Shall a taxpayer report invoice usage after their TIN is reactivated in Vietnam?

Shall a taxpayer report invoice usage after their TIN is reactivated in Vietnam?

Based on the provisions in Clause 4, Article 6 of Decree 126/2020/ND-CP, it is regulated as follows:

Tax Registration

The taxpayer shall perform the taxpayer registration procedure according to the provisions in Articles 30, 31, 32, 33, 34, 35, 36, 38, 39, 40, 41 of the Law on Tax Administration and the following regulations:

1. Structure of TIN

a) A 10-digit TIN is used for enterprises, organizations with legal status or organizations without legal status but directly incurring tax obligations; representatives of households, business households, and other individuals.

b) A 13-digit TIN and other characters are used for dependent units and other subjects.

2. Taxpayers perform changes in information taxpayer registration according to the provisions in Clauses 2 and 3, Article 36 of the Law on Tax Administration with the directly managing tax authority. Taxpayers who are individuals, when changing information regarding their identity card, citizen ID card, or passport, the date of change of information shall be 20 days (for highland districts, border, and island districts, it is 30 days) from the date recorded on the identity card, citizen ID card, or passport.

...

Thus, based on the above regulations, after a taxpayer's TIN is reactivated, they must report the usage status of any missing invoices.

Shall a taxpayer report invoice usage after their TIN is reactivated in Vietnam? (Image from the Internet)

What are procedures for handling the TIN reactivation application by the tax authority in Vietnam?

Based on the provisions in Clause 1, Article 19 of Circular 105/2020/TT-BTC regarding handling the TIN reactivation application and returning the results, the handling of the file by the tax authority is specifically regulated as follows:

For the taxpayer's file: The tax authority receives, processes the TIN reactivation application, and returns the result to the taxpayer according to the regulations in Articles 40 and 41 of the Law on Tax Administration 2019 and Clause 4, Article 6 of Decree 126/2020/ND-CP as follows:

- Within 03 (three) working days from the date of receiving the complete file for reactivating the taxpayer's TIN for cases regulated at Point a, Clause 1, Article 18 of Circular 105/2020/TT-BTC, the tax authority shall:

+ Issue a Notification regarding the reactivatement of the TIN using form 19/TB-DKT, Notification on the reactivatement of the TIN according to the managing unit form 37/TB-DKT (if applicable) as issued with Circular 105/2020/TT-BTC to send to the taxpayer or dependent unit (if the reactivated TIN belongs to the managing unit).

+ Reprint the taxpayer registration certificate or TIN notification for the taxpayer in case the taxpayer submitted the original to the tax authority per the TIN deactivation file.

+ Update the status of the taxpayer's TIN on the taxpayer registration application system on the same working day or at the latest by the beginning of the next working day from the date of issuing the Notification on reactivating the TIN.

- Within 10 (ten) working days from receiving the complete TIN reactivatement file from the taxpayer for cases regulated at Point b, Clause 1, Article 18 of Circular 105/2020/TT-BTC,

The tax authority compiles a list of missing tax declaration files, invoice usage status, the amount of tax, and other funds payable or owed to the state budget and imposes penalties for any violations of tax and invoice laws up to the time the taxpayer submits the TIN reactivatement request file according to regulations,

Simultaneously conducts actual verification at the business address of the taxpayer and prepares a Verification Record of the taxpayer's operational status at the registered address using form 15/BB-BKD as issued with this Circular according to the taxpayer's TIN reactivatement request file (the taxpayer must sign the verification record).

Within 03 (three) working days from the date the taxpayer fully complies with administrative violations related to tax and invoices, pays the full amount of tax and other funds to the state budget payable or owed (except for certain cases not required to clear tax debts and other collections to the state budget under Clause 4, Article 6 of Decree 126/2020/ND-CP, the tax authority shall:

+ Issue a Notification regarding the reactivatement of the TIN for the taxpayer using form 19/TB-DKT, Notification on the reactivatement of the TIN according to the managing unit form 37/TB-DKT (if applicable) as issued with this Circular, sent to the taxpayer, dependent unit (if the reactivated TIN is for the managing unit).

+ Reprint the taxpayer registration certificate or TIN notification for the taxpayer in case the taxpayer submitted the original to the tax authority per the TIN deactivation file.

+ Update the status of the taxpayer's TIN on the taxpayer registration application system on the same working day or at the latest by the beginning of the next working day from the date of issuing the Notification on reactivating the TIN.

The tax authority publicly announces the Notification on the reactivatement of the TIN on the General Department of Taxation's electronic portal according to Article 22 of Circular 105/2020/TT-BTC.

Relevant state management agencies in the area (including customs authorities, business registration authorities, except where they have coordinated business registration and taxpayer registration), the Prosecutors, police department, market management authority, licensing authorities for establishment and operation, and other organizations and individuals are responsible for searching the information and status of the taxpayer's TIN as published by the tax authority to fulfill their state management duties and other relevant content.

- Within 10 (ten) working days from receiving the complete TIN reactivatement file from the taxpayer for cases regulated at Points c, d Clause 1, Article 18 of Circular 105/2020/TT-BTC, the tax authority compiles a list of missing tax declaration files, invoice usage status, the amount of tax, and other payments due to the state budget, owed or unpaid, and imposes penalties for any violations of tax and invoice laws to the time the taxpayer submits the TIN reactivatement request file according to regulations.

Within 03 (three) working days from the date the taxpayer fully complies with administrative violations related to tax and invoices, pays the full amount of tax and other payments required to the state budget or owed (except for certain cases where it is not required to clear tax debts and other budgetary allocations according to Clause 4, Article 6 of Decree 126/2020/ND-CP, the tax authority shall:

+ Issue a Notification regarding the reactivatement of the TIN for the taxpayer using form 19/TB-DKT, Notification on the reactivatement of the TIN according to the managing unit form 37/TB-DKT (if applicable) as issued with this Circular, sent to the taxpayer, dependent unit (if reactivated TIN belongs to the managing unit).

+ Reprint the taxpayer registration certificate or TIN notification for the taxpayer in case the taxpayer submitted the original to the tax authority per the TIN deactivation file.

- Update the status of the taxpayer's TIN on the taxpayer registration application system on the same working day or at the latest by the beginning of the next working day from the date of issuing the Notification on reactivating the TIN.

- In cases where the taxpayer submits an incomplete TIN reactivatement file or does not fall under cases eligible to reactivate the TIN under Clause 1, Article 18 of Circular 105/2020/TT-BTC, the tax authority issues a Notification on the non-reactivatement of the TIN using form 38/TB-DKT as issued with Circular 105/2020/TT-BTC sent to the taxpayer.

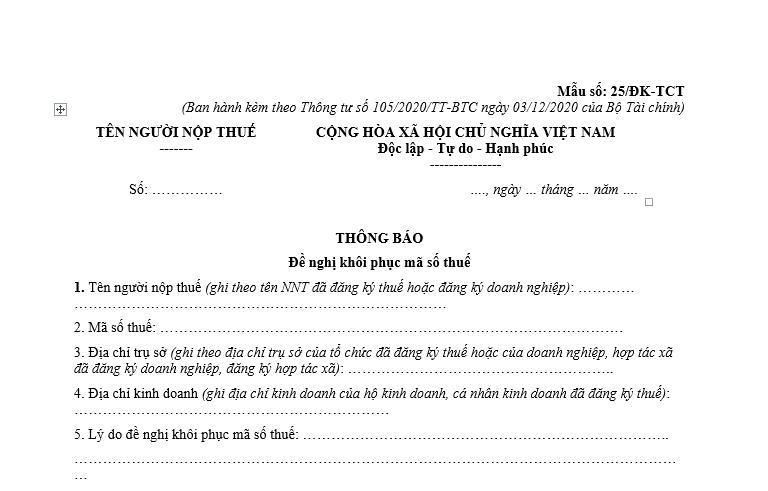

Download the form for requesting the reactivatement of the TIN Form No. 25/DK-TCT 2024?

Pursuant to Appendix II issued with Circular 105/2020/TT-BTC a form for requesting the reactivatement of the TIN is provided as Form No. 25/DK-TCT 2024 as follows:

Download the current TIN reactivation application form here: Here