What are distribution methods for resource royalty in Vietnam?

What are distribution methods for resource royalty in Vietnam?

Based on Clause 2, Article 15 of Circular 80/2021/TT-BTC, the distribution methods for resource royalty is regulated as follows:

(1) Basis for distributing resource royalty payable to each province:

- The area of the hydroelectric reservoir is t, the area of the hydroelectric reservoir in province G is t.1, the area in province H is t.2.

+ The percentage (%) of the reservoir area in province G is T.1 = t.1/t x 100.

+ The percentage (%) of the reservoir area in province H is T.2 = t.2/t x 100.

- Compensation expenses for site clearance and resettlement are k; expenses for site clearance and resettlement in province G is k.1; in province H is k.2.

+ The percentage (%) for compensation expenses for site clearance and resettlement in province G is K.1 = k.1/k x 100.

+ The percentage (%) in province H is K.2 = k.2/k x 100.

- The number of households needing relocation is s, with s.1 in province G, and s.2 in province H.

+ The percentage (%) of households needing relocation in province G is S.1 = s.1/s x 100.

+ The percentage (%) in province H is S.2 = s.2/s x 100.

- The value of compensation for material damage in the reservoir area is v, with v.1 in province G and v.2 in province H.

+ The percentage (%) of compensation value for material damage in province G is V.1 = v.1/v x 100.

+ The percentage (%) in province H is V.2 = v.2/v x 100.

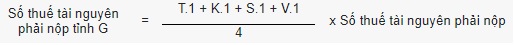

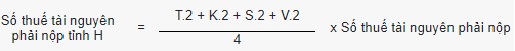

(2) Calculation formula:

What are distribution methods for resource royalty in Vietnam? (Image from the Internet)

When is the resource royalty distributed? How is resource royalty declared and paid in Vietnam?

Based on Clauses 1 and 3, Article 15 of Circular 80/2021/TT-BTC, regulations are provided for cases where the resource royalty is distributed and how it is declared and paid. Specifically:

- The case where resource royalty is distributed is the production activity of hydroelectric power with reservoirs located in multiple provinces.

- Declaration and payment of resource royalty:

Taxpayers with hydroelectric power plants are required to declare resource royalty and submit tax declaration dossiers according to Form No. 01/TAIN, and tax finalization dossiers according to Form No. 02/TAIN to the tax authority managing the state budget revenue where the exploitation of water resources occurs.

If the hydroelectric reservoir of a power plant is located in multiple provinces, taxpayers must submit tax declarations according to Form No. 01/TAIN and tax finalization according to Form No. 02/TAIN, along with an appendix of the resource royalty distribution to localities benefiting from the revenue from hydroelectric power production, according to Form No. 01-1/TAIN issued with Appendix 2 of Circular 80/2021/TT-BTC of the hydroelectric plant at the tax authority where the power plant's headquarters are located; tax payments shall be distributed to the province with the hydroelectric reservoir as regulated in Clause 4, Article 12 of Circular 80/2021/TT-BTC.

What are regulations on the resource royalty calculation price in Vietnam?

According to Article 6 of the Law on resource royalty 2009, the tax calculation price is regulated as follows:

- The price for calculating resource royalty is the selling price per unit of resource product by the exploiting organization or individual, excluding value-added tax.

- If the resource's selling price is not determined, the tax calculation price shall be determined based on one of the following bases:

+ The actual market selling price in the area for the same type of resource product, but not lower than the tax calculation price prescribed by the Provincial People's Committee;

+ If the exploited resource contains different substances, the tax calculation price is determined based on the selling price per unit of each substance and its content in the exploited resource, but not lower than the price prescribed by the Provincial People's Committee.

- Specific resource royalty calculation prices in certain cases are regulated as follows:

+ For natural water used for hydroelectric production, it is the average commercial electricity selling price;

+ For timber, it is the selling price at the delivery site; if the price is not determined at the delivery site, the tax price is determined based on the price specified by the Provincial People's Committee;

+ For resources exploited for export without domestic consumption, it is the export price;

+ For crude oil, natural gas, and coal gas, it is the selling price at the delivery point, as agreed in the petroleum contract, where ownership is transferred to participants in the petroleum contract.

- The Provincial People's Committee specifically prescribes the tax calculation price for resources without a determined selling price per unit, excluding crude oil, natural gas, coal gas, and natural water used for hydroelectric production.