Shall the tax authority disclose the taxpayer information after the TIN deactivation in Vietnam?

Shall the tax authority disclose the taxpayer information after the TIN deactivation in Vietnam?

Based on Article 22 of Circular 105/2020/TT-BTC regarding the public disclosure of tax registration of taxpayers:

Public disclosure of tax registration of taxpayers

1. The tax authority shall publicly disclose tax registration of taxpayers on the General Department of Taxation's electronic portal in the following cases:

a) The taxpayer ceases operation and has completed the deactivation procedures of the TIN (status 01).

b) The taxpayer ceases operation and has not completed the deactivation procedures of the TIN (status 03).

c) The taxpayer temporarily suspends operations or business (status 05).

d) The taxpayer is not operating at the registered address (status 06).

dd) The taxpayer reactivates the TIN according to the Notice form No. 19/TB-DKT issued with this Circular.

e) The taxpayer violates the law regarding taxpayer registration.

Thus, if a taxpayer has completed the deactivation procedures of their TIN (status 01), the tax authority will publicly disclose the taxpayer's registration information on the General Department of Taxation's electronic portal.

Regarding the content, form, and timing of public disclosure of tax registration of taxpayers (Clause 2, Article 22 of Circular 105/2020/TT-BTC)

Regarding content disclosure:

- The information listed in the Notice regarding the deactivation of the taxpayer's TIN;- Notice regarding the taxpayer ceasing operations and in the process of terminating the TIN;- Notice regarding the taxpayer not operating at the registered address.

Regarding the form of disclosure: Publishing on the General Department of Taxation's electronic portal.

Regarding the timing of disclosure: No later than 01 (one) working day from the date the tax authority issues the Notice or updates the TIN status following the decision or notice of another competent state authority.

Regarding the authority to disclose information (Clause 3, Article 22 of Circular 105/2020/TT-BTC)

The tax authority directly managing the taxpayer is responsible for the public disclosure of taxpayer information.

Before disclosing taxpayer information, the directly managing tax authority must conduct a review and comparison to ensure the accuracy of the disclosed information.

In cases where the publicly disclosed information is inaccurate, the tax authority shall make corrections and must publicly disclose the corrected content following the disclosure form.

Can tax authorities disclose information of taxpayers who delay paying taxes in Vietnam? (Image from the Internet)

Can tax authorities disclose information of taxpayers who delay paying taxes in Vietnam?

According to Article 100 of the Law on Tax Administration 2019 which regulates the public disclosure of taxpayer information as follows:

Public Disclosure of Taxpayer Information

1. tax administration authorities are permitted to publicly disclose taxpayer information in the following cases:

a) Tax evasion, delay in paying taxes and other revenues to the state budget on time; tax debts and other revenues to the state budget;

b) Violations of tax law that affect the tax rights and obligations of other organizations and individuals;

c) Non-compliance with requests from tax administration authorities according to the law.

Thus, if taxpayers delay paying taxes, tax administration authorities are allowed to publicly disclose their information.

What are the principles of tax administration in Vietnam?

Based on Article 5 of the Law on Tax Administration 2019 regarding the principles of tax administration:

Principle 1. All organizations, households, business households, and individuals have the obligation to pay taxes as prescribed by law.

Principle 2. tax administration authorities and other state agencies assigned the task of revenue management shall perform tax administration according to the provisions of this Law and other relevant legal provisions, ensuring openness, transparency, equality, and safeguarding the legitimate rights and interests of taxpayers.

Principle 3. Agencies, organizations, and individuals have the responsibility to participate in tax administration according to the law.

Principle 4. Implement administrative procedure reform and apply modern information technology in tax administration; apply international tax administration principles, including the principle that the nature of activities and transactions decides tax obligations, the risk management principle in tax administration, and other principles suitable to Vietnam's conditions.

Principle 5. Apply preferential measures in tax procedures for exported and imported goods according to the laws on customs and regulations of the Government of Vietnam.

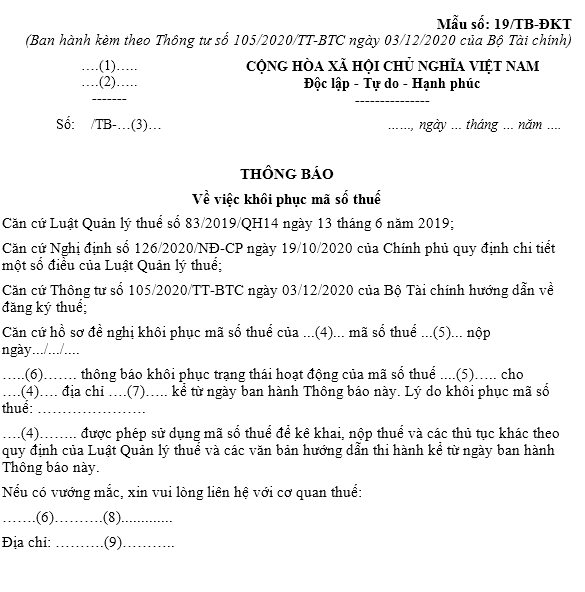

What is the form No. 19/TB-DKT notification on the TIN reactivation by the tax authority in Vietnam?

The notification form regarding the TIN reactivation by the tax authority is Form No. 19/TB-DKT issued with Circular 105/2020/TT-BTC as follows:

Download the notification form on the TIN reactivation by the tax authority.