Ministry of Finance of Vietnam provides guidelines on implementing the total stocktaking of public property under the Official Dispatch 1818? What is the e-invoice form for selling public property in 2025?

Ministry of Finance of Vietnam provides guidelines on implementing the total stocktaking of public property under the Official Dispatch 1818

On February 17, 2025, the Ministry of Finance issued Official Dispatch 1818/BTC-QLCS in 2025 regarding the implementation of the total stocktaking of public property at agencies, organizations, units, and infrastructure assets invested and managed by the State.

>> See detailed guidance on implementing the total stocktaking of public property according to Official Dispatch 1818 here

According to Official Dispatch 1818/BTC-QLCS in 2025, to ensure the implementation of the comprehensive inventory on schedule as approved by the Prime Minister of the Government of Vietnam, the Ministry of Finance requests that ministries, central agencies, and provincial People's Committees direct the implementation as follows:

- Agencies, organizations, units, businesses managing and using the assets:

+ Register inventory subjects for assigned/temporarily managed asset types on the Comprehensive public property Inventory Software, to be completed by February 20, 2025 (Guidance on registering inventory subjects as per Appendix 1 – attached to Official Dispatch 1818/BTC-QLCS in 2025).

+ Establish the Inventory Team of the agency, organization, unit, enterprise, and conduct a physical count of assets at the inventory time; compare and verify with tracking data, entries in accounting records, to be completed by March 31, 2025.

+ Update comprehensive inventory data results on the Comprehensive public property Inventory Software and send the Comprehensive Inventory Result Report on the Comprehensive public property Inventory Software, to be completed by March 31, 2025, and send a paper copy of the Comprehensive Inventory Result Report to the directly managing superior agency.

- Superior management agencies (compiling unit) should check the logic and accuracy of reports submitted by agencies, organizations, and units within their management scope, approve reports on the Comprehensive public property Inventory Software, and prepare a composite report (paper copy) to send to the superior management agency immediately after all agencies, organizations, units, businesses under their management scope have completed the comprehensive inventory, submitted reports, and completed report approval.

- Assign specialized agencies of the Ministry, central agencies, Finance Departments, and specialized provincial agencies, as well as district-level People's Committees, to regularly urge, inspect, and directly inventory, and compile inventory data of agencies, organizations, and units within their management scope.

- Ministries, central agencies, and provincial People's Committees send reports on comprehensive inventory results of ministries, central agencies, local administrations (paper copy) according to the format (in Appendix 2 – attached to Official Dispatch 1818/BTC-QLCS in 2025) to the Ministry of Finance for general compilation to be completed before June 15, 2025.

Note: The timeline for conducting the total stocktaking of public property is as follows:

(1) Complete the comprehensive inventory: Before March 31, 2025;

(2) Ministries, central authorities, and local authorities report to the Ministry of Finance: Before June 15, 2025;

(3) The Ministry of Finance reports to the Government of Vietnam, the Prime Minister: Before July 31, 2025.

Ministry of Finance of Vietnam provides guidelines on implementing the total stocktaking of public property under the Official Dispatch 1818? What is the e-invoice form for selling public property in 2025? (Image from the Internet)

What is the e-invoice form for selling public property in Vietnam in 2025?

According to Clause 2, Article 95 of Decree 151/2017/ND-CP amended by Clause 60, Article 1 of Decree 114/2024/ND-CP which regulates the invoice template for selling public property as follows:

Invoice for Selling public property

...

- e- Invoice for Selling public property:

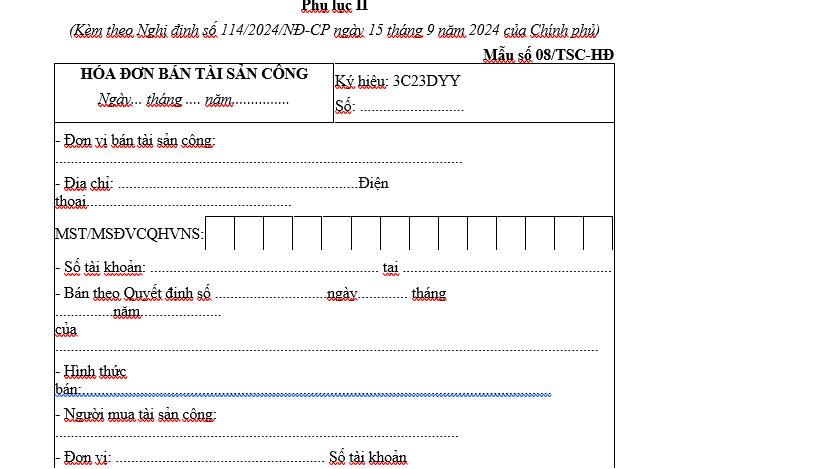

a) The e-invoice form for selling public property follows Template No. 08/TSC-HD issued with this Decree.

...

Thus, the e-invoice form for selling public property is Template No. 08/TSC-HD issued alongside Decree 114/2024/ND-CP.

Template No. 08/TSC-HD is as follows:

Download Template 08/TSC-HD: e- invoice for selling public property

What is the guidance on registering to use e-invoices for selling public property in 2025?

Based on Official Dispatch 14590/BTC-QLCS in 2024 of the Ministry of Finance about the guidance on registering to use e- invoices for selling public property and destroying unused paper public property sales invoices, the registration is carried out as follows:

(1) Agencies, organizations, or units using public property (hereinafter referred to as units) not yet issued a Tax Code should contact the provincial tax authority (where the headquarters is located) to obtain a Tax Code.

(2) The registration for new, change of registered content, and use of public property sales invoices on the General Department of Taxation’s e- invoice portal "https://hoadondientu.gdt.gov.vn" is conducted following Decree 123/2020/ND-CP. To register for using e- Invoices for Selling public property, the unit registering to use the invoices must have a digital certificate.

(3) Before January 31, 2025, ministries, central agencies, and local administrations compile a list to register for using the public property Sales Invoice on the General Department of Taxation’s e- Invoice Portal. Specifically:

- Step 1: Financial agencies of Ministries, ministerial-level agencies, Government of Vietnam agencies, other central agencies compile lists of units under their management registering for service use; Finance Departments of provinces and centrally-run cities compile lists of units registering for local management service use.

- Step 2: Send the registration list to the provincial tax authority (where the asset-used unit is headquartered). Information sent to the tax authority includes: (i) Unit name; (ii) Tax Code; (iii) Budget relationship code.

+ If units are already using e- invoice services, they do not need to re-register. They should update registration content to include “public property Sales Invoice” per regulations.

+ After March 31, 2025, if ministries, central agencies, or local administrations have not submitted registration lists as guided, units execute per section (2) above.

(4) Provincial People’s Committees direct Finance Departments to:

- Destroy unused public property sales invoices remaining until December 31, 2024; deadline: before January 31, 2025.

- The destruction of paper-based public property Sales Invoices is conducted following procedures stipulated in Article 27 of Decree 123/2020/ND-CP.

- Notify the result of invoice destruction to the Ministry of Finance (public property Management Department) within 05 working days from the date of performing invoice destruction.

- Report the management and use situation of public property Sales Invoices by December 31, 2024, to the Ministry of Finance (public property Management Department) before January 31, 2025.