How to use the IF function? What is the retail sales invoice form in Vietnam?

How to Use the IF Function?

The IF function in Excel and Google Sheets is used to test a condition and return one value if the condition is true, and another value if the condition is false.

Syntax: IF(condition, value_if_true, value_if_false)

- condition: The logical expression to test (e.g., A1>10).

- value_if_true: The value to return if the condition is true.

- value_if_false: The value to return if the condition is false.

1. Simple Example: =IF(A1>10, "Greater than 10", "Less than or equal to 10")

- If cell A1 is greater than 10, the formula returns "Greater than 10".

- Otherwise, it returns "Less than or equal to 10".

2. Nested IF Functions

If there are multiple conditions, you can nest multiple IFs: =IF(A1>10, "Greater than 10", IF(A1=10, "Equal to 10", "Less than 10"))

- If A1 is greater than 10 → Returns "Greater than 10".

- If A1 equals 10 → Returns "Equal to 10".

- If A1 is less than 10 → Returns "Less than 10".

3. Using IF with Other Functions:

You can combine IF with other functions such as AND, OR, ISBLANK, COUNTIF,...

Check multiple conditions with AND: =IF(AND(A1>10, B1<5), "Satisfied", "Not satisfied")

- If A1 > 10 and B1 < 5, the formula returns "Satisfied".

- Otherwise, it returns "Not satisfied".

Check at least one true condition with OR: =IF(OR(A1>10, B1<5), "Satisfied", "Not satisfied")

- If one of the two conditions is true, the formula returns "Satisfied".

Check for blank cells with ISBLANK: =IF(ISBLANK(A1), "Blank cell", "Has data")

- If A1 is blank, it returns "Blank cell", otherwise it returns "Has data".

Count and check data with COUNTIF: =IF(COUNTIF(A1:A10,">10")>5, "Many values greater than 10", "Few values greater than 10")

- If there are more than 5 cells in A1:A10 containing values greater than 10, it returns "Many values greater than 10".

For informational purposes only!

How to use the IF function? What is the retail sales invoice form in Vietnam? (Image from the Internet)

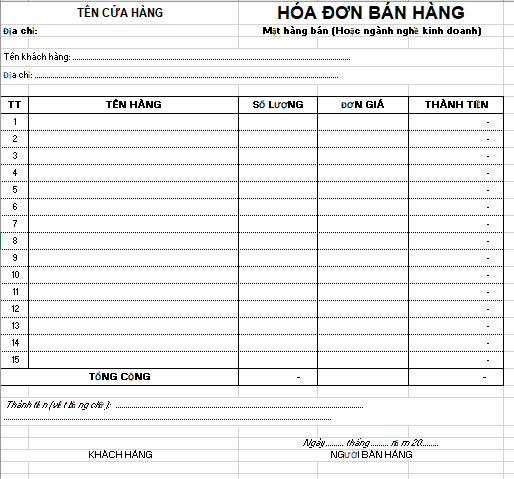

What is the retail sales invoice form in Vietnam?

The sales invoice is an indispensable part of business activities, especially for retail stores. A retail sales invoice form file helps save time, allows easy customization, and improves management efficiency.

Currently, the law does not specify a template for retail sales invoices in Excel format. Therefore, individuals or organizations selling can refer to the retail sales invoice form file below:

retail sales invoice form file...Download

What are principles for preparing, managing, and using invoices and records in Vietnam?

Based on Article 4 of Decree 123/2020/ND-CP regulating principles of preparing, managing, and using invoices and records as follows:

(1) When selling goods or providing services, the seller must prepare an invoice to give to the buyer (including cases where goods or services are used for promotion, advertising, sample goods; goods, services used for gifts, donations, exchange, payment in lieu of salary for employees, and internal consumption (except for internally circulated goods for continuing the production process); goods delivered under forms of lending, borrowing, or returning goods) and must complete all the contents prescribed in Article 10 of Decree 123/2020/ND-CP, in case of using electronic invoices, it must follow the standard data format of the tax authority as prescribed in Article 12 of Decree 123/2020/ND-CP.

(2) When withholding personal income tax, when collecting taxes, fees, charges, the withholding tax organization, the fee and tax collecting organization must prepare withholding tax records, tax receipts, and fee and charge receipts to provide to the person with income subject to tax withholding, the taxpayer, fee payer, and charge payer and must complete all content prescribed in Article 32 of Decree 123/2020/ND-CP. In cases of using electronic receipts, it must follow the standard data format of the tax authority. In case of personal tax accounting authorization, withholding tax records are not issued.

For individuals without a labor contract or with a contract under 3 months, the organization or individual paying income can choose to issue a withholding tax record for each tax deduction or issue one record for multiple tax deductions in a tax period.

For individuals with a labor contract of 3 months or more, the organization or individual paying income only issues one withholding tax record in a tax period.

(3) Before using invoices, receipts, enterprises, economic organizations, other organizations, households, business individuals, tax authorities, and fee and charge collecting organizations must register use with the tax authority or notify issuance as provided in Article 15, Article 34, and clause 1 Article 36 of Decree 123/2020/ND-CP.

For invoices, receipts printed by the tax authority, the tax authority issues notifications as per clause 3 Article 24 and clause 2 Article 36 of Decree 123/2020/ND-CP.

(4) Organizations, individuals engage in business activities during usage must report the situation of using purchased invoices from tax authorities, report the situation of using printed or self-printed receipts, purchase receipts according to Article 29, Article 38 of Decree 123/2020/ND-CP.

(5) Registration, management, and use of electronic invoices and records must comply with the legal regulations on electronic transactions, accounting, taxation, tax administration, and the provisions of this Decree.

(6) Invoice and record data when selling goods, providing services, data of records when conducting tax payment transactions, tax deduction, and payment of taxes, fees, charges is the database to serve tax management work and provide invoice and record information to related organizations and individuals.

(7) The seller of goods or service provider as enterprises, economic organizations, other organizations are authorized to third parties for creating electronic invoices for goods selling or service providing activities. The invoice created by the third party must still display the selling unit's name as the authorizer. The authorization must be defined in writing between the authorizing and receiving parties, showing all information about the delegated invoices (authorization purpose; authorization term; authorization invoice payment method) and must notify the tax authority when registering electronic invoice use.

In cases where the third-party delegated invoice is an electronic invoice without the tax authority's code, the authorizing party must transfer electronic invoice data to the tax authority through the service provider. The Ministry of Finance provides specific guidance on this content.

(8) Fee and charge collecting organizations are authorized to third parties to prepare fee and charge receipts. The delegated receipt by the third party must still record the name of the fee and charge collecting organization as the authorizer. The authorization must be defined in writing between the authorizing and receiving parties, showing all information about the delegated receipts (authorization purpose; authorization term; authorization receipt payment method) and must notify the tax authority when notifying the issuance of receipts.