Vietnam: How many types of accounting accounts are there according to Circular 200/2014?

Vietnam: How many types of accounting accounts are there according to Circular 200/2014?

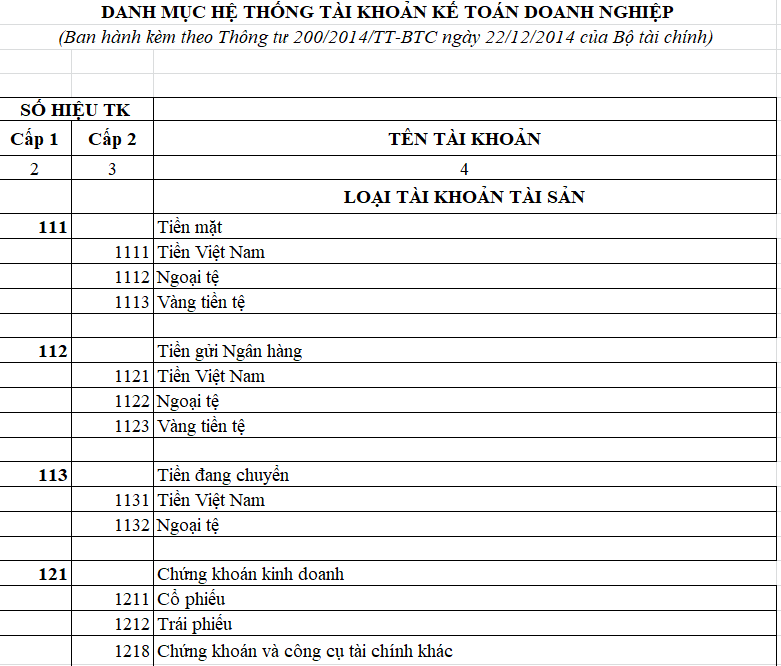

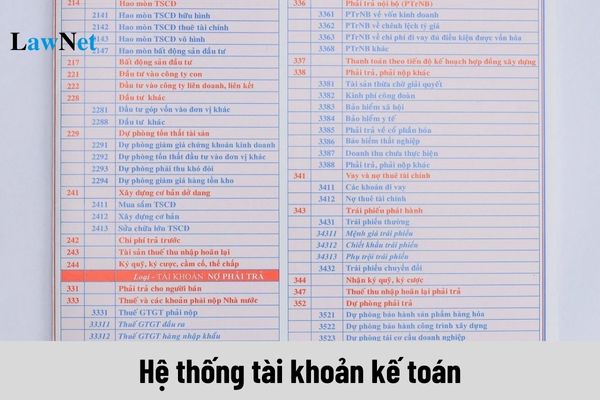

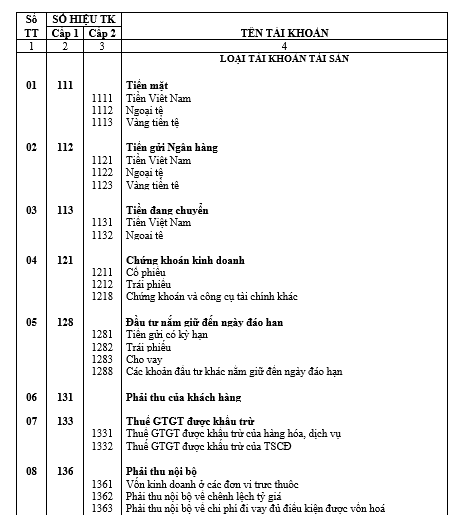

The current Vietnamese enterprise accounting account system is issued together with Circular 200/2014/TT-BTC.

The accounting account system table under Circular 200 is provided in Appendix 1 issued together with Circular 200/2014/TT-BTC, which currently includes 76 level-1 accounts and no off-balance-sheet accounts.

View the Accounting Account System according to Circular 200: here

Vietnam: How many types of accounting accounts are there according to Circular 200/2014? (Image from the Internet)

How are level-1 accounting accounts designated?

Based on the accounting account system table under Circular 200, provided in Appendix 1 issued together with Circular 200/2014/TT-BTC.

Level-1 accounts are aggregate accounts reflecting subjects in a generalized form.

Level-1 accounts are designated by 3-digit codes, as follows:

Example: Account 111 - Cash; Account 131 - Receivables from Customers

What are regulations on selection of monetary unit in accounting in Vietnam?

According to Article 4 of Circular 200/2014/TT-BTC, the selection of monetary units in accounting is clarified as follows:

- The enterprise primarily conducting transactions in foreign currency, based on the provisions of the Law on Accounting, considers and decides on the selection of monetary units in accounting and is responsible for that decision before the law. Upon selecting monetary units in accounting, the enterprise must notify the directly managing tax authority.

- The monetary unit in accounting is the monetary unit:

+ Mainly used in the sales transactions and service provision of the unit, significantly affecting the goods sale price and service provision and often is the monetary unit used for listing sale prices and payment; and

+ Mainly used in purchasing goods and services, significantly affecting labor costs, raw materials, and other production and business expenses, and is commonly the monetary unit used to pay for those costs.

- The following factors are also considered and provide evidence for the monetary unit in the unit's accounting:

+ The monetary unit used to mobilize financial resources (such as issuing shares, bonds);

+ The monetary unit regularly earned from business activities and is accumulated.

- The monetary unit in accounting reflects transactions, events, and conditions related to the unit's activities. Once the monetary unit in accounting is determined, the unit must not change it unless there is a significant change in those transactions, events, and conditions.

What are the principles for cash accounting in Vietnam?

According to Article 11 of Circular 200/2014/TT-BTC, the principles for cash accounting are outlined as follows:

Principles for Cash Accounting

1. Accounting must open a ledger to record daily and continuously in order of occurrence the receipts, expenditures, inflows, outflows of cash, and foreign currency, and calculate the remaining balance in the fund and each bank account at all times to facilitate checking and reconciliation.

2. Money deposited by other enterprises and individuals as deposits or pledges at the enterprise is managed and accounted for as the enterprise's money.

3. Receipts and expenditures must have receipts and payment vouchers and have sufficient signatures as stipulated by accounting document policies.

4. Accounting must keep detailed follow-up of cash in the original currency. When transactions occur in foreign currency, accounting must convert foreign currency into Vietnamese Dong based on the principle:

- Debit side of cash accounts applies the actual transaction exchange rate;

- Credit side of cash accounts applies the weighted average book rate.

5. At the time of preparing financial statements as per legal regulations, the enterprise must reevaluate the balance of foreign currency and monetary gold based on the actual transaction exchange rate.

Accountants must ensure the implementation of the following principles:

- Accounting must open a ledger to record daily and continuously in order of occurrence the receipts, expenditures, inflows, outflows of cash, and foreign currency, and calculate the remaining balance in the fund and each bank account at all times to facilitate checking and reconciliation.

- Money deposited by other enterprises and individuals as deposits or pledges at the enterprise is managed and accounted for as the enterprise's money.

- Receipts and expenditures must have receipts and payment vouchers and have sufficient signatures as stipulated by accounting document policies.

- Accounting must keep detailed follow-up of cash in the original currency. When transactions occur in foreign currency, accounting must convert foreign currency into Vietnamese Dong based on the principles:

+ Debit side of cash accounts applies the actual transaction exchange rate;

+ Credit side of cash accounts applies the weighted average book rate.

- At the time of preparing financial statements as per legal regulations, the enterprise must reevaluate the balance of foreign currency and monetary gold based on the actual transaction exchange rate.