What are guidelines for searching foreign providers who have completed tax registration in Vietnam 2025?

What are guidelines for searching foreign providers who have completed tax registration in Vietnam 2025?

Below are the guidelines for searching foreign providers who have completed tax registration in Vietnam for 2025, detailed in the following steps:

Step 1: Access the website:

https://etaxvn.gdt.gov.vn/nccnn/Request

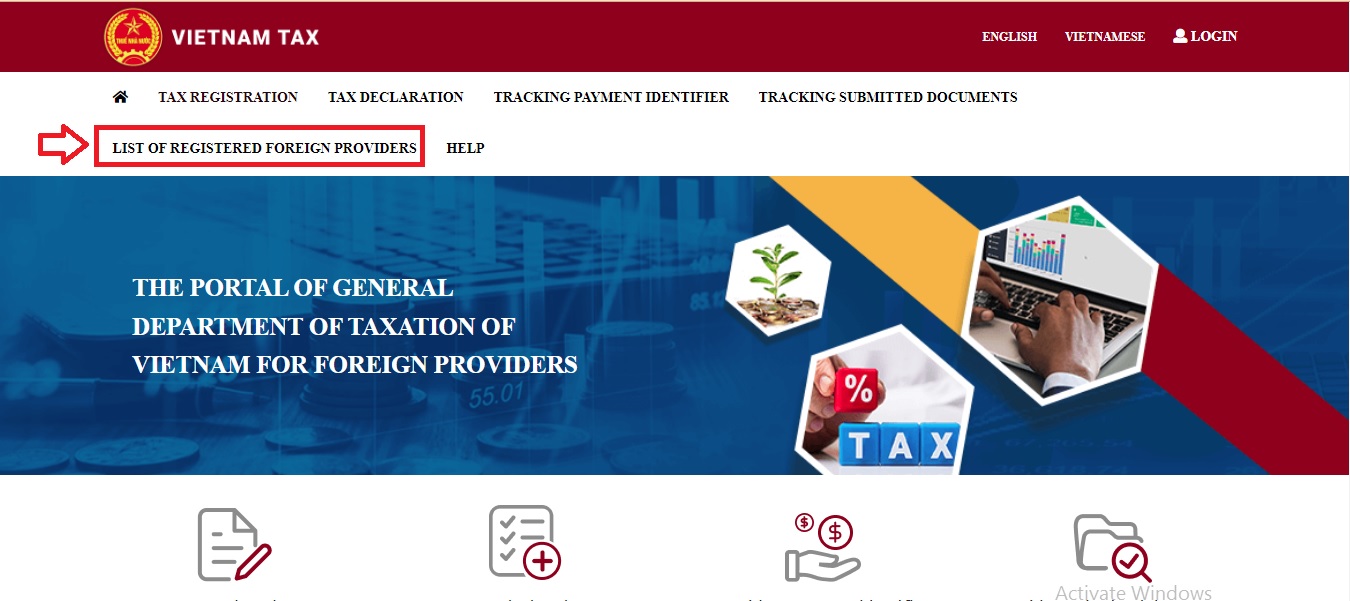

Step 2: On the homepage, select the option “LIST OF REGISTERED FOREIGN PROVIDERS” to search for foreign providers who have tax registration in Vietnam.

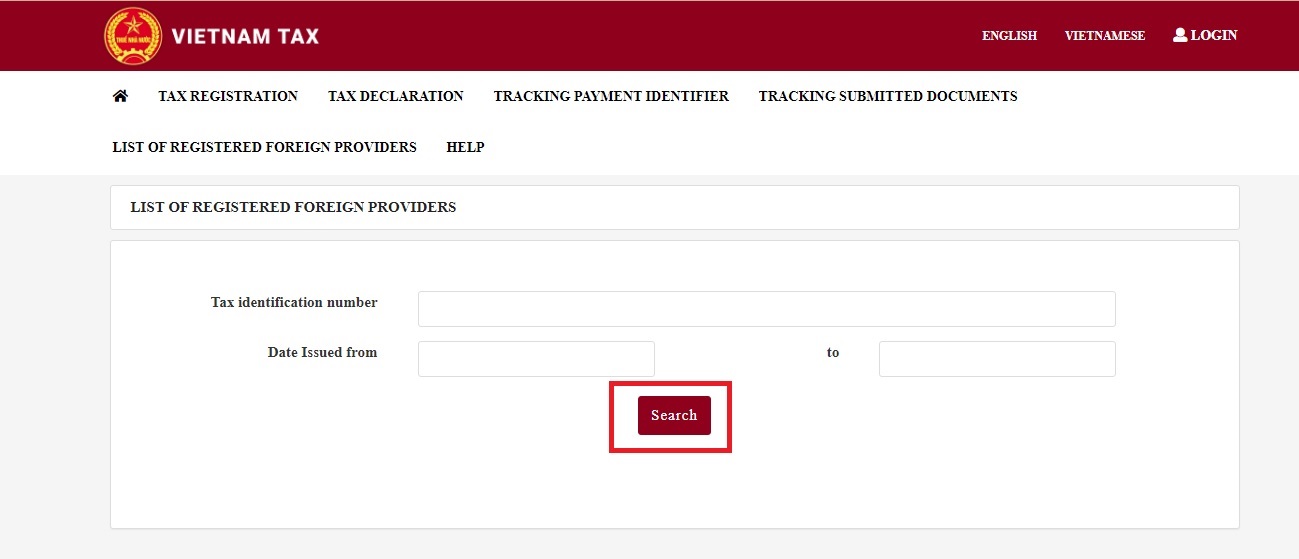

Step 3: Enter the Tax identification number and Date Issued from…to … (tax registration date) (if available).

Step 4: After filling in all the information, click “Search” to proceed with the search.

If you only know the Tax identification number, you do not need to fill in the Date Issued from…to … (tax registration date) and can still conduct the search.

What are guidelines for searching foreign providers who have completed tax registration in Vietnam 2025? (Image from the Internet)

What is the List of 04 foreign providers without tax registration in Vietnam?

According to Official Dispatch 6369/TCT-DNL 2024 by the General Department of Taxation regarding announcing information on foreign providers who have not registered, declared, or paid taxes.

Below is the list of 04 foreign providers without tax registration in Vietnam:

| No. | COMPANY NAME | COMPANY WEBSITE |

|---|---|---|

| 1 | Agoda International Pte. Ltd | https://www.agoda.com |

| 2 | Paypal Pte. Ltd | https://www.paypal.com |

| 3 | Airbnb Ireland Unlimited | https://www.Airbnb.com |

| 4 | Booking.com BV | https://www.Booking.com |

Which authotity is responsible for tax withholding when purchasing from overseas providers without tax registration in Vietnam?

Based on Clause 2, Article 81 of Circular 80/2021/TT-BTC, it is stipulated as follows:

Responsibilities of Organizations and Individuals in Vietnam Related to Purchasing Goods, Services from Overseas Providers

...

2. Individuals purchasing goods and services from overseas providers who have not registered for tax registration, declared taxes, or paid taxes in Vietnam, as stipulated in Articles 76, 77, 78, and 79 of this Circular, commercial banks, and intermediary payment service providers are responsible for withholding and paying on behalf as stipulated in Point a, Clause 3, Article 30 of Decree No. 126/2020/ND-CP.

The General Department of Taxation is responsible for announcing the names and website addresses of overseas providers who have not registered, declared, or paid taxes, from whom buyers of goods and services conduct transactions, to the Head Office of Banks and intermediary payment service providers. The Head Office is responsible for notifying foreign providers' lists to the bank branches so that these branches can declare, withhold, and pay tax obligations when transacting with overseas providers following the regulations in Decree No. 70/2014/ND-CP dated July 17, 2014, by the Government of Vietnam detailing the implementation of some articles of the Foreign Exchange Ordinance and its amendments. The tax amount declared, withheld, and paid on behalf is determined based on the revenue received by the foreign provider, the percentage to calculate value-added tax, and corporate income tax based on revenue as per Points d and e of Clause 1, Article 77 of this Circular. If it is impossible to determine the type of goods or services for each transaction, the highest percentage rate applies to calculate value-added tax and corporate income tax.

...

As per the above regulation, in the case of purchasing goods from overseas providers who have not registered as taxpayers, commercial banks, and intermediary payment service providers are responsible for withholding and paying tax obligations as per tax laws for each product, goods, or service paid by individuals in Vietnam to overseas providers related to e-commerce business activities, based on digital platforms.