What are 03 methods to look up TIN of enterprises online? Which entities are corporate income taxpayers in Vietnam?

Vietnam: What are 03 methods to look up TIN of enterprises online?

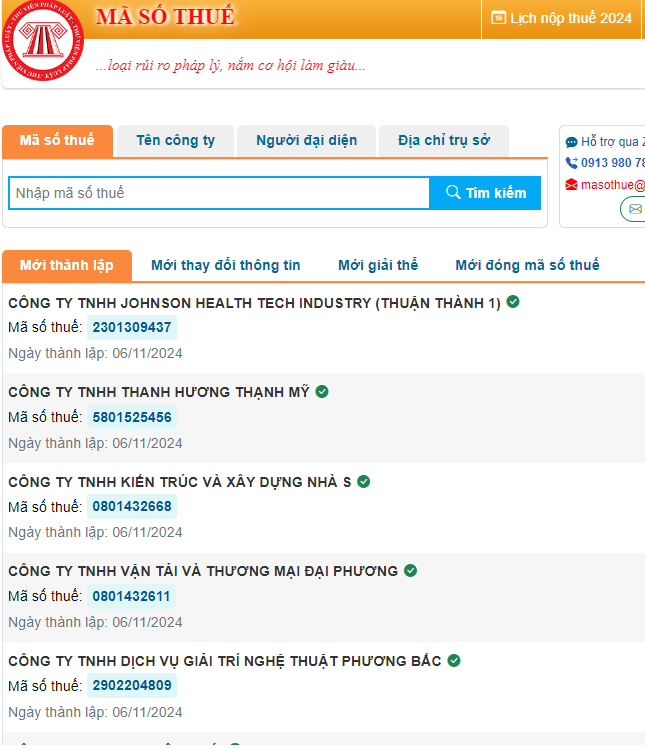

Method 1: Lookup TIN of enterprises on the Tax Identification Lookup Tool of THU VIEN PHAP LUAT

To lookup a TIN of enterprises using the tool from THU VIEN PHAP LUAT, follow these steps:

Step 1: Visit the website: https://thuvienphapluat.vn/ma-so-thue.

Step 2:

On the search bar, depending on the information you have (tax ID, company name, representative, or head office address), choose one of the four corresponding tabs and enter the information to lookup.

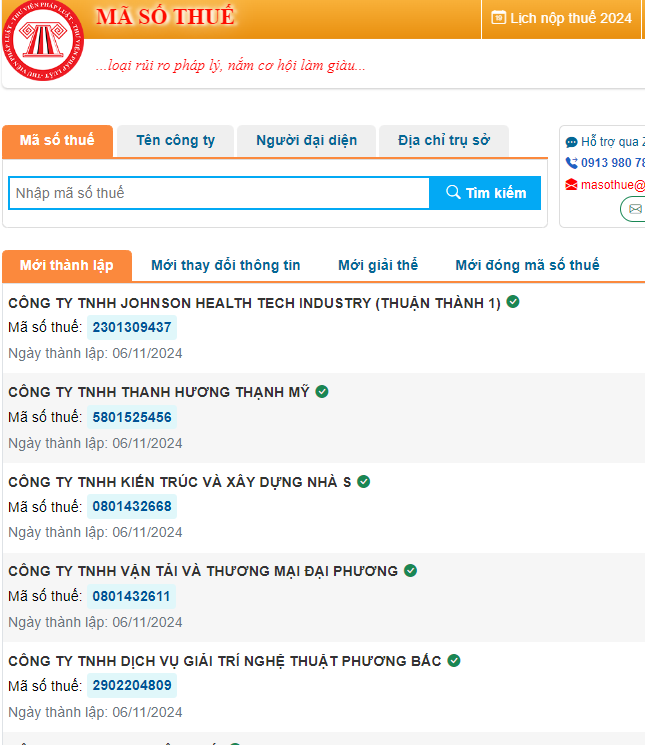

Step 3:

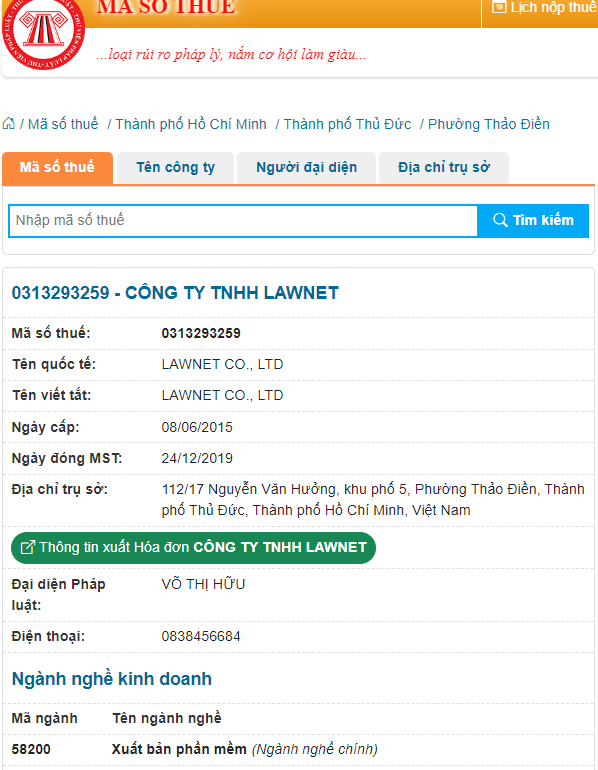

View the business tax identification information.

After entering the required information to search, the tool will display results. Simply click on the result to view detailed information about the business, including:

- Tax ID- International Name- Abbreviated Name- Legal form- Date of tax code issuance- Head office address- Legal representative- Charter capital- Business activities, etc.

Additionally, you can also view invoice issuance information of the business by selecting the "Information on Invoice Issuance…" option. Regarding invoice issuance, the Tax Identification tool of THU VIEN PHAP LUAT ensures to provide customers with three necessary fields to meet invoice issuance conditions.

Method 2: Lookup TIN of enterprises on the General Department of Taxation

To lookup the business tax ID on the General Department of Taxation's portal, you can proceed as follows:

Step 1: Visit the General Department of Taxation’s search website at: https://tracuunnt.gdt.gov.vn/tcnnt/mstdn.jsp

Step 2: In the section “Taxpayer Information,” enter any of the following information (no need to fill in all):

- Tax ID- Name of the tax-registered organization or individual- Business address- ID card/Identity card number of the representative

Step 3: Click "Search" to view results.

Step 4: If you need more detailed information about the business, click on the company name in the results table to view more information.

This information portal, provided by the Ministry of Finance, supports individuals and organizations in quickly looking up the tax ID of businesses, business households, and individuals.

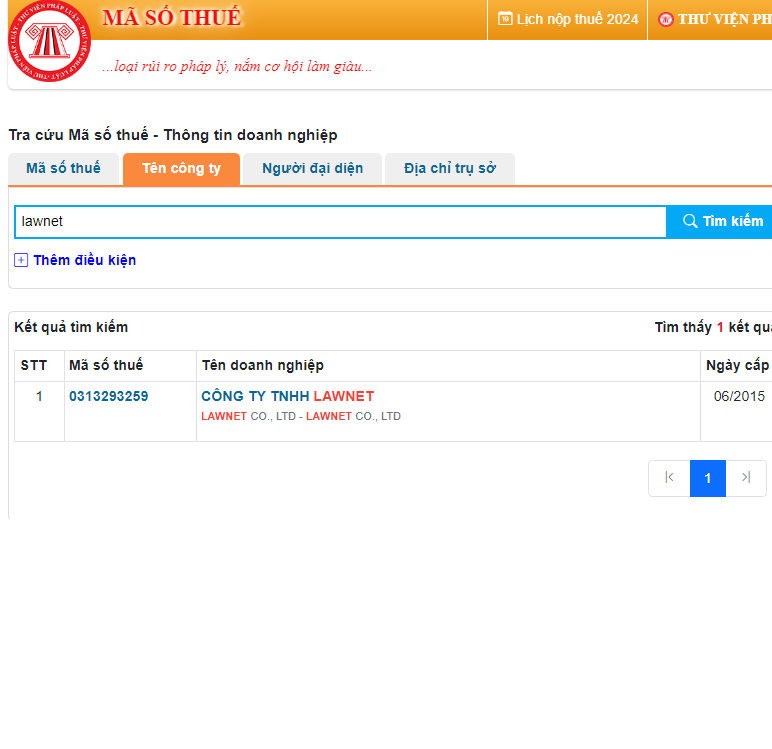

Method 3: Lookup TIN on the National Business Registration Portal

Step 1: Visit the National Business Registration Portal website at: https://dangkykinhdoanh.gov.vn/

Step 2: In the search section, enter the information of the business name or business code.

The system will then suggest company names similar or close to the name for which you want to look up the tax ID. Proceed to select the suitable business name for the purpose of lookup from these suggestions.

When looking up a business tax ID on the National Information Portal, besides knowing the tax ID, the searcher will also get other basic information about the business, including:

- Business name/foreign language name

- Abbreviated business name

- Business code

- Legal form

- Date of establishment

- Name of the legal representative

- Registered office address

- Seal sample (if any)

- Business sectors

- List of announced electronic proclamations

Vietnam: What are 03 methods to look up TIN of enterprises online? (Image from the Internet)

Which entities are corporate income taxpayers in Vietnam?

According to Article 2 of the Law on Corporate Income Tax 2008 as amended and supplemented by Clause 1, Article 1 of the Law on Amending and Supplementing the Law on Corporate Income Tax 2013, the corporate income taxpayers are:

- A corporate income taxpayer is an organization engaging in the production and trading of goods and services that generate taxable income according to this Law (hereinafter referred to as an enterprise), including:

+ Enterprises established under the laws of Vietnam;

+ Enterprises established under the laws of foreign countries (hereinafter referred to as foreign enterprises) with or without a permanent establishment in Vietnam;

+ Organizations established under the Cooperative Law;

+ Public service units established under the laws of Vietnam;

+ Other organizations engaged in production and business activities that generate income.

- Enterprises with taxable income as stipulated in Article 3 of this Law must pay corporate income tax as follows:

+ Enterprises established under Vietnamese law pay tax on taxable income arising in Vietnam and taxable income arising outside Vietnam;

+ Foreign enterprises with a permanent establishment in Vietnam pay tax on taxable income arising in Vietnam and taxable income arising outside Vietnam related to the activities of said permanent establishment;

+ Foreign enterprises with a permanent establishment in Vietnam pay tax on taxable income arising in Vietnam, where such income is not related to the activities of the permanent establishment;

+ Foreign enterprises without a permanent establishment in Vietnam pay tax on taxable income arising in Vietnam.

- A permanent establishment of a foreign enterprise is a production and business location through which the foreign enterprise conducts part or all of its production and business operations in Vietnam, including:

+ Branches, management offices, factories, workshops, means of transportation, oil fields, gas fields, mines, or other places of extraction of natural resources in Vietnam;

+ Construction sites, construction installations, assembly or installation works;

+ Service provision centers, including consultancy services conducted through employees or other organizations and individuals;

+ Agents for foreign enterprises;

+ Representatives in Vietnam in the case where the representative has the authority to sign contracts in the name of the foreign enterprise or a representative without the authority to sign contracts in the name of the foreign enterprise but regularly deliver goods or provide services in Vietnam.

Which expenses are deductible for determining taxable income for corporate income tax in Vietnam?

According to Clause 1, Article 9 of Decree 218/2013/ND-CP, as supplemented by Clause 5, Article 1 of Decree 12/2015/ND-CP, expenses not deductible when determining taxable income for corporate income tax, expenses will be deductible if they meet the following conditions:

- Expenses actually incurred related to the production and business activities of the enterprise, including the following expenses:

+ Expenses related to performing national defense and security education duties, training, activities of the militia and self-defense forces, and serving other national defense and security missions according to the provisions of law; expenses related to supporting the activities of party organizations, political-social organizations in the enterprise;

+ Expenses related to vocational education activities, vocational training for employees according to the provisions of law;

+ Actual expenses for HIV/AIDS prevention and control activities at the workplace of the enterprise, including costs for training HIV/AIDS prevention officers of the enterprise, organizing HIV/AIDS prevention communication for the employees of the enterprise, fees for consulting, examination, and testing for HIV, and supporting the HIV-infected employees of the enterprise.

- Expenses with sufficient invoices and documents as prescribed by law.

For situations such as: Purchasing goods that are agricultural, forestry, or aquatic products sold directly by producers or harvesters; purchasing handcrafted products made from jute, rush, bamboo, leaves, rattan or materials recycled from agricultural products sold directly by producers; purchasing land, stone, sand, gravel from households, individuals who self-extract and sell directly, purchasing scrap from collectors, purchasing used assets from households, individuals who sell directly and services purchased from non-business households and individuals, payment vouchers must be provided, along with a purchasing statement certified and signed by the legal representative or authorized person of the business.

- For invoices for goods or services with a value equal to or greater than twenty million VND must have documents proving non-cash payment, except for the business expenses for: Fulfilling national defense and security tasks, HIV/AIDS prevention and control activities at workplaces, supporting activities of party organizations, political-social organizations in the business as stipulated at point a Clause 1 Article 9 Decree 218/2013/ND-CP; purchasing goods and services with statements made as stipulated at point b Clause 1 Article 9 Decree 218/2013/ND-CP.