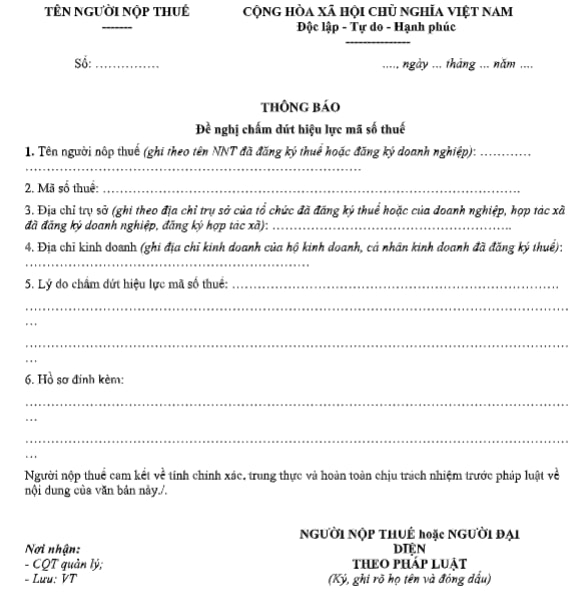

The document for applying for the deactivation of a TIN is specified in Form 24/DK-TCT issued together with Circular 105/2020/TT-BTC as prescribed in Article 38 and Article 39 of the 2019 Tax Administration Law.

Download Form 24/DK-TCT for the application to reactivate the TIN validity: Here

What are the documents and procedures for the deactivation of a personal TIN at the tax authority in Vietnam?

(1) Documents for reactivating a TIN

In case the taxpayer has not registered for an electronic transaction account and does not have a digital signature, the taxpayer shall carry out the procedures directly at the tax authority.

According to Article 14 of Circular 105/2020/TT-BTC, the documents for reactivating the TIN validity for taxpayers registering directly with the tax authority include:

(1) The application for reactivating the TIN validity as specified in Form 24/DK-TCT issued together with Circular 105/2020/TT-BTC, according to the provisions of Article 38 and Article 39 of the 2019 Tax Administration Law

(2) Other documents (if any):

- For business households; individual businesses; business locations of business households and individual businesses as prescribed at point i Clause 2 Article 4 of Circular 105/2020/TT-BTC, the documents are:

A copy of the decision to revoke the Business Household Registration Certificate (if available).

(2) Procedures:

Based on Clause 6 Article 39 and Clause 3 Article 41 of the 2019 Tax Administration Law, the procedures for reactivating the TIN validity, and the responsibilities for handling taxpayer registration documents are as follows:

Step 1: Taxpayers who register directly with the tax authority shall submit the application for reactivating the TIN validity to the directly managing tax authority within 10 business days from the date of the cessation of operation document or cessation of business activities or contract deactivation date.

Step 2: The tax authority shall handle taxpayer registration documents according to the following regulations:

- In case the documents are complete, the tax authority shall inform the acceptance of the documents and the time frame for processing the taxpayer registration documents is no later than 03 business days from the date of receipt of the complete documents;

- In case the documents are incomplete, the tax authority shall notify the taxpayer no later than 02 business days from the date of receipt of the documents.