Is it necessary to notify the Tax Authority when issuing e-sales invoices in Vietnam? What does the e-sales invoice content include?

Is it necessary to notify the Tax Authority when issuing e-sales invoices in Vietnam?

- Pursuant to Clause 1, Article 15 of Decree 123/2020/ND-CP stipulating the registration of e-invoices as follows:

Registration, change of registered contents for using e-invoices

- Enterprises, economic organizations, other organizations, households, and individual businesses not subject to invoice usage suspension as per Clause 1, Article 16 of this Decree shall register to use e-invoices (including e-invoices for selling public assets, e-invoices for national reserve sales) through e-invoice service providers.

In cases where using e-invoices with tax authority codes without paying for the service, registration can be done through the e-portal of the General Department of Taxation or through e-invoice service providers authorized by the General Department of Taxation to provide tax code-included e-invoices free of service charge.

Enterprises that act as data transmission organizations directly connecting to the tax authority shall register to use e-invoices through the General Department of Taxation's e-portal.

Registration information content follows Form No. 01/ĐKTĐ-HĐĐT Appendix IA issued together with this Decree.

The General Department of Taxation's e-portal sends an e-notification regarding the receipt of e-invoice registration through e-invoice service providers for enterprises, economic organizations, other organizations, households, and individual businesses registering through such service providers.

Direct e-notifications following Form No. 01/TB-TNĐT Appendix IB will be sent by the General Department of Taxation’s e-portal regarding the receipt of e-invoice registration directly to enterprises, economic organizations, other organizations, households, and individual businesses via the email address registered with the tax authorities in cases of direct registration at the portal.

According to the above regulations, enterprises, economic organizations, other organizations, households, and individual businesses not subject to invoice suspension must register for e-invoice use through e-invoice service providers using Form 01/ĐKTĐ-HĐĐT.

Therefore, taxpayers currently only need to register to use e-invoices with the tax authorities and do not need to issue a notification for invoice issuance.

Is it necessary to notify the Tax Authority when issuing e-sales invoices in Vietnam? What does the e-sales invoice content include? (Image from the Internet)

Vietnam: What does the content on an e-sales invoice include?

According to Article 10 of Decree 123/2020/ND-CP, the mandatory contents on an e-sales invoice include:

- Invoice name, invoice symbol, invoice form number

- Invoice link name applicable to invoices printed by the tax authority as per the Ministry of Finance’s guidance.

- Invoice number

- Seller's name, address, tax identification number

- Buyer's name, address, tax identification number

Name, unit of measurement, quantity, unit price of goods, services; amount before value-added tax (VAT), VAT rates, total VAT amount by each tax rate, total VAT amount, total payment amount including VAT.

- Seller’s signature, buyer’s signature

- Invoice creation time as guided in Article 9 of Decree 123/2020/ND-CP and displayed in the date, month, year format of the Gregorian calendar.

- The digital signing time on the e-invoice is the time the seller or buyer uses a digital signature to sign the e-invoice, displayed in the date, month, year format of the Gregorian calendar. If the e-invoice is created with a different digital signing time from the invoicing time, the tax declaration time is the invoicing time.

- Tax authority code for e-invoices with tax authority codes as prescribed in Clause 2, Article 3 of the Decree 123/2020/ND-CP.

- State budget-related fees, discounts, promotions (if any) as guided at point e, clause 6, Article Decree 123/2020/ND-CP and other relevant content (if any).

- Name, tax identification number of the organization printing the invoice for invoices printed by the tax authority.

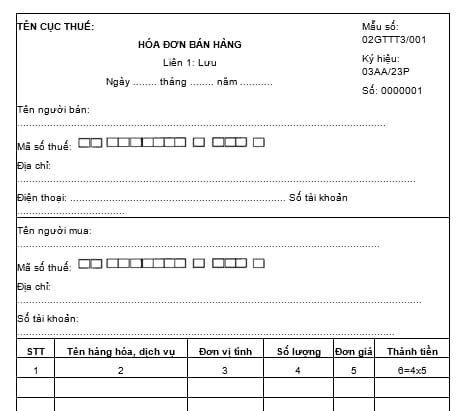

What is the e-sales invoice form in Vietnam under Circular 78 for 2024?

According to Form No. 7 in Appendix II issued with Circular 78/2021/TT-BTC, the e-sales invoice form issued by the Tax Department is:

Download the latest e-sales invoice form for 2024 here