What are guidelines for checking TINs of enterprises in Vietnam? Is the TIN of enterprise a string of 10 digits?

What are guidelines for checking TINs of enterprises in Vietnam?

an enterprise identification number is a series of numbers generated by the National Business Registration System and issued to businesses upon establishment, as recorded on the Business Registration Certificate. Each business is assigned a unique number not reused for any other business.

*Taxpayers can refer to the most common methods to check a TIN of enterprises below:

1. Online Check on the General Department of Taxation's Website:

This is the quickest and most convenient method.

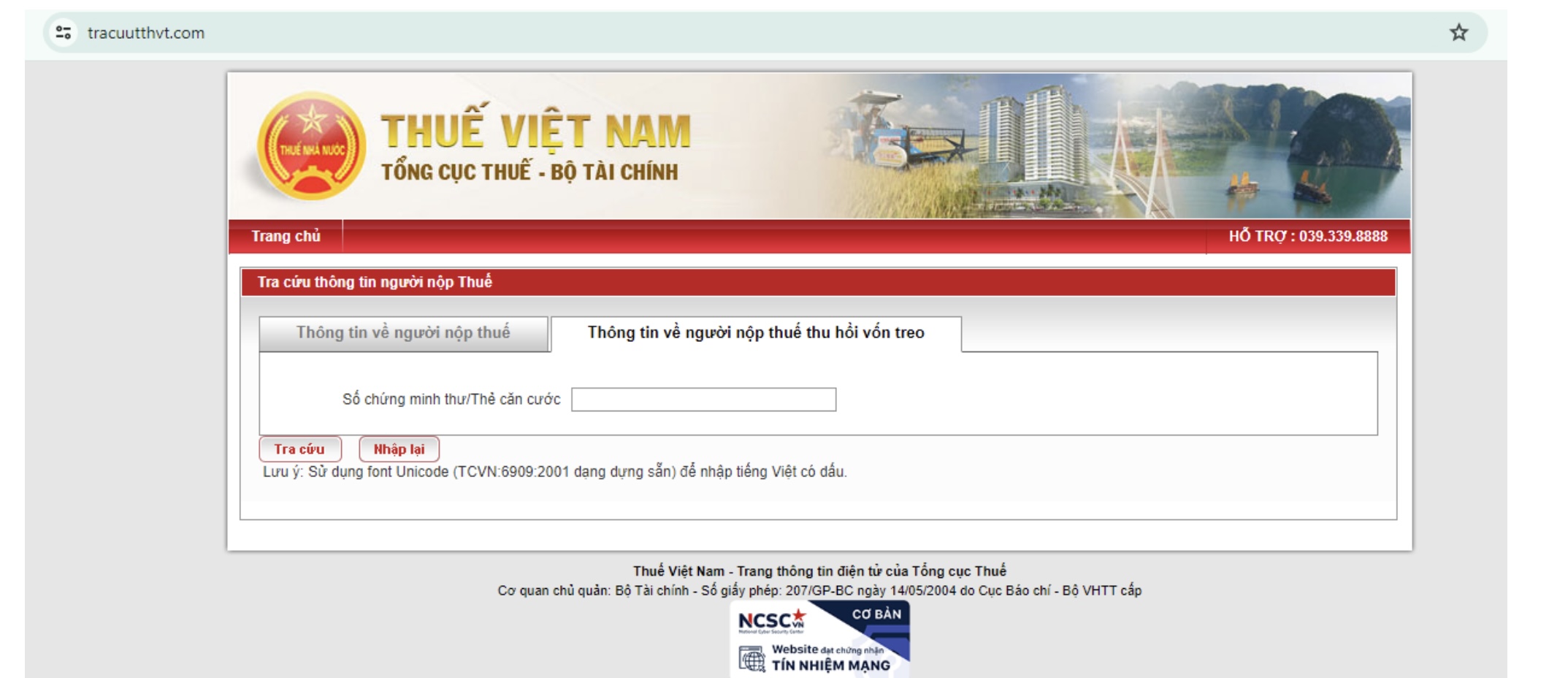

Step 1: Access the official website of the General Department of Taxation at http://tracuunnt.gdt.gov.vn/tcnnt/mstdn.jsp

Step 2:

Then, enter the required information into the corresponding fields. You need to input any of the following information:

- Tax number: If known accurately.

- Name of the tax-paying organization or individual: Fill in the full name of the business.

- Business headquarters address: Enter the specific address.

- ID card/ Citizen ID card of the representative: If available.

Step 3:

Finally, press the "Search" button for the system to display the results.

Method 2: Check Tax Number on the National Business Registration Portal

Step 1: Visit the National Business Registration Portal website at: https://dangkykinhdoanh.gov.vn/

Step 2: In the search section, enter the information which could be the business name or business identification number

- The system will suggest company names similar or closely related to the company name you want to find the tax number for. Proceed to choose the appropriate business name for your search purpose from these suggestions.

- When searching for a TIN of enterprises on the National Information Portal, aside from knowing the tax number, you will also find other basic information about the business, including:

+ Business name/ name in foreign languages

+ Abbreviated business name

+ Business identification number

+ Legal form

+ Date of establishment

+ Name of the legal representative

+ Main office address

+ Stamp template (if any)

+ Business lines

+ List of published electronic announcements

Step 3: Click to search

What are guidelines for checking TINs of enterprises in Vietnam? Is the TIN of enterprise a string of 10 digits? (Image from the Internet)

What are guidelines for checking TINs of enterprises in Vietnam? Is the TIN of enterprise a string of 10 digits? (Image from the Internet)

Vietnam: Is the TIN of enterprises a series of 10 digits?

Based on Clause 2, Article 30 of the Law on Tax Administration 2019, the structure of the TIN is as follows:

Taxpayer Registration and Issuance of TIN

1. Taxpayers must complete taxpayer registration and be issued a TIN by the tax authority before commencing production and business activities or incurring obligations to the state budget. Taxpayer registration subjects include:

a) Enterprises, organizations, individuals conducting taxpayer registration through a one-stop-shop mechanism along with business registration, cooperative registration, and business registration in accordance with the Law on Enterprises and other related legal provisions;

b) Organizations and individuals not falling under the case specified in point a of this clause shall directly register with the tax authority as prescribed by the Minister of Finance.

2. The structure of the TIN is regulated as follows:

a) A 10-digit TIN is used for enterprises, organizations with legal status; representatives of households, household businesses, and other individuals;

b) A 13-digit TIN and other characters are used for dependent units and other entities;

c) The Minister of Finance provides detailed regulation on this clause.

3. The issuance of TINs is as follows

From the above provisions, it can be seen that a TIN of enterprises consists of 10 digits.

How many TINs may an enterprise have in Vietnam?

Based on point a, clause 3, Article 30 of the Law on Tax Administration 2019 the regulation on TINs is as follows:

- Enterprises, economic organizations, and other organizations are granted a unique TIN for use throughout their operational period from taxpayer registration until the termination of the TIN's validity.

- Taxpayers with branches, representative offices, dependent units directly fulfilling tax obligations are issued dependent TINs.

- In cases where enterprises, organizations, branches, representative offices, and dependent units register through a one-stop-shop mechanism along with business registration, cooperative registration, or business registration, the number on the business registration certificate, cooperative registration certificate, or business registration certificate is concurrently the TIN.