Is it required to pay registration fee when purchasing an apartment in Vietnam?

Is it required to pay registration fee when purchasing an apartment in Vietnam?

Pursuant to Clause 1, Article 3 of Decree 10/2022/ND-CP, which stipulates the subjects liable to registration fee, include:

Subjects Liable to Registration Fee

1. Houses, land.

- Hunting guns; guns used for training, sports competitions.

- Ships as prescribed by the laws on inland waterway traffic and maritime law (hereinafter referred to as watercraft), including barges, canoes, tugboats, push boats, submarines, and submersibles; except floating docks, storage buoys, and mobile platforms.

- Boats, including yachts.

- Aircraft.

- Two-wheeled motorbikes, three-wheeled motorbikes, mopeds, other vehicles similar to motorbikes and mopeds that are required to be registered and have a state-issued license plate (hereinafter collectively referred to as motor vehicles).

- Cars, trailers or semi-trailers pulled by cars, vehicles similar to cars required to be registered and have a state-issued license plate.

- Hulls, core frames, core engines, engine blocks of assets specified in Clauses 3, 4, 5, 6, and 7 of this Article, which are replaced and must be registered with the competent state authority.

The Ministry of Finance details this Article.

Additionally, pursuant to the regulation in Clause 1, Article 2 of Circular 13/2022/TT-BTC, which specifies the following:

Subjects Liable to Registration Fee

The subjects liable to registration fee shall follow Article 3 of Decree 10/2022/ND-CP. Some details are specified as follows:

1. Houses, land as stipulated in Clause 1, Article 3 of Decree 10/2022/ND-CP

a) Houses, including: residential houses; office buildings; houses used for other purposes.

b) Land, includes: types of agricultural land and non-agricultural land as per the Land Law (regardless of whether structures are built upon it or not).

...

The subject liable for registration fee includes houses, encompassing residential houses, office buildings, and houses for other purposes. Hence, currently, when purchasing an apartment, it is required to pay the registration fee.

Is it required to pay registration fee when purchasing an apartment in Vietnam? (Image from the Internet)

What is the current registration fee rate for apartments in Vietnam?

According to Clause 1, Article 8 of Decree 10/2022/ND-CP which specifies the fee collection rate as follows:

Registration Fee Rate by Percentage (%)

- Houses, land: The fee is 0.5%.

- Hunting guns; guns used for training, and sports competitions: The fee is 2%.

- Watercraft, including barges, canoes, tugboats, push boats, submarines, and submersibles; boats, including yachts; aircraft: The fee is 1%.

...

Thus, the current registration fee rate for apartment buildings is 0.5%.

What is the formula for calculating the registration fee when buying and selling an apartment in Vietnam?

Based on Article 6, Point c, Clause 1, Article 7 of Decree 10/2022/ND-CP and Point b, Clause 1, Article 3 of Circular 13/2022/TT-BTC, the formula for calculating the registration fee when buying and selling an apartment is as follows:

(1) In the case where the apartment price on the sale contract is higher than the price issued by the People's Committee at the provincial level (provinces and centrally run cities):

registration fee payable = 0.5% x Transfer price in the contract

Example: Mr. A sells to Mr. B an apartment of 70m2 for 2 billion VND, the registration fee Mr. B has to pay in this case is 10 million VND (0.5% x 2 billion VND).

(2) In the case where the apartment price on the sale contract is lower than or equal to the price issued by the People's Committee at the provincial level:

registration fee payable = 0.5% x Valuation for registration fee according to government price

In which, the valuation for the registration fee according to government price includes:

- Valuation for registration fee for the apartment:

Value of the apartment for the registration fee (in VND) = Area x Price per m2 x Remaining quality percentage (if it is an old apartment)

- Valuation for registration fee for the land part used for apartment construction allocated:

Valuation for the registration fee = Land price in the land price table issued by the People's Committee at the provincial level x Allocation coefficient

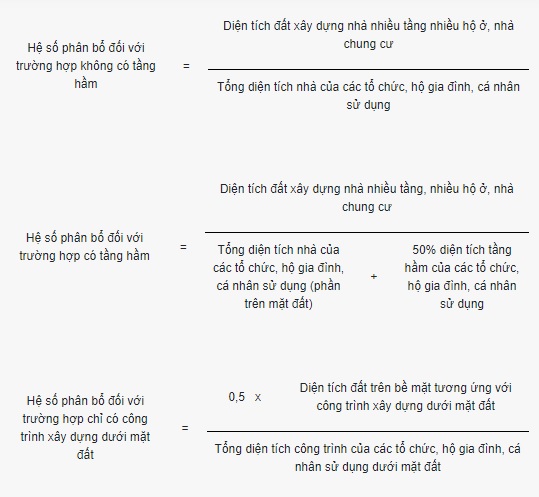

According to Clause 2, Article 4 of Decree 53/2011/ND-CP, the allocation coefficient is determined for each case as follows:

Example: Mr. C sells Mr. D a 70m2 apartment in a 20-story building, 70 m high, with a total floor area of 14,000 m2, the building has been used for 7 years, the land area used for construction is 700m2, the total area of all apartments is 13,000m2, and the apartment building shares 3 underground floors. The apartment building is located on street X, Cau Giay District, Hanoi City.

When is the deadline for paying registration fee for apartments?

According to Clause 2, Article 10 of Decree 16/2020/ND-CP which provides the deadline for paying the registration fee specifically as follows:

Deadline for Filing Tax Declarations on Land, License Fees, Registration Fees, and Other Fees As Prescribed By the Law on the Management and Use of Public Assets

...

- Registration Fee

The deadline for filing the registration fee declaration is the same as the deadline for filing the application for the registration of ownership, the usage rights of the property with the competent state management agency (including the case processed via the one-stop shop mechanism or directly submitted at the tax authority).

...

Thus, the deadline for filing the registration fee tax declaration for apartments will also be the deadline for filing the application for the registration of ownership, usage rights of the property, which is the apartment, with the competent state management agency (including cases carried out through the interlinked one-stop mechanism or directly at the tax authority).