How to declare value added tax for a taxpayer which has operational investment projects in Vietnam?

How to declare value added tax for a taxpayer which has operational investment projects in Vietnam?

Pursuant to the provisions at point d, clause 2, Article 7 of Decree 126/2020/ND-CP, it is stipulated as follows:

Tax declaration dossiers

...

2. The tax declaration dossierss correspond to each type of tax, taxpayer, suitable to the tax calculation method, tax period (monthly, quarterly, yearly, per occurrence, or settlement). In the case of the same type of tax where the taxpayer has multiple business activities, a consolidated tax declaration shall be made on one tax declaration dossiers, except in the following cases:

a) Taxpayers with multiple business activities, including lottery design, computerized lottery must make separate tax declaration dossierss for VAT, Special Consumption Tax, post-tax profit for lottery design, computerized lottery activities.

b) Taxpayers with multiple business activities, including trading, crafting gold, silver, gemstones must make separate tax declaration dossierss for VAT for trading, crafting gold, silver, gemstones.

c) Taxpayers with revenue collected on behalf authorized by competent state authorities must make separate tax declaration dossierss for VAT for collected activities.

d) Taxpayers conducting ongoing operations with an investment project eligible for VAT refund must make separate VAT tax declaration dossierss for each investment project; simultaneously offset the VAT of goods and services purchased for each investment project against the VAT payable (if any) of ongoing business activities for the same tax period.

dd) Taxpayers authorized to manage business cooperation contracts with organizations but do not establish separate legal entities must make separate tax declarations for business cooperation contracts based on the agreement in the business cooperation contract.

...

A taxpayer conducting ongoing operations with an investment project eligible for VAT refund must make separate VAT tax declaration dossierss for each investment project; simultaneously offset the VAT of goods and services purchased for each investment project against the VAT payable (if any) of the ongoing business activities for the same tax period.

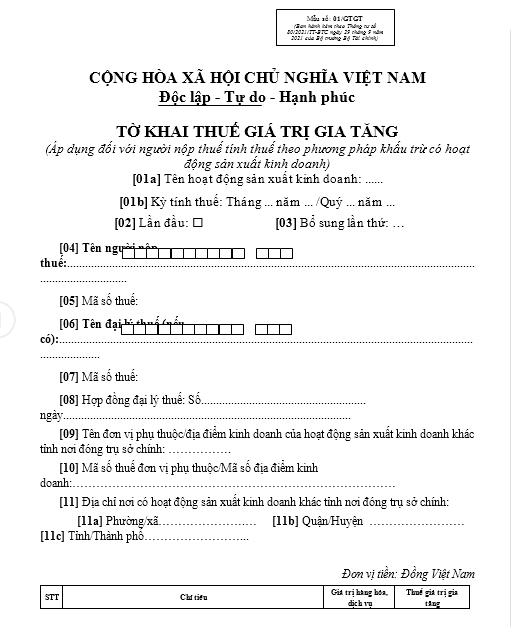

Therefore, businesses and organizations declaring VAT for a taxpayer which has operational investment projects must declare VAT using the declaration form 01/GTGT, based on point a, clause 2.1, Appendix 1 of Decree 126/2020/ND-CP.

How to declare value added tax for a taxpayer which has operational investment projects in Vietnam? (Image from Internet)

How to determine revenue for taxpayers required to declare VAT monthly in Vietnam?

Pursuant to point a, clause 1, Article 9 of Decree 126/2020/ND-CP, VAT declaration by quarter applies to:

- Taxpayers required to declare VAT monthly as prescribed at point a, clause 1, Article 8 of Decree 126/2020/ND-CP, if their total sales revenues from goods and services in the preceding year is 50 billion VND or less, they are allowed to declare VAT on a quarterly basis. Sales revenues from goods and services are determined as the total sales revenues on the VAT returns of tax periods in the calendar year.

In cases where taxpayers conduct a centralized tax declaration at the headquarters for dependent units and business locations, sales revenues from goods and services include revenues from dependent units and business locations.

- In cases where taxpayers are new to business activities, they can opt to declare VAT quarterly. After producing and conducting business for 12 months, from the following consecutive calendar year with full 12 months, the VAT declaration will be based on the revenue of the preceding full 12-month calendar year to determine whether to declare VAT monthly or quarterly.

Therefore, for taxpayers required to declare VAT monthly, revenue is determined as the total sales revenues on VAT returns of tax periods in the calendar year.

Which form is used for the VAT declaration in Vietnam for the fourth quarter of 2024?

The VAT declaration for the fourth quarter of 2024 is made according to the form in the Appendix issued with Circular 80/2021/TT-BTC as follows:

Download VAT Declaration Form for the Fourth Quarter of 2024.

What are the regulations for declaring VAT for enterprises and household businesses in Vietnam?

According to the regulations at Article 3 of Circular 219/2013/TT-BTC, enterprises and household businesses required to declare and pay Value Added Tax (VAT) are enterprises and household businesses producing and trading goods and services subject to VAT in Vietnam, regardless of industry, form, business organization, and enterprises and household businesses importing goods or purchasing services from abroad subject to VAT, specifically:

- Enterprises and household businesses established and registered under the Law on Enterprises 2020 and other specialized business laws.

- Enterprises with foreign investment and foreign parties participating in business cooperation contracts according to the Investment Law 2020.

- Enterprises and household businesses conducting production and business in Vietnam and purchasing services (including cases of purchasing services associated with goods) from foreign organizations without a permanent establishment in Vietnam or individuals abroad who are non-residents, shall be subject to VAT unless specified otherwise under Section 2 below.

- Branches of export processing enterprises established to engage in the buying and selling of goods and related activities directly to the purchase and sale of goods in Vietnam as stipulated by law regarding industrial zones, export processing zones, and economic zones.