Vietnam: What is the VAT declaration form for Q4 2024? Where to download the declaration form?

Vietnam: What is the VAT declaration form for Q4 2024? Where to download the declaration form?

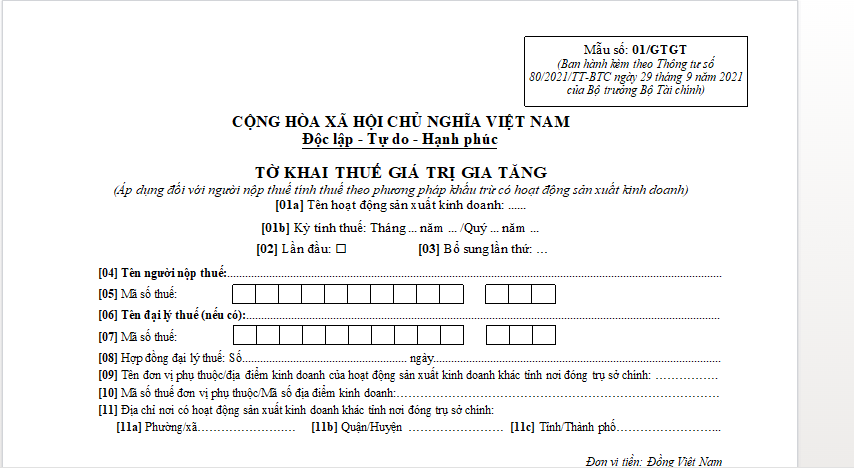

The VAT declaration form for the fourth quarter of 2024 is form No. 01/GTGT, stipulated in Appendix II issued together with Circular 80/2021/TT-BTC. The VAT declaration form for Q4 2024 is as follows:

Download form No. 01/GTGT: VAT Declaration Form for Q4 2024

Vietnam: What is the VAT declaration form for Q4 2024? Where to download the declaration form? (Image from the Internet)

What is the deadline for submitting the VAT declaration in Vietnam for Q4 2024?

Based on Clause 1, Article 44 of the Tax Management Law 2019, which stipulates the deadlines for tax declaration submission as follows:

Deadline for submitting tax declaration dossiers

- The deadline for submitting tax declaration dossiers for taxes declared monthly or quarterly is as follows:

a) No later than the 20th day of the month following the month in which the tax obligation arises, in the case of monthly declarations and submissions;

b) No later than the last day of the first month of the subsequent quarter following the quarter in which the tax obligation arose, in the case of quarterly declarations and submissions.

- The deadline for submitting tax declaration dossiers for taxes calculated annually is as follows:

a) No later than the last day of the third month from the end of the calendar year or fiscal year for annual tax finalization dossiers; no later than the last day of the first month of the calendar year or fiscal year for annual tax declaration dossiers;

b) No later than the last day of the fourth month from the end of the calendar year for individual income tax finalization dossiers of individuals directly finalizing taxes;

c) No later than December 15 of the previous year for fixed tax declarations of business households or individuals paying fixed tax; in case of new business, no later than 10 days from the start of business.

- The deadline for submitting tax declaration dossiers for taxes declared and paid on each occasion of tax obligation arising is no later than the 10th day from the day the tax obligation arises.

...

The deadline for submitting the quarterly VAT declaration is no later than the last day of the first month of the quarter following the quarter in which the tax obligation arose. This means the deadline for submitting the VAT declaration for Q4 2024 is January 31, 2025.

However, January 31, 2025, is the third day of Tet and a holiday according to Notification 6150/TB-BLDTBXH 2024.

Additionally, based on Article 86 of Circular 80/2021/TT-BTC, which prescribes the deadlines for tax declaration submission and tax payment as follows:

Deadline for tax declaration submission and tax payment

The tax declaration submission deadline is implemented according to the provisions in Clauses 1, 2, 3, 4, 5 of Article 44 of the Tax Management Law and Article 10 of Decree No. 126/2020/ND-CP. The tax payment deadline is implemented according to the provisions in Clauses 1, 2, 3 of Article 55 of the Tax Management Law and Article 18 of Decree No. 126/2020/ND-CP. If the deadline for filing a tax declaration or paying taxes falls on a holiday, the deadline is extended to the next business day according to the provisions of the Civil Code.

From the above regulations, it can be seen that the final deadline for submitting the VAT declaration for Q4 2024 is the next working day after the Tet holiday, which is February 3, 2025.

What is the penalty for late submission of the VAT declaration in Vietnam for Q4 2024?

According to Article 13 of Decree 125/2020/ND-CP stipulating the handling of violations on tax declaration submission deadlines as follows:

(1) A warning is imposed for filing tax declarations 1 to 5 days late with mitigating circumstances.

(2) A fine ranging from 2,000,000 VND to 5,000,000 VND is imposed for filing tax declarations 1 to 30 days late.

(3) A fine ranging from 5,000,000 VND to 8,000,000 VND is imposed for filing tax declarations 31 to 60 days late.

(4) A fine ranging from 8,000,000 VND to 15,000,000 VND is imposed for one of the following:

- Filing tax declarations 61 to 90 days late;

- Filing tax declarations more than 91 days late but no tax amount is due;

(5) A fine ranging from 15,000,000 VND to 25,000,000 VND is imposed for filing tax declarations over 90 days late from the tax declaration submission deadline, with a tax amount due and the taxpayer has paid the full tax amount and late payment interest to the state budget before the tax authority announces the decision to inspect or audit the tax or before the tax authority drafts a record of late submission according to Clause 11 Article 143 of the Tax Management Law 2019

If the fine according to this clause exceeds the tax amount incurred in the tax declaration, the maximum fine is equal to the tax amount incurred but not less than the average level of fines between 8,000,000 VND and 15,000,000 VND.

(6) Remedial measures

Besides the monetary fine mentioned above, the taxpayer is also subjected to remedial measures requiring full payment of the late payment amount into the state budget if the late submission leads to late tax payment.

Note: The fines listed in Article 13 of Decree 125/2020/ND-CP are applicable to organizations. The fines imposed on business households or individual businesses are half of those for organizations (according to Clause 5 Article 5 and Point a Clause 4 Article 7 of Decree 125/2020/ND-CP).