Is the taxpayer entitled to a refund of paid import duty if the imported goods must be temporarily exported to Vietnam?

Is the taxpayer entitled to a refund of paid import duty if the imported goods must be temporarily exported to Vietnam?

The refund of import duties for goods that need to be re-exported is stipulated in Clause 1, Article 19 of the Law on Export and Import Duties 2016 as follows:

Tax Refund

1. Cases eligible for tax refund:

a) The taxpayer has paid import duty, export duty but does not have imported or exported goods, or the imported, exported goods are less than those for which tax has been paid;

b) The taxpayer has paid export duty but goods need to be temporarily exported, thus refunded export duty and exempted from paying import duty;

c) The taxpayer has paid import duty but goods need to be re-exported, thus refunded import duty and exempted from paying export duty;

d) The taxpayer has paid tax for imported goods to produce, but has converted them to export products and has already exported the products;

...

Accordingly, should the taxpayer have paid export duty, a refund of the paid import duty is granted for the consignment that needs re-importation. Additionally, no export duty is required for re-importing that consignment.

Is the taxpayer entitled to a refund of paid import duty if the imported goods must be temporarily exported to Vietnam? (Image from the Internet)

When can imported goods that need to be temporarily exported receive a tax refund in Vietnam?

Re-export of imported goods is stipulated in Clause 2, Article 19 of the Law on Export and Import Duties 2016 as follows:

Tax Refund

1. Cases eligible for tax refund:

...

c) The taxpayer has paid import duty but goods need to be re-exported, thus refunded import duty and exempted from paying export duty;

...

d) The taxpayer has paid tax for machinery, equipment, tools, transport vehicles of organizations, individuals allowed temporary import for re-export, excluding those rented for investment projects, construction, installation, when they are re-exported abroad or to non-tariff zones.

The refundable import duty is determined based on the remaining usage value of the goods upon re-export according to the usage duration and retention time in Vietnam. If the goods have no remaining usage value, a refund is not applicable.

No tax refund shall be granted if the refundable amount is below the minimum level as prescribed by the Government.

2. Goods specified in points a, b, and c of Clause 1 of this Article are eligible for tax refund when they have not gone through any usage, processing, or transformation.

3. Tax refund procedures are implemented according to the law on tax management.

Thus, under the regulations, for imported goods that must be temporarily exported, taxpayers are only eligible for a refund of the paid import duty if the goods have not undergone usage, processing, or transformation.

What are the provisions regarding tax exemption for temporarily exported goods within a specific time frame?

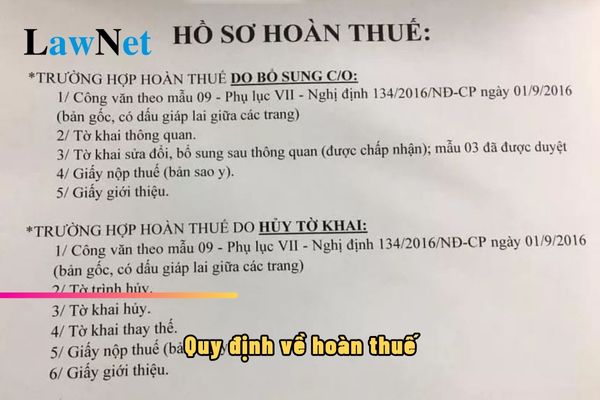

Pursuant to Article 13 of Decree 134/2016/ND-CP, tax exemption for temporarily exported goods within a specific duration is outlined as follows:

- Goods temporarily imported for re-export or temporarily exported for re-import within a specific timeframe are eligible for tax exemption as prescribed in Clause 9, Article 16 of the Law on Export and Import Duties 2016.

- Goods temporarily imported for re-export or temporarily exported for re-import for warranty, repair, or replacement as prescribed in Point c, Clause 9, Article 16 of the Law on Export and Import Duties 2016 must ensure no alteration of shape, function, or basic characteristics of the temporarily imported or exported goods and must not result in the creation of other goods.

In the event of replacing goods under warranty conditions of a purchase contract, the substitute goods must ensure conformity with the shape, function, and basic characteristics of the goods being replaced.

- Circulating vehicles under temporary import for re-export or temporary export for re-import to contain exported and imported goods include:

+ Empty containers with or without hangers;

+ Liner sacks in containers for holding liquid goods;

+ Other multiple-use means for containing exported or imported goods.

- Tax exemption dossiers and procedures are carried out as regulated in Article 31 of Decree 134/2016/ND-CP.

For goods temporarily imported for re-export for business, the taxpayer must provide an additional letter of guarantee from a credit institution or a deposit receipt to the deposit account of the customs authority at the State Treasury: 1 original for cases where the letter of guarantee has not been updated into the electronic customs data processing system.

The guarantee or deposit of import duty for goods temporarily imported for re-export for business is executed according to regulations in Article 4 of Decree 134/2016/ND-CP.