How to look up automobile and motorcycle registration fees on the eTax mobile application in Vietnam?

How to look up automobile and motorcycle registration fees on the eTax mobile application in Vietnam?

To check automobile and motorcycle registration fees on the eTax Mobile application, users need to follow these steps:

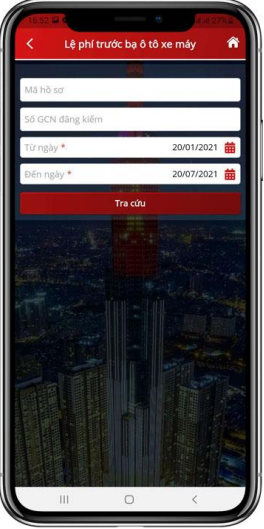

- Step 1:

+ Select the menu "Tra cứu hồ sơ" -> "LPTB ô tô, xe máy." The system will display the search screen according to the search conditions: File Code, Inspection Certificate Number, and from date to date.

+ This function allows tax payers who are individuals registered to use the service with the tax authority to search for registration fee records that have been paid on the electronic tax system - the subsystem for individuals.

- Step 2:

Users enter search conditions, and the system displays a list of automobile and motorcycle registration fee declarations that satisfy the search criteria.

- Step 3:

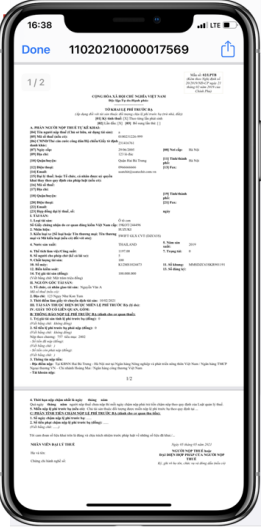

Users select a record, and the system displays the Declaration Information screen, including the content of the automobile and motorcycle registration fee declaration and the notification list.

- Step 4:

Users click on "Chi tiết" and the system displays the details of the registration fee declaration.

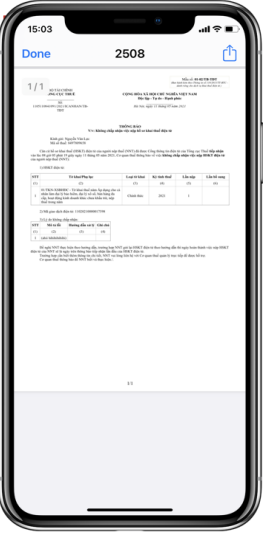

- Step 5:

Users click on the content of the notification list or the icon, and the system displays the details of the notification.

- Step 6:

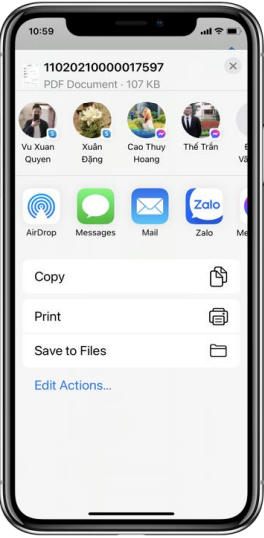

+ Users click on the download button, and the system displays functions that allow users to share invoices via Skype, Facebook, Zalo, etc., download files to mobile devices, or connect to a printer to print the invoice.

+ Users click "Done," and the system returns to the declaration information screen.

What is the time to pay registration fee for cars and motorcycles in Vietnam?

According to Article 4 of Decree 10/2022/ND-CP, organizations and individuals who purchase automobiles or motorcycles must pay registration fees upon registering ownership with a competent state authority, except for cases exempt from registration fees as prescribed in Article 10 of Decree 10/2022/ND-CP.

How to look up automobile and motorcycle registration fees on the eTax mobile application in Vietnam? (Image from Internet)

What are the automobile and motorcycle registration fees in Vietnam?

* Motorcycle Registration Fees:

The registration fee for motorcycles is 2%.

Exceptions:

- Motorcycles owned by organizations or individuals in centrally-run cities, province-level cities, and district-level towns where the provincial People's Committee headquarters are located, pay an initial registration fee of 5%.

- For motorcycles paying registration fees from the second time onwards, the fee is 1%. If the owner has declared and paid a 2% registration fee for the motorcycle and then transfers it to an organization or individual in the areas specified in point a of this section, the registration fee is 5%.

Legal basis: Clause 5, Article 8 of Decree 10/2022/ND-CP

* Automobile Registration Fees:

The registration fee for automobiles, trailers, or semi-trailers pulled by automobiles, and similar vehicles is 2%.

Exceptions:

- Passenger cars with up to 9 seats (including pick-up trucks): The initial registration fee is 10%. If higher rates need to be applied to suit local conditions, the provincial or city People’s Council under central authority may decide to adjust the rate, but not higher than 50% of the general rate specified here.

- Pick-up trucks with a carrying capacity of less than 950 kg and up to 5 seats, and VAN trucks with a carrying capacity of less than 950 kg, pay an initial registration fee equal to 60% of the initial fee for passenger cars with up to 9 seats.

- Battery electric cars:

+ Within 3 years from the effective date of this Decree: The initial registration fee is 0%.

+ In the next 2 years: The initial registration fee is 50% of the fee for gasoline and diesel cars with the same seating capacity.

- The types of automobiles specified in points a, b, and c of this section: From the second registration onwards, the fee is 2%, and it’s uniformly applied nationwide.

Based on the type of vehicle recorded on the Technical Safety and Environmental Protection Certificate issued by the Vietnamese Registry Authority, the tax authority determines the registration fee for automobiles, trailers, or semi-trailers pulled by automobiles, and similar vehicles as specified in this section.

Note: The registration fee for domestically assembled or manufactured automobiles from September 01, 2024, to November 30, 2024, is 50% of the above rate.

Legal basis: Clause 5, Article 8 of Decree 10/2022/ND-CP, Article 1 of Decree 109/2024/ND-CP

How to declare and pay registration fees in Vietnam?

Based on Article 11 of Decree 10/2022/ND-CP on the declaration and payment of registration fees:

- Organizations and individuals declare and pay registration fees following the tax management laws when registering ownership or usage rights for assets with competent state authorities.

- Electronic data on registration fees paid through the State Treasury, commercial banks, or intermediary payment service providers, signed by the General Department of Taxation and provided on the National Public Service Portal, are valid as paper vouchers for traffic police, environmental resource authorities, and other competent state authorities connected to the National Public Service Portal to access and exploit data for resolving administrative procedures related to the registration of ownership and usage rights for assets.