Vietnam: What are the online procedures for PIT refund in 2024?

What are the online procedures for PIT refund in 2024 in Vietnam?

Online PIT refund 2024 can be executed through the following methods:

METHOD 1: Submit via the General Department of Taxation's Web Portal

Step 1: Visit the website: https://thuedientu.gdt.gov.vn/ -> Select the individual section

Step 2: Choose the login account and fill in the information

Step 3: Select "Tax Finalization" -> Select "Online Tax Declaration"

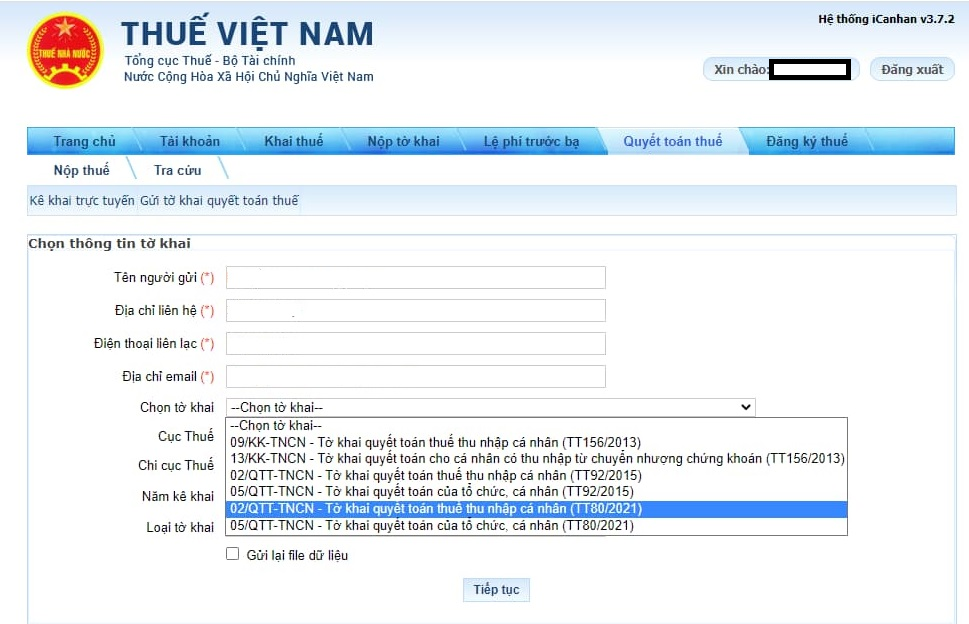

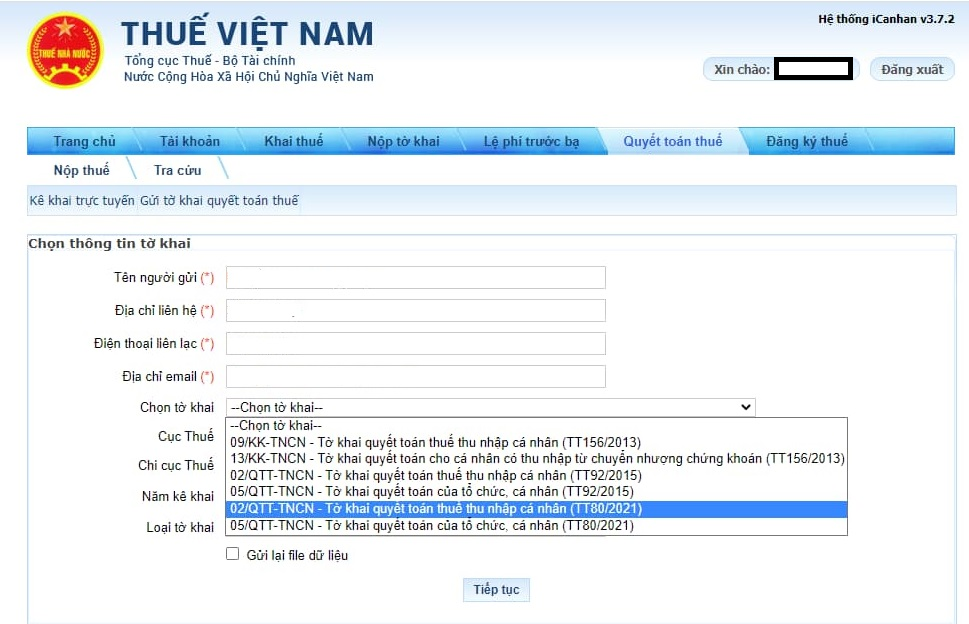

Step 4: Select the declaration information

Step 4: Select the declaration information

- Taxpayer's Name: Name of the person self-finalizing

- Contact Address: Permanent or temporary address

- Contact Phone Number: Phone number of the person self-finalizing

- Email Address: Email of the person self-finalizing

- Select declaration: 02/QTT-TNCN- PIT Tax Finalization Declaration (TT80/2021)

Download the 02/QTT-TNCN- PIT Tax Finalization Declaration form: DOWNLOAD

The system displays the refund request form's declaration screen for the taxpayer to input data:

- From [01] to [06]: The system automatically fills in.

- From [07] to [08]: Select the municipality/province in the field [08] first, then select the district in the field [07] (Permanent address).

- [09]: Fill in the taxpayer's phone number (Mandatory).

- [10]: Fax: Not mandatory.

- [11]: Fill in the taxpayer's email address (Mandatory).

- From [12] to [19]: Tax agent information (if not available, skip it).

... [Text truncated for brevity. The original text here would repeat the Vietnamese text's clause and field entry explanations.]

METHOD 2: Submit via eTax Mobile

Step 1: Log in to the eTax Mobile application

Step 2: Select "Request for Processing Excess Payment"

Step 3: Select the Tax Department and the Tax Branch (if any) to send the request -> Select "Continue"

Step 4: Fill in the information of the person making the excess payment processing request -> Select "Continue"

Note: Fields marked with * are mandatory

Step 5: Verify the information on the tax amount, late payment interest, and fines paid in excess -> Select "Continue"

Step 6: Fill in the payable amounts, the amounts left to be paid which are requested to be offset from the excess amount, as well as the mandatory information -> Select "Continue"

Note: Fields marked with * are mandatory

Step 7: Verify the information on the amounts requested for processing excess payment -> Select "Continue"

Step 8: Name the attached document and select the refund request form -> Select "Continue"

Select declaration: 02/QTT-TNCN- PIT Tax Finalization Declaration (TT80/2021)

Download the 02/QTT-TNCN- PIT Tax Finalization Declaration form: DOWNLOAD

Step 9: Enter OTP sent to the taxpayer's phone number -> Select "Finish"

What are the online procedures for PIT refund in 2024 in Vietnam? (Image from the Internet)

What is the time limit for PIT refund from the date of submitting the tax refund application in Vietnam?

Under Article 75 of the Tax Administration Law 2019:

Time limits for processing tax refund claims

1. In case a claim is eligible for refund before inspection, within 06 working days from the day on which the tax authority issues the notice of receipt of the claim, the tax authority shall decide whether to provide the refund, demand inspection before refund in the cases mentioned in Clause 2 Article 73 of this Law, or reject the claim if it is unqualified.

In case information on the tax refund claim is different from that of the tax authority, the tax authority shall request the taxpayer in writing to provide explanation and additional information. The time needed for providing explanation and additional information shall not be included in the time limit for processing tax refund claims.

2. In case a claim is subject to inspection before refund, within 40 working days from the day on which the tax authority issues the notice of receipt of the claim, the tax authority shall decide whether to provide the refund or reject the claim.

3. If the tax authority fails to issue the tax refund decision by the deadline specified in Clause 1 and Clause 2 of this Article, the tax authority shall pay an interest at 0,03% per day on the refundable and the number of days late. The interest shall be paid by central government budget in accordance with regulations of law on state budget.

Thus, the time limit for PIT refund is stipulated as follows:

- For applications subject to tax refund before inspection, no later than 6 working days from the date the tax authority issues a notification of acceptance of the application and the processing time.

- For applications subject to inspection before the tax refund, no later than 40 days from the date the tax authority issues a written notification of acceptance of the application and the processing time.

What documents are included in the PIT refund application for income from salaries and remunerations in Vietnam?

According to Clause 1, Article 42 of Circular 80/2021/TT-BTC, the PIT refund application for income from salaries and remunerations in Vietnam includes:

- For organizations or individuals paying income from salaries and remunerations conducting finalization for individuals with authorization:

The application includes:

+ A document requesting the processing of excess tax, late payment interest, and fines according to Form 01/DNXLNT, enclosed in Appendix I of this Circular;

+ A power of attorney as per legal regulations if the taxpayer does not personally handle the refund procedure, except for tax agents submitting refund applications under a signed contract with the taxpayer;

+ A list of tax payment vouchers according to Form 02-1/HT, enclosed in Appendix I of this Circular (applies to income-paying organizations and individuals).

- No separate refund application is required for individuals with income from salaries and remunerations who directly finalize taxes with the tax authority with excess tax payment and request a refund on the PIT finalization declaration form.

The tax authority processes the refund based on the PIT finalization application and refunds the excess payment to the taxpayer as regulated.

Download Form 01/DNXLNT here.

Download Form 02-1/HT here.