Vietnam: How to fill in Section 2 of the VAT reduction appendix according to Resolution 142/2024/QH15 on HTKK?

Vietnam: How to fill in Section 2 of the VAT reduction appendix according to Resolution 142/2024/QH15 on HTKK?

Currently, the VAT reduction appendix form according to Resolution 142/2024/QH15 on HTKK software version 5.2.3 includes three sections, with Section 2 designated for goods or services sold during the tax declaration period filled in as follows:

- Name of Goods, Services (2): Enter the name of goods and services sold during the period subject to the VAT rate of 8%.

- Value of Goods, Services excluding VAT (3): Enter the value of goods and services sold excluding VAT.

- VAT Rate as per Regulations (4): The VAT rate of goods, services before applying VAT reduction according to Resolution 142/2024/QH15 (10%).

- VAT Rate after Reduction (5): The VAT rate of goods, services after applying VAT reduction according to Resolution 142/2024/QH15 (8%).

- Reduced VAT of Goods, Services Sold (6): After entering the names of goods, services subjected to tax reduction and the pre-tax value in columns (2) and (3), the HTKK software will automatically calculate the reduced VAT amount in column (6).

Vietnam: How to Fill in Section 2 of the VAT reduction appendix according to Resolution 142/2024/QH15 on HTKK? (Image from Internet)

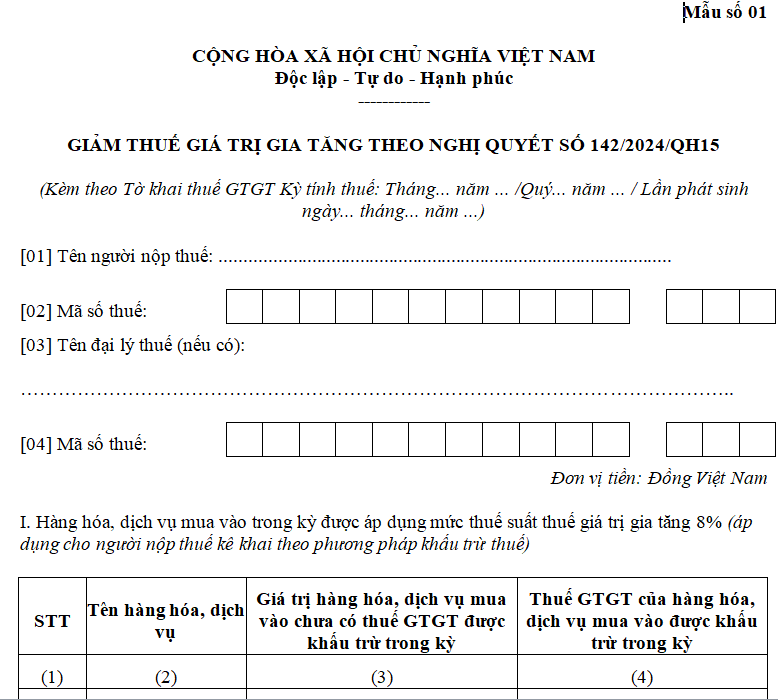

Vietnam: What is Form 01 of the VAT reduction appendix according to Resolution 142/2024/QH15?

The VAT reduction appendix form according to Resolution 142/2024/QH15 in HTKK Software is the VAT Reduction Appendix stipulated in Appendix IV issued along with Decree 72/2024/ND-CP:

Download the VAT reduction appendix form according to Resolution 142/2024/QH15

What goods and services are not eligible for VAT reduction in Vietnam under the Appendix of Decree 72?

According to Article 1 of Decree 72/2024/ND-CP, VAT reduction is applied to goods, services groups currently subject to a 10% VAT rate, except for the following groups:

- Telecommunications, financial activities, banking, securities, insurance, real estate business, metals and fabricated metal products, mining products (excluding coal mining), coke, refined petroleum, chemical products.

Details in Appendix 1 issued along with Decree 72/2024/ND-CP

- Products and services subject to special consumption tax.

Details in Appendix 2 issued along with Decree 72/2024/ND-CP

- Information technology as per information technology laws.

Details in Appendix 3 issued along with Decree 72/2024/ND-CP

Additionally, the reduction of VAT for each type of goods, services specified in Clause 1 Article 1 of Decree 72/2024/ND-CP is uniformly applied at various stages of import, production, processing, commercial business. For coal products mined for sale (including cases where mined coal undergoes screening, classification in a closed process before sale) fall under VAT reduction. Coal items in Appendix 1 issued along with Decree 72/2024/ND-CP, in stages other than mining sale are not subject to VAT reduction.

Major corporations, economic groups conducting a closed sale process also benefit from VAT reduction concerning coal mining sales.

In case goods, services listed in Appendices 1, 2, and 3 issued along with Decree 72/2024/ND-CP are non-VAT liable or subject to a 5% VAT rate in accordance with the Law on VAT, it shall comply with the Law on VAT and not receive a VAT reduction.

VAT Reduction According to Decree 72 Until the End of 2024?

Pursuant to the provision in Clause 1 Article 2 of Decree 72/2024/ND-CP as follows:

Effective Date and Implementation

1. This Decree takes effect from July 01, 2024, until December 31, 2024.

2. Ministries by function, duties, and People's Committees of provinces, centrally run cities direct relevant agencies to carry out propaganda, guidance, inspection, supervision so that consumers understand and benefit from the VAT reduction provision in Article 1 of this Decree, focusing on measures to stabilize the supply-demand of goods, services subject to VAT reduction aiming to maintain market price stability (prices excluding VAT) from July 01, 2024, until December 31, 2024.

3. In case difficulties arise during implementation, the Ministry of Finance shall provide guidance, resolution.

4. Ministers, heads of ministerial-level agencies, heads of government-attached agencies, Chairpersons of People's Committees of provinces, centrally run cities and related enterprises, organizations, individuals are responsible for the implementation of this Decree.

Decree 72/2024/ND-CP takes effect from July 01, 2024, to December 31, 2024.

This also means the provision reducing VAT to 8% is only applicable until December 31, 2024.

From January 01, 2025, the VAT rate for goods, services that were reduced will revert to 10% (unless otherwise regulated).