Shall a person declared dead by the court eligible for tax chargeoff in Vietnam?

Shall a person declared dead by the court eligible for tax chargeoff in Vietnam?

Cases eligible for tax chargeoff are stipulated in Article 83 of the Law on Tax Administration 2019. Specifically:

Cases Eligible for tax chargeoff

1. The taxpayer has died, or has been declared dead, missing, or incapacitated by a court.

The suspension period commences from the date of issuance of the death certificate, notice of death, or any document in lieu of a notice of death as per civil status laws, or from the date of the court's decision declaring a person deceased, missing, or incapacitated.

2. The taxpayer has submitted a dissolution decision to the tax authority and business registration agency to proceed with dissolution. The business registration agency has announced that the taxpayer is undergoing dissolution procedures on the national business registration information system, but the taxpayer has not yet completed the dissolution process.

The suspension period commences from the date the business registration agency announces the taxpayer's dissolution process on the national business registration information system.

3. The taxpayer has filed a petition to initiate bankruptcy proceedings or has had such a petition filed against them by a creditor or related party as per bankruptcy law.

...

Accordingly, under the above stipulations, a person declared dead by the court falls under one of the cases eligible for tax chargeoff.

Shall a person declared dead by the court eligible for tax chargeoff in Vietnam? (Image from the Internet)

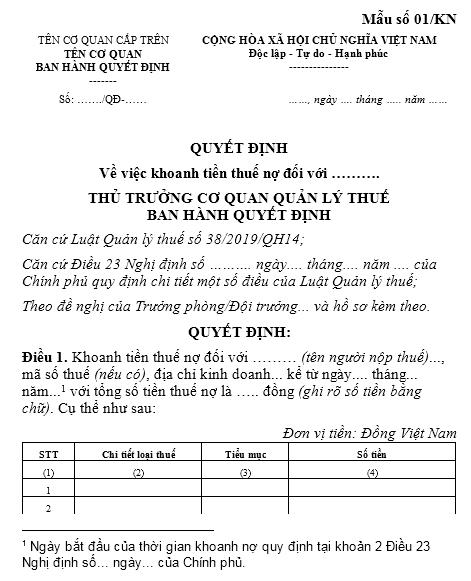

What is the decision form for tax chargeoff when a taxpayer is dead in Vietnam?

The decision form for tax chargeoff when a taxpayer is dead is implemented in accordance with Form No. 01/KN in Appendix 3 issued with Decree 126/2020/ND-CP. Specifically:

Download the decision form for tax chargeoff when a taxpayer is dead

How to determine the chargeoff date in Vietnam?

According to Clause 2, Article 23 of Decree 126/2020/ND-CP, the chargeoff date is stipulated as follows:

- For taxpayers specified in Clause 1, Article 83 of the Law on Tax Administration 2019, the suspension period is calculated from the date of issuance of a death certificate, notice of death, or equivalent document following civil status law, or from the date of the court's decision declaring a person deceased, missing, or incapacitated, until the court revokes the declaration or the debt is written off according to legal provisions.

- For taxpayers specified in Clause 2, Article 83, the suspension period commences from the date the business registration agency publishes information about the taxpayer undergoing dissolution procedures on the national business registration information system until the taxpayer resumes business activities, completes dissolution procedures, or their debt is written off according to legal provisions.

- For taxpayers specified in Clause 3, Article 83, the suspension period begins from the date the competent court announces the acceptance of the bankruptcy request, or from when the taxpayer submits bankruptcy firm documentation to the tax authority, but the period is still under debt settlement as per Bankruptcy Law 2014, until the taxpayer resumes business activities or their debt is written off as per regulations.

In the case where the competent court has announced the acceptance of a bankruptcy petition, the taxpayer is eligible for a debt suspension for the outstanding tax as of the time the court accepts the bankruptcy request.

- For taxpayers specified in Clause 4, Article 83, the suspension period is calculated from the date the tax authority issues a nationwide notice about the taxpayer or their legal representative not being present at the registered business or contact address with the tax authority until the taxpayer resumes business activities or their debt is written off as per regulations.

- For taxpayers specified in Clause 5, Article 83, the suspension period is calculated from the date the tax authority requests the competent authority to revoke, or from the effective date of the decision to revoke, the business registration certificate, enterprise registration certificate, cooperative registration certificate, household business registration certificate, operating license, practice license, or branch or representative office registration certificate, until the taxpayer resumes business activities or their debt is written off as per regulations.