Vietnam: When is the notification of failure to submit a tax declaration dossier sent?

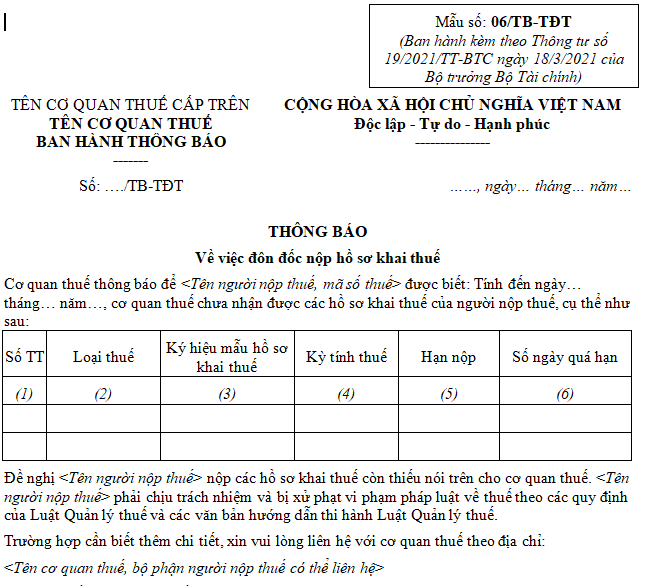

What is the latest notification form reminding submission of the tax declaration dossier in Vietnam?

Currently, the form used for a notification reminding submission of the tax declaration dossier is form number 06/TB-TDT issued along with Circular 19/2021/TT-BTC as follows:

Download the notification form reminding submission of the tax declaration dossier: Here

Vietnam: When is the notification of failure to submit a tax declaration dossier sent? (Image from the Internet)

Vietnam: When is the notification of failure to submit a tax declaration dossier sent?

Based on Article 19 of Circular 19/2021/TT-BTC which regulates the notification of failure to submit tax declaration dossiers as follows:

- The tax authority shall send a reminder notice for tax declaration dossier submission to taxpayers within 05 working days from the expiration date of the tax declaration dossier submission or extension, or from the date of the deadline for explanation and additional documentation according to the tax authority's notice if the taxpayer has not submitted the tax declaration dossiers, or has not provided explanation or additional information according to the tax authority's notice.

- After 10 (ten) working days from the expiration date of the tax declaration dossier submission or its extension, or from the deadline for explanation and additional documentation, if the taxpayer has not submitted the tax declaration dossiers, the tax authority will send a second reminder notice for tax declaration dossier submission to the taxpayer as prescribed.

Additionally, the tax authority shall send a reminder notice via post to the registered business address or the registered tax notification address of the taxpayer.

- After 05 working days from the time the General Department of Taxation's electronic portal sends the second reminder notice if the taxpayer continues not to submit the tax declaration, the tax authority shall verify the taxpayer's operational status at the registered business registration address or tax registration to act accordingly under tax management regulations.

What are cases where there is no requirement to submit tax declaration dossiers in Vietnam?

Based on Clause 3, Article 7 of Decree 126/2020/ND-CP (supplemented by Clause 2, Article 1 of Decree 91/2022/ND-CP) as follows:

tax declaration dossiers

...

- Taxpayers are not required to submit tax declaration dossiers in the following cases:

a) Taxpayers engage in activities subjected to no tax as per tax law regulations for each type of tax.

b) Individuals with income exempt from personal income tax as per tax law and point b, Clause 2, Article 79 of the Tax Management Law, except those receiving inheritance, gifts in the form of real estate, or real estate transactions.

c) Export-processing enterprises only conducting export activities do not have to submit VAT declaration documents.

d) Taxpayers temporarily ceasing operations or business as specified in Article 4 of this Decree.

đ) Taxpayers submitting dossiers for termination of tax code efficacy, except in cases of business cessation, contract termination, or business restructuring as per Clause 4, Article 44 of the Tax Management Law.

e) Individuals handling personal income tax are organizations or individuals paying out that have no instances of personal income tax withholding in a month or quarter.

...

Taxpayers are not required to submit tax declaration dossiers in the following cases:

- Taxpayers only conduct activities subjected to no tax under tax law pertaining to each specific tax type.

- Individuals with income exempt from personal income tax as per the tax law and point b, Clause 2, Article 79 of the 2019 Tax Management Law, except those receiving inheritance, gifts in the form of real estate, or real estate transactions.

Referring to point b, Clause 2, Article 79 of the 2019 Tax Management Law regulates tax exemption for the case where:

Individuals with annual tax liability of 50,000 VND or less from wages or salaries after a personal income tax finalization.

- Export-processing enterprises conducting only export activities are not required to submit VAT declaration documents.

- Taxpayers temporarily halting operations or businesses as specified in Article 4 of Decree 126/2020/ND-CP.

- Taxpayers submit procedures for the termination of tax code efficacy, except for cases of business cessation, contract termination, or business restructuring as specified in Clause 4, Article 44 of the 2019 Tax Management Law.

Referring to Clause 4, Article 44 of the 2019 Tax Management Law stipulates:

The deadline for submitting tax declaration dossiers for cessation of activity, contract termination, or business restructuring is no later than the 45th day from the occurrence of the event.

- Individuals filing personal income tax are organizations or individuals paying out in scenarios where no withholding of personal income tax occurred in a given month or quarter.