How to resign from a job legally in Vietnam? Will person resigned from the job be entitled to PIT refund in Vietnam?

How to resign from a job legally in Vietnam?

Based on the provisions of the Labor Code 2019, employees wishing to resign must comply with the following regulations:

(1) Give Notice as Required

Article 35 of the Labor Code 2019 stipulates the notice periods for resigning as follows:

For standard jobs:

- At least 45 days: Indefinite-term labor contract

- At least 30 days: Fixed-term labor contract from 12 to 36 months

- At least 3 working days: Fixed-term labor contract under 12 months

For specific jobs such as aircraft crew member; aircraft maintenance personnel; enterprise manager; seafarer, etc., notice is required as follows:

- At least 120 days: fixed-term labor contract of 12 months or more

- At least 3 working days: fixed-term labor contract under 12 months.

Employees do not need to give notice in the following cases:

+ Not being assigned to the correct job, workplace, or not being ensured working conditions as agreed, except for being transferred.

+ Not being paid in full or on time.

+ Being maltreated, assaulted, or verbally abused, having actions affecting health, dignity, honor; being forced to labor.

+ Being sexually harassed at the workplace.

+ Female employees being pregnant and needing to quit because work negatively affects the fetus.

+ Reaching retirement age unless otherwise agreed.

+ The employer provides false information affecting the performance of the contract.

- Resigning without proper notice is considered unilateral illegal termination of the contract. As a result, the employee will face several disadvantages:

+ Not entitled to severance pay.

+ Not entitled to unemployment benefits.

+ Must reimburse training costs.

+ Must compensate the enterprise half a month's salary and an amount equivalent to the salary for the days not notified in advance.

(2) Handover Work and Company Assets

Current law does not stipulate the obligation for employees to hand over work before resigning, unless there is a provision in the company’s labor regulations.

(3) Receive Insurance Books and Allowances (if any)

According to Article 48 of the Labor Code 2019, upon termination of labor contracts, the employer must settle all related payments to the employee within 14 working days, including salary, severance pay, etc.

Additionally, the employer must complete procedures to certify the period of social insurance and unemployment insurance contributions and return them along with the original documents retained from the employee.

How to resign from a job legally in Vietnam? Will person resigned from the job be entitled to PIT refund in Vietnam? (Image from the Internet)

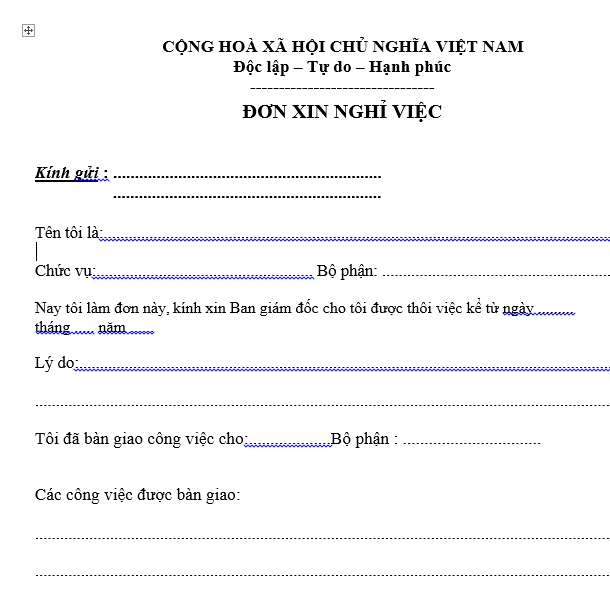

Download the latest resignation letter template in Vietnam?

A resignation letter can be either handwritten or typed. According to the Labor Code 2019, there is no specific resignation letter template required. Therefore, employees often use self-drafted templates in Word format.

Below are some standard resignation letter templates you can refer to:

Template No. 1: Latest resignation letter 2025 ...download

Template No. 2: Latest resignation letter 2025 ... download

Will person resigned from the job be entitled to PIT refund in Vietnam?

According to Clause 2, Article 8 of the Personal Income Tax Law 2007https://thuvienphapluat.vn/van-ban/Thue-Phi-Le-Phi/Luat-thue-thu-nhap-ca-nhan-2007-04-2007-QH12-59652.aspx?anchor=dieu_8 provides the following:

Tax Management and Refund

1. Taxpayer registration, declaration, deduction, payment, settlement, refund, handling of tax law violations, and tax management measures are performed according to tax management laws.

2. Individuals are eligible for a tax refund in the following cases:

a) The amount of tax paid exceeds the payable tax amount;

b) Individuals who have paid tax but their taxable income does not reach the tax payment threshold;

c) Other cases as decided by competent state agencies.

Thus, the current regulation does not require employees to be working in a company or organization for PIT refund eligibility.

Therefore, taxpayers who resign are still entitled to a PIT refund if they have paid taxes exceeding their tax liability while employed, paid taxes with a taxable income below the threshold, and other cases as decided by state agencies.