What are obligations to be fulfilled by enterprises operating in the sectors of insurance in Vietnam prior to TIN deactivation?

What are obligations to be fulfilled by enterprises operating in the sectors of insurance in Vietnam prior to TIN deactivation?

Based on Article 15 of Circular 105/2020/TT-BTC, the provisions are as follows:

Obligations to be fulfilled by the taxpayer prior to TIN deactivation

1. For taxpayers as stipulated in Points a, b, c, d, đ, e, g, h, m, n Clause 2 Article 4 of this Circular:

- Taxpayers must submit a report on the usage of invoices according to the regulations on invoices;

- Taxpayers must complete the obligation of submitting tax return files, paying taxes, and processing any tax overpayments, as well as any non-deductible value-added tax (if any) as stipulated in Articles 43, 44, 47, 60, 67, 68, 70, 71 of the Tax Administration Law with the tax authority;

- In cases where the parent entity has subsidiary units, all subsidiary units must complete the procedures for terminating the effectiveness of their TINs before the parent entity terminates the effectiveness of its TIN.

2. For business households and individuals as stipulated in Point i Clause 2 Article 4 of this Circular:

- Taxpayers must submit a report on the usage of invoices according to the regulations on invoices, if they are using invoices;

- Taxpayers must complete the obligation of paying taxes and processing any tax overpayments as stipulated in Articles 60, 67, 69, 70, 71 of the Tax Administration Law with the tax authority for business households and individuals paying taxes by the fixed tax method.

- Taxpayers must complete the obligation of submitting tax return files, paying taxes, and processing any tax overpayments, and any non-deductible value-added tax (if any) as stipulated in Articles 43, 44, 47, 60, 67, 68, 70, 71 of the Tax Administration Law with the tax authority for business households and individuals paying taxes by the declaration method.

...

Referring to Article 4 of Circular 105/2020/TT-BTC, the regulations are as follows:

Subjects of Taxpayer Registration

1. The subjects of taxpayer registration include:

a) Taxpayers who are subject to taxpayer registration through the one-stop-shop mechanism as stipulated in Point a Clause 1 Article 30 of the Tax Administration Law.

b) Taxpayers who are subject to direct taxpayer registration with the tax authority as stipulated in Point b Clause 1 Article 30 of the Tax Administration Law.

2. Taxpayers subject to direct taxpayer registration with the tax authority include:

a) Enterprises operating in fields such as insurance, accounting, auditing, lawyers, notary services, or other specialized fields that are not required to register businesses through the business registration authority according to specialized laws (hereinafter referred to as Economic Organizations).

...

enterprises operating in the sectors of insurance must fulfill the following obligations before the TIN deactivation effectiveness:

- Submit a report on the usage of invoices according to the regulations on invoices;

- Complete the obligation of submitting tax return files, paying taxes, and processing any tax overpayments, and any non-deductible value-added tax (if any) with the tax authority;

- In cases where the parent entity has subsidiary units, all subsidiary units must complete the procedures for terminating the effectiveness of their TINs before the parent entity terminates the effectiveness of its TIN.

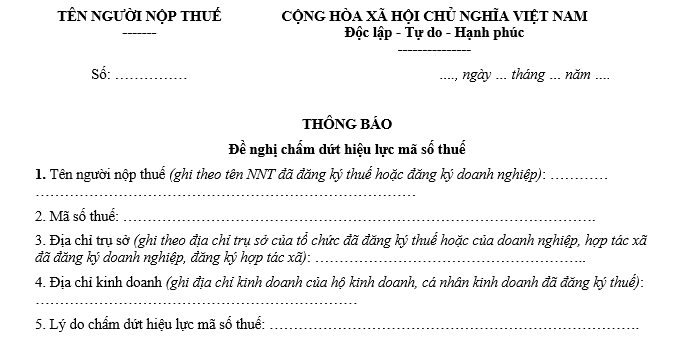

Where to download a request for TIN deactivation form No. 24/DK-TCT?

The notification form to request for TIN deactivation form No. 24/DK-TCT is issued with Circular 105/2020/TT-BTC as follows:

>> Download the request for TIN deactivation form No. 24/DK-TCT here

What are obligations to be fulfilled by enterprises operating in the sectors of insurance in Vietnam prior to TIN deactivation? (Image from the Internet)

Is the TIN of an enterprise operating in the sectors of insurance the same as the business code in Vietnam?

Based on Article 5 of Circular 105/2020/TT-BTC, the provisions are as follows:

Structure of TIN

1. The structure of the TIN:

N1N2 N3N4N5N6N7N8N9 N10 - N11N12N13

In which:

- The first two digits N1N2 are the segment numbers of the TIN.

- The seven digits N3N4N5N6N7N8N9 are defined by a specified structure, sequentially increasing from 0000001 to 9999999.

- The digit N10 is the check digit.

- The three digits N11N12N13 are the sequence numbers from 001 to 999.

- The dash (-) is the character used to separate the first 10 digits group from the last 3 digits group.

2. The business code, the cooperative code, and the dependent unit code of the business or cooperative issued according to the regulations on business registration and cooperative registration are the TINs.

...

Thus, the TIN of an enterprise operating in the sectors of insurance is also the business code of that business.