How to look up the issuance date of TIN for enterprises in Vietnam?

How to look up the issuance date of TIN for enterprises in Vietnam?

Below is a guide on how to look up the issuance date of a TIN of enterprises for the year 2025:

Step 1: Access the link to the General Department of Taxation's electronic information page:

https://tracuunnt.gdt.gov.vn

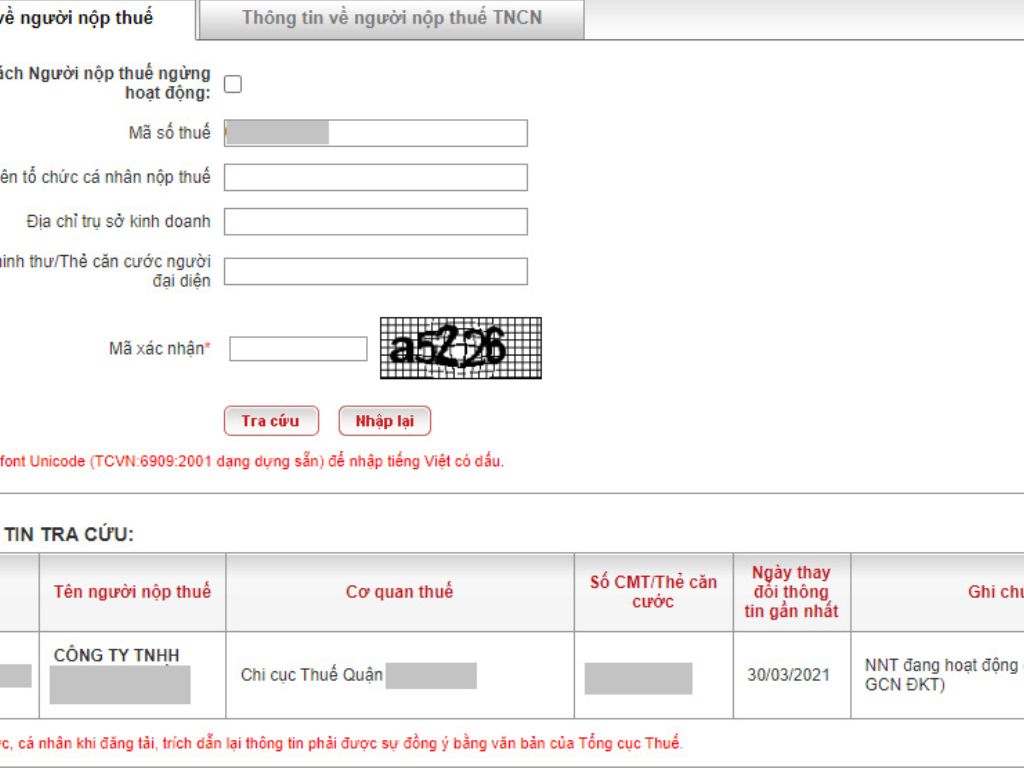

Step 2: Enter the information of the TIN/Name of the taxpayer organization or individual/Business address/ID card number/Citizen identity card of the representative and enter the verification code. Then, select "Lookup" for results and click on the enterprise to find information about the TIN issuance date.

How to look up the issuance date of TIN for enterprises in Vietnam? (Image from the Internet)

What is the time limit for re-issuing a TIN of enterprises in Vietnam?

Based on Clause 2, Article 9 of Circular 105/2020/TT-BTC stipulated as follows:

Re-issuance of the taxpayer registration certificate and TIN Notification

The taxpayer registration certificate and TIN Notification are re-issued according to the provisions in Clause 3, Article 34 of the Law on Tax Administration and the following regulations:

1. In cases of loss, tearing, destruction, or burning of the taxpayer registration certificate, personal taxpayer registration certificate, TIN Notification, dependent TIN Notification, the taxpayer sends a written request for re-issuance of the taxpayer registration certificate, TIN Notification form No. 13-MST issued with this Circular to the directly managing tax authority.

2. The tax authority shall re-issue the taxpayer registration certificate, personal taxpayer registration certificate, TIN Notification, dependent TIN Notification within 02 (two) working days from the date of receipt of the complete dossier as prescribed.

According to Clause 3, Article 34 of Law on Tax Administration 2019 stipulated as follows:

Issuance of taxpayer registration certificate

1. The tax authority shall issue a taxpayer registration certificate to the taxpayer within 03 working days from the date of receipt of the complete taxpayer registration dossier as prescribed. The information of the taxpayer registration certificate includes:

a) Name of the taxpayer;

b) TIN;

c) Number, day, month, year of the business registration certificate or establishment and operation license, or investment registration certificate for organizations, business individuals; number, day, month, year of the establishment decision for organizations not subject to business registration; information of ID card, citizen identity card or passport for individuals not subject to business registration;

d) Directly managing tax authority.

2. The tax authority notifies the taxpayer of the TIN in replacement of the taxpayer registration certificate in the following cases:

[...]

3. In cases of loss, tearing, destruction, or burning of the taxpayer registration certificate or TIN Notification, the tax authority shall re-issue within 02 working days from the date of receipt of the complete dossier requested by the taxpayer as prescribed.

In the event of loss, tearing, destruction, or burning of the TIN Notification, the taxpayer is responsible for sending a written request for re-issuance of the TIN of enterprises Notification to the tax authority.

The tax authority will carry out procedures for re-issuing the TIN of enterprises Notification within 02 working days from the date of receipt of the taxpayer's complete request dossier.

What Is the structure of TIN of enterprises in Vietnam?

Based on Article 5 of Circular 105/2020/TT-BTC on the structure of TIN of enterprises as follows:

Structure of TINs

1. Structure of TINs

N1N2 N3N4N5N6N7N8N9 N10 - N11N12N13

In which:

- The first two digits N1N2 are the segment number of the TIN.

- Seven digits N3N4N5N6N7N8N9 are defined according to a specific structure, increasing gradually from 0000001 to 9999999.

- The digit N10 is the check digit.

- Three digits N11N12N13 are sequential numbers from 001 to 999.

- The hyphen (-) is a character to separate the group of the first 10 digits and the last 3 digits.

2. The enterprise code, cooperative code, subsidiary code of an enterprise, cooperative assigned according to the law on enterprise registration, cooperative registration is the TIN.

3. Classification of TIN structure

a) TIN of 10 digits is used for enterprises, cooperatives, organizations with legal status or organizations without legal status but directly arising tax obligations; representative households, business households, and other individuals (hereinafter referred to as independent units).

b) TIN of 13 digits and the hyphen (-) used to separate between the first 10 digits and the last 3 digits is used for dependent units and other subjects.

....

Thus, according to the above regulations, the structure of a TIN of enterprises is a series comprising a maximum of 13 digits structured as:

N1N2 N3N4N5N6N7N8N9 N10 - N11N12N13

In which:

- A 10-digit TIN is used for enterprises, cooperatives, organizations with legal status, or organizations without legal status but directly arising tax obligations; representative households, business households, and other individuals (hereinafter referred to as independent units).

- A 13-digit TIN and the hyphen (-) used to separate between the first 10 digits and the last 3 digits is used for dependent units and other subjects.