What is the newest application for cancellation of customs declaration in Vietnam?

What is the definition of customs declaration in Vietnam?

Under Clause 8, Article 3 of the Law on Tax Administration 2019, the definition of customs declaration is prescribed as follows:

Article 3. Definitions

In this Law, the undermentioned terms shall be defined as follows:

1. “tax” means a compulsory amount payable to the state budget by organizations, households, household businesses, individuals as prescribed by tax laws.

2. Other amounts payable to the state budget collected by tax authorities include:

a) Fees and charges prescribed in the Law on Fees and charges;

b) Land levies payable to the state budget;

c) Rents for land and water surface;

d) Payment for the mining permit;

dd) Payment for the water resources exploitation permit;

e) Amounts payable to the state budget derived from revenue from sale of property on lands, transfer of land use rights as prescribed in the Law on Management and use of public property;

g) Fines for administrative tax offences and customs offences;

h) Late payment interest and other revenues as prescribed by law.

...

8. “customs declaration” means a document stipulated by the Minister of Finance and used as a tax return for imported or exported goods.

9. “tax dossier” is either an application for taxpayer registration, tax declaration, tax refund, tax exemption, tax reduction, late payment interest exemption, late payment interest cancellation, extension of tax payment deadline, tax payment by installments, tax cancellation; customs dossier; application for tax debt freezing; application for cancellation of tax debts, late payment interest, penalties.

10. “Tax statement” means the calculation of tax accrued in a tax year or over the period from the beginning of a tax year to the termination of taxable activities, or over the period during which taxable activities occur as prescribed by law.

11. “Tax year” is determined based on the Gregorian calendar, from January 01 to December 31; in case the fiscal year is different from the Gregorian year, the tax year will be the fiscal year.

...

Thus, “customs declaration” means a document stipulated by the Minister of Finance and used as a tax return for imported or exported goods.

According to Circular 38/2015/TT-BTC, customs declarations include two forms for exports and imports: Form HQ/2015/XK and Form HQ/2015/NK:

Form HQ/2015/XK prescribed in Appendix 5 issued together with Circular 38/2015/TT-BTC: DOWNLOAD

Form HQ/2015/NK prescribed in Appendix 4 issued together with Circular 38/2015/TT-BTC: DOWNLOAD

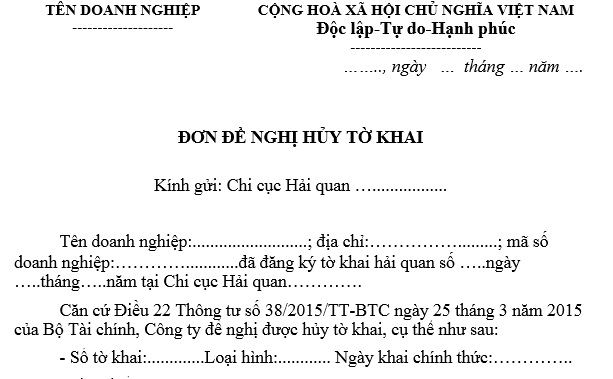

What is the newest application for cancellation of customs declaration in Vietnam? (Image from the Internet)

What is the newest application for cancellation of customs declaration in Vietnam?

Currently, the newest application for cancellation of customs declaration in Vietnam is Form No. 04/HTK/GSQL in Appendix 5 issued together with Circular 38/2015/TT-BTC (amended and supplemented in Appendix 2 issued together with Circular 39/2018/TT-BTC):

Form No. 04/HTK/GSQL: DOWNLOAD

What are the cases where customs declarations are canceled upon request by the customs declarant in Vietnam?

Under Point d, Clause 1, Article 22 of Circular 38/2015/TT-BTC amended by Clause 11, Article 1 of Circular 39/2018/TT-BTC regarding cases of customs declaration cancellation:

(1) The export procedures have been completed and goods have been taken into the CCA but the declarant wishes to take the goods back to the domestic market for repair or recycling;

(2) The declaration of in-country export has been granted customs clearance or conditional customs clearance but the exporter or importers cancels the transaction;

(3) Cases other than those mentioned in (1) and (2) in which the export declaration has been granted customs clearance or conditional customs clearance but goods are not exported in reality;

(4) The declarant provides in correct information on the declaration according to Section 3 of Appendix II hereof, unless the import declaration has been granted customs clearance or conditional customs clearance and goods have been released from the CCA; the export declaration has been granted customs clearance or conditional customs clearance and the goods have been exported in reality.

Additionally, customs declarations are canceled if they are no longer valid for customs procedures in the following cases:

- The imports do not arrive at the checkpoint of import within 15 days from the day on which the import declaration is registered;

- The exports are exempt from document inspection and physical inspection but have not entered the CCA at the checkpoint of export within 15 days from the day on which the export declaration is registered;

- The exports have to undergo document inspection but the declarant has not submitted the customs dossier, or customs procedures have been completed but the goods have are not taken into the CCA at the checkpoint of export within 15 days from the day on which the export declaration is registered;

- The exports have to undergo physical inspection but the declarant fails submit documents and present goods to the customs authority for inspection within 15 days from the day on which the export declaration is registered;

- The customs declaration has been registered and the goods are subject to licensing by a competent authority but such a license is not available when the declaration is registered.