What are cases where is it necessary to report on use of printed invoices purchased from tax authorities in Vietnam?

What are cases where is it necessary to report on use of printed invoices purchased from tax authorities in Vietnam?

Pursuant to Article 29 of Decree 123/2020/ND-CP, reports on the use of printed invoices purchased from tax authorities are required in the following cases:

(1) Quarterly, businesses, economic organizations, households, and individual businesses purchasing invoices from the tax authority are responsible for submitting reports on on use of invoices and the list of invoices used during the period to the directly managing tax authority.

Reports on the use of invoices must be submitted quarterly, no later than the last day of the first month of the next quarter following the quarter in which the invoices are used.

In case invoices are not used during the period, businesses, economic organizations, households, and individual businesses must submit a report on invoice usage recording the number of invoices used as zero (= 0), without the need to send a list of invoices used during the period.

In case invoices were fully used in the previous period and reported with a remaining balance of zero (0), and no invoices are purchased or used in the current period, businesses, economic organizations, households, and individual businesses are not required to report the use of invoices.

(2) Enterprises, economic organizations, households, and individual businesses selling goods and services are responsible for submitting reports on the use of invoices and the list of invoices used during the period when undergoing division, separation, merger, dissolution, bankruptcy, change of ownership; transferring, selling, contracting, or leasing state-owned enterprises along with the deadline for submitting tax finalization dossiers.

(3) In case businesses, economic organizations, households, and individual businesses relocate their business location to a different jurisdiction from the tax authority currently managing them, they must submit reports on the use of invoices and the list of invoices used during the period to the tax authority where they relocate.

What are cases where is it necessary to report on use of printed invoices purchased from tax authorities in Vietnam? (Image from the Internet)

What is the latest form of the report on use of invoices in Vietnam in 2024?

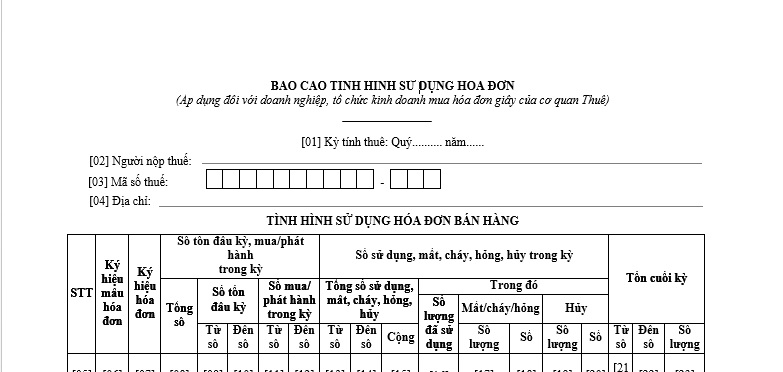

The latest form of the report on use of invoices 2024 is Form BC26/HDG, Appendix 1A issued together with Decree 123/2020/ND-CP.

The latest form of the report on use of invoices 2024 has the following format:

Latest Form of the report on use of invoices 2024...Download

What are cases where is it necessary to report on use of internally- and externally-printed receipts?

According to Article 38 of Decree 123/2020/ND-CP, the conditions for reporting on use of internally- and externally-printed receipts are stipulated as follows:

(1) Quarterly, fee, and charge collecting organizations are responsible for submitting reports on on use of receipts.

The deadline for submitting quarterly reports on the usage of receipts is no later than the last day of the first month of the next quarter following the quarter in which receipts are used.

(2) The report on receipt usage includes the following contents: Name of unit, tax code (if any), address; type of receipt, receipt template code, receipt symbol; opening balance, purchased and issued during the period; number used, canceled, lost, destroyed during the period; final balance sent to the directly managing tax authority.

In case receipts are not used during the period, in the receipt usage report, the quantity of receipts used is recorded as zero (=0).

In case receipts were fully used in the previous period and reported with a remaining balance of zero (0), no notice of issuance for collection receipts of fees and charges, and no receipts are used during the period, the fee and charge collecting organization is not required to submit a report on receipt usage.

In case the fee and charge collecting organization authorizes a third party to issue receipts, the fee and charge collecting organization must still report on use of receipts.

The report on receipt usage follows Form BC26/BLDT or Form BC26/BLG, Appendix 1A issued together with Decree 123/2020/ND-CP.

(3) Fee and charge collecting organizations are responsible for submitting a report on on use of receipts when dissolving, dividing, merging, or changing ownership along with the deadline for submitting fee and charge finalization dossiers.

What are regulations on destruction of receipts in Vietnam?

According to Clause 2, Article 39 of Decree 123/2020/ND-CP, regulations on receipt destruction are as follows:

- Destruction of self-printed, pre-printed receipts involves using measures such as burning, cutting, shredding, or other destruction methods to ensure the receipt cannot be reused or involve any information or data from it.

- Destruction of electronic receipts involves making the electronic receipt no longer exist in the information system, unable to be accessed or referenced for information contained within the electronic receipt.

Electronic receipts that have expired according to regulations in the Accounting Law 2015 can be destroyed if there is no other decision from a competent state agency. The destruction of electronic receipts must not affect the integrity of non-destroyed electronic receipts and must ensure the normal operation of the information system.