What are guidelines for completing Form 05-2/BK-QTT-TNCN on the detailed list of individuals subject to tax calculation at a flat rate in Vietnam?

What are guidelines for completing Form 05-2/BK-QTT-TNCN on the detailed list of individuals subject to tax calculation at a flat rate in Vietnam?

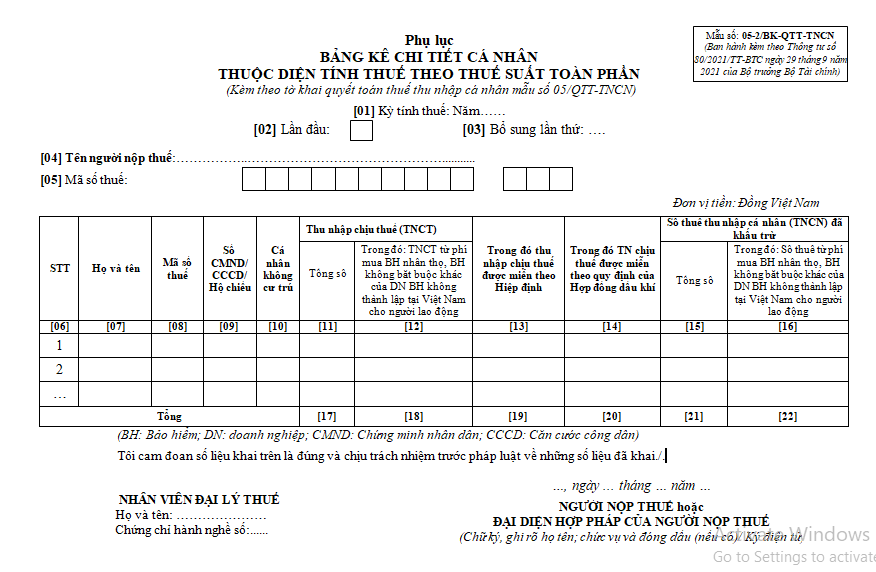

Form 05-2/BK-QTT-TNCN, the appendix for the detailed list of individuals subject to tax calculation at a flat rate, is issued in conjunction with Circular 80/2021/TT-BTC.

Download Form 05-2/BK-QTT-TNCN Appendix for detailed list of individuals subject to tax calculation at a flat rate.

Below are the guidelines for completing Form 05-2/BK-QTT-TNCN Appendix for detailed list of individuals subject to tax calculation at a flat rate:

[1] General Information Section

[01] Tax Period: Enter the year of the tax declaration period. Organizations or individuals paying income should settle personal income tax according to the calendar year.

[02] Initial Declaration: If it is the first tax declaration, mark “x” in the square box.

[03] Additional Declaration Number: If it is not the initial declaration, it should be considered an additional declaration and the number of additional declarations should be filled in the blank. The number is recorded with natural numbers (1, 2, 3…).

[04] Name of the Taxpayer: Clearly and fully record the name of the organization or individual paying the income as per the Establishment Decision, Business Registration Certificate, Taxpayer Registration Certificate, or Investment Certificate.

[05] Tax Code: Clearly and fully record the tax code of the organization or individual paying the income as per the Taxpayer Registration Certificate or Tax Code Notification.

[2] Declaration of the Indicators of the Table

[06] Serial Number: Recorded sequentially using natural numbers (1, 2, 3…).

[07] Full Name: Clearly and fully record the full name of the resident individual receiving income from salaries or wages through a labor contract of 3 months or more, including those receiving income below the tax deduction threshold or those who have resigned by the time of the declaration based on the tax code registration or personal identification/passport.

[08] Tax Code: Clearly and fully record the tax code of the individual according to the Taxpayer Registration Certificate or Tax Code Notification or Tax Card issued by the tax authority.

[09] ID/Passport Number (in case of not having a Tax Code): If the individual does not qualify to receive a tax code, record their ID or passport number.

[10] Non-resident Individual: Select for non-resident individuals.

[11] Total: Total taxable income amounts from salaries or wages paid to resident individuals without a labor contract, or with a labor contract less than 3 months, non-resident individuals.

[12] Of which: Taxable income from life insurance, other non-mandatory insurance fees paid by an insurance company not established in Vietnam for employees.

[13] Of which taxable income exempt under Agreement: Taxable income as a basis for tax exemption or reduction under double taxation agreements.

[14] Of which taxable income exempt under Petroleum Contract: Taxable income exempt as per Petroleum Contract provisions.

[15] Total (Personal Income Tax (PIT) Deducted): Total amount of PIT deducted from the employee's salary in the settlement year. For individuals who have made the commitment 02/CK-TNCN, enter 0 here.

[16] Of which: Tax from life insurance, other non-mandatory insurance fees paid by a foreign insurance company for employees: Tax from the life insurance and other non-mandatory insurance fees paid by the enterprise for employees. Indicator [16] = Indicator [12] x 10%.

Note: The content for completing Form 05-2/BK-QTT-TNCN Appendix for detailed list of individuals subject to tax calculation at a flat rate is for reference only.

What are guidelines for completing Form 05-2/BK-QTT-TNCN on the detailed list of individuals subject to tax calculation at a flat rate in Vietnam? (Image from the Internet)

What are the income subject to personal income tax calculated at a flat rate?

According to Clause 1, Article 23 of the Law on Personal Income Tax 2007 regulation on flat tax rates is as follows:

Flat Tax Rate

- A flat tax rate applies to taxable income specified in Clause 2, Article 21 of this Law.

...

Simultaneously, based on Clause 2, Article 21 of the Law on Personal Income Tax 2007 regarding taxable personal income as follows:

Taxable Income

...

- Taxable income for income from capital investment, transfer of capital, real estate transfer, winnings, royalties, franchising, inheritance, gifts are taxable income as prescribed in Articles 12, 13, 14, 15, 16, 17, and 18 of this Law.

Furthermore, based on sub-point b.3, point b, clause 1, Article 25 of Circular 111/2013/TT-BTC regulation on tax deduction as follows:

Tax Deduction and Tax Deduction Receipts

- Tax deduction

Tax deduction is the calculation by which organizations or individuals paying income deduct the payable tax from the income of the taxpayer before paying the income. To be specific:

...

b) Income from salaries, wages

...

b.3) For individuals who are foreigners working in Vietnam, the organization or individual paying the income bases on the working period in Vietnam of the taxpayer recorded in the Contract or documents sent to work in Vietnam to temporarily deduct tax according to the Progressive Tax Tariff (for individuals working in Vietnam for 183 days or more in the tax year) or the Flat Tax Rate (for individuals working in Vietnam less than 183 days in the tax year).

...

Thus, the income subject to personal income tax calculated at a flat rate includes:

- Income from capital investment.

- Income from capital transfer.

- Income from real estate transfer.

- Income from winnings.

- Income from royalties.

- Income from franchising.

- Income from inheritance.

- Income from gifts.

- Income from salaries and wages for individuals who are foreigners working in Vietnam according to contracts or documents sent for work in Vietnam, with a working period of less than 183 days in the tax year.

What are the tax rates for personal income tax on income taxed at a flat rate in Vietnam?

Based on Clause 2, Article 23 of the Law on Personal Income Tax 2007 amended by Clause 7, Article 2 of the Law on amendments to Tax Laws 2014 regarding the flat tax rates.

Simultaneously, Article 2 of the Law on Personal Income Tax 2007 defines taxable entities, whereby individuals who are foreigners working for less than 183 days in a tax year in Vietnam are considered non-resident individuals.

Additionally, based on Clause 1, Article 18 of Circular 111/2013/TT-BTC regarding the tax base for income from salaries and wages of non-resident individuals as follows:

For Income from Salaries, Wages

- Personal income tax for income from salaries and wages of non-resident individuals is determined by the taxable income from salaries and wages multiplied by the tax rate of 20%.

...

Thus, the personal income tax rates for income taxed at a flat rate are determined as follows:

- Income from capital investment: 5%

- Income from capital transfer as specified in Clause 1, Article 13 of the Law on Personal Income Tax 2007: 20%

- Income from securities transfer as specified in Clause 1, Article 13 of the Law on Personal Income Tax 2007: 0.1%

- Income from real estate transfer: 2%

- Income from winnings: 10%

- Income from royalties: 5%

- Income from franchising: 5%

- Income from inheritance: 10%

- Income from gifts: 10%

- Income from salaries and wages for individuals who are foreigners working in Vietnam according to contracts or documents sent for work in Vietnam, with a working period of less than 183 days in the tax year: 20%